Bitcoin Miner IREN Reports Record Revenue as Bitcoin Mining Revenue Hits $1B Annually

TLDR

- IREN posted record quarterly revenue of $187.3 million and returned to profitability with $176.9 million in net income

- The company achieved $1 billion in annualized Bitcoin mining revenue and outproduced competitor MARA in July with 728 BTC

- IREN became a “Preferred Partner” with Nvidia and increased GPU count to 1,900, up 132% year-over-year

- The stock surged 14% in after-hours trading and has gained 312% over the past four months

- Company plans $200 million investment to reach 10,900 GPUs and target $200-250 million in AI revenue by December

Bitcoin mining company IREN Limited delivered its strongest financial performance to date in the quarter ending June 30. The company reported record quarterly revenue of $187.3 million, marking a 226% increase from the same period last year.

The strong results helped IREN swing back to profitability after previous losses. The company posted net income of $176.9 million for the quarter and EBITDA of $241.4 million.

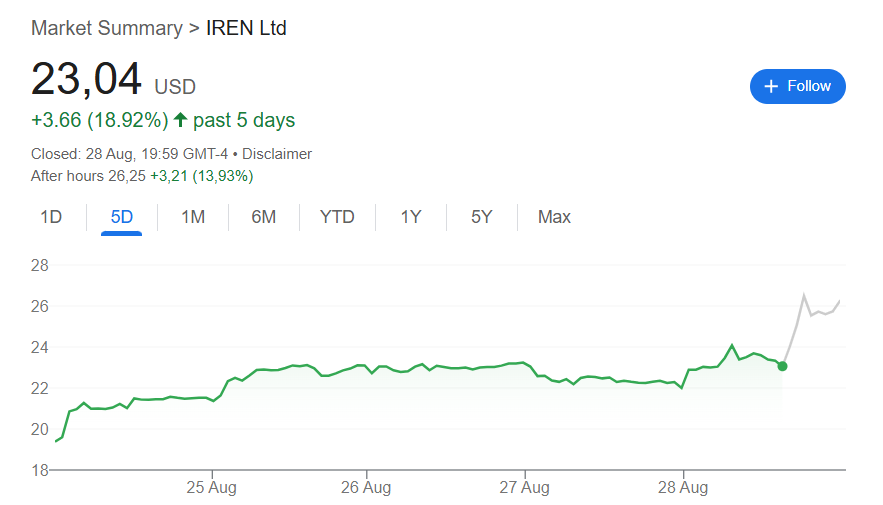

Source: Google Finance

Source: Google Finance

For the full fiscal year, IREN achieved record revenue of $501 million. Under current mining conditions, the company now generates $1 billion in annualized revenue from Bitcoin mining operations alone.

IREN’s Bitcoin mining performance has positioned it as an industry leader. In July, the company produced 728 BTC, surpassing competitor MARA Holdings which mined 703 BTC during the same period.

The company currently operates 50 exahashes per second in installed Bitcoin mining capacity. IREN has temporarily paused further Bitcoin mining expansion to focus resources on artificial intelligence initiatives.

GPU Business Drives Growth Strategy

IREN has been building its AI cloud computing business alongside traditional Bitcoin mining. The company increased its GPU count to 1,900 units during the quarter, representing 132% growth compared to the previous year.

The expansion received a boost when IREN became a “Preferred Partner” with Nvidia. This partnership provides more direct access to Nvidia’s hardware for the company’s AI operations.

IREN generates AI revenue by renting GPU computational power to clients. These services support machine learning tasks, large language model training, and other high-performance computing needs for businesses.

The company plans to invest $200 million to expand its GPU fleet to 10,900 units in the coming months. This expansion aims to generate between $200 million and $250 million in annualized AI revenue by December 2025.

Current AI revenue would need to increase eight to ten times to reach these targets. The growth would build on approximately $250 million in existing annualized AI revenue.

Stock Performance and Market Response

IREN shares closed Thursday at $23.04, up 3.1% for the regular trading session. The stock jumped another 13.9% in after-hours trading following the earnings announcement.

The recent gains continue a strong recovery for IREN stock. Shares have rallied 312% over the past four months after hitting lows around $5.59 in April.

IREN’s current market capitalization stands at $5.4 billion based on its Nasdaq-listed shares. The company trades under the ticker symbol IREN.

The stock performance represents a turnaround from criticism the company faced in 2024. Short-selling firm Culper Research had called IREN “wildly overvalued” and questioned its AI investments.

IREN recently settled a legal dispute with creditor NYDIG. The confidential settlement resolved a nearly three-year battle over $105 million in defaulted equipment loans for approximately 35,000 Antminer S19 devices. Co-CEO Daniel Roberts said fiscal 2025 was “a breakout year financially and operationally” with more than 10 times EBITDA growth.

The post Bitcoin Miner IREN Reports Record Revenue as Bitcoin Mining Revenue Hits $1B Annually appeared first on CoinCentral.

You May Also Like

Pump.fun CEO to Call Low-Cap Gem to Test New ‘Callouts’ Feature — Is a 100x Incoming?

This U.S. politician’s suspicious stock trade just returned over 200% in weeks