Circle’s Rate Cut Dilemma

By Jack Inabinet, Bankless

Compiled by Saoirse, Foresight News

Stablecoin issuer Circle made a lot of headlines earlier this summer. On June 5th, Circle's shares opened trading on the public market at a high price of $69, allowing early investors who participated in its already-expanded initial public offering to double their money.

Throughout June, CRCL's stock price continued to soar, and as it approached $300, it firmly established itself as a "high-performing cryptocurrency stock." Unfortunately, the good times didn't last long. As summer progressed, the stock ultimately suffered the effects of the seasonal downturn.

Although the stock rose 7% on Friday after Powell's rate cut remarks, it has been in decline for most of the past month and is now down nearly 60% from its all-time high.

Today, we will explore the interest rate cut dilemma faced by stablecoins and analyze the impact of monetary policy shifts on the future of CRCL.

The thorny issue of interest

Circle uses a business model similar to that of a bank: it makes money from interest.

USDC is backed by over $60 billion in bank deposits, overnight lending agreements, and short-term U.S. Treasury bonds. In the second quarter of 2025, Circle earned $634 million in interest from these stablecoin reserves.

When interest rates rise, each $1 USDC held in the portfolio earns more interest; conversely, when interest rates fall, the returns decrease. While interest rates are driven by market forces, the cost of the dollar is also affected by Federal Reserve policy, particularly for the short-term instruments Circle uses to manage its reserves.

Last Friday, Federal Reserve Chairman Jerome Powell strongly hinted at the possibility of a rate cut in his speech at Jackson Hole. We've seen "fake rate cuts" before, but this was the first time Chairman Powell himself had so clearly favored a rate cut.

Powell attributed any remaining inflation to a one-time tariff spike and highlighted a slowing labor market, while defending a possible interest rate cut, which markets currently expect the Fed to announce at its September 17 policy meeting.

According to data from CME FedWatch and Polymarket, the likelihood of a rate cut increased significantly after Powell's speech, and the significant change in probability actually began on August 1. The employment data released that day showed that only 73,000 new jobs were added in July, and the data for the previous two months were also significantly revised downward.

Since August 1, both CME FedWatch and Polymarket have consistently predicted a 25 basis point (0.25%) rate cut. If the Fed actually implements the expected rate cut, Circle's revenue will decrease overnight.

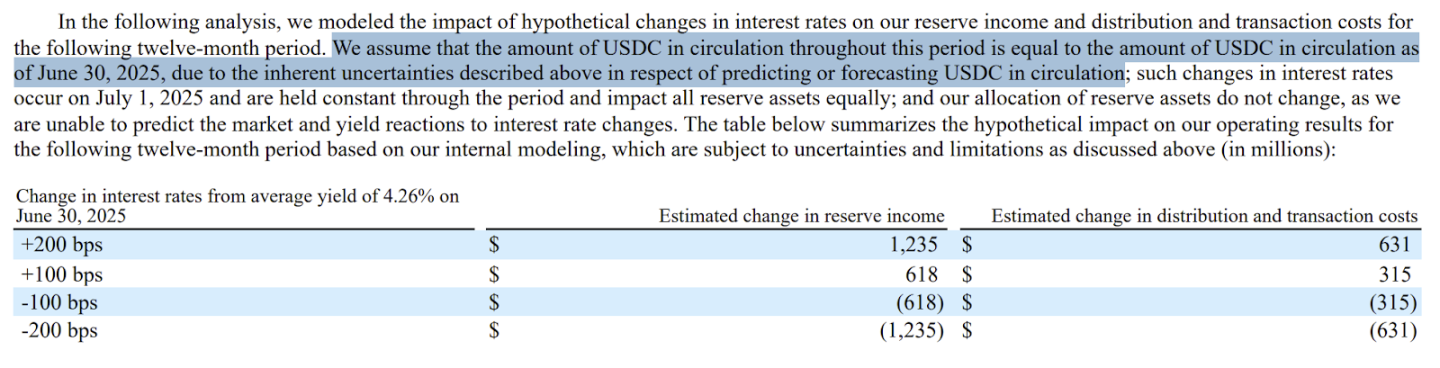

According to Circle’s own financial forecasts, for every 100 basis point (1%) drop in the federal funds rate, the company will lose $618 million in interest income annually. In other words, a “standard” 25 basis point rate cut will result in a loss of $155 million in revenue.

Fortunately, half of the revenue loss will be offset by lower distribution costs. This is consistent with Circle's agreement with Coinbase, which provides for approximately 50% of interest income from USDC reserves to be distributed to Coinbase. However, the reality is that in an environment of falling interest rates, Circle's operations will become increasingly difficult.

Modeling analysis of the impact of hypothetical interest rate changes on reserve income and distribution and transaction costs over the next 12 months

Source: Circle

While Circle reported a second-quarter net loss of $482 million, significantly smaller than analysts expected, the unexpected difference stemmed primarily from a $424 million accounting write-off related to employee stock compensation at the time of its initial public offering.

Even so, Circle’s financial situation highlights the fragility of a company teetering on the brink of breakeven, which cannot withstand a significant drop in interest rates at current USDC supply levels.

Solution

On the surface, falling interest rates might seem to reduce Circle’s interest income per dollar of reserves, hurting profitability. But fortunately for CRCL holders, changing one simple variable can completely reverse the situation…

Powell and many financial commentators believe that current interest rates are already at a "restrictive" level and that fine-tuning the Fed's policy rate can both address the weak labor market and control inflation.

If these experts are correct, rate cuts could trigger an economic rebound, with employment remaining high, credit costs falling, and cryptocurrency markets soaring. If this optimistic scenario materializes, demand for crypto-native stablecoins could rise, especially if they offer above-market yield opportunities native to decentralized finance.

To offset the negative impact of a 100 basis point rate cut (the lowest level considered in Circle’s aforementioned rate cut sensitivity analysis), the circulating supply of USDC would need to increase by approximately 25%, requiring an injection of $15.3 billion into the crypto economy.

Circle currently trades at 192 times its projected net profit in 2024, making it a high-growth opportunity. However, while the stock market is optimistic about CRCL's expansion prospects, the stablecoin issuer will need to grow to survive if the Federal Reserve implements rate cuts in the coming weeks.

Assuming the Fed cuts interest rates by at least 25 basis points, Circle would need to increase the supply of USDC by approximately $3.8 billion to maintain its current profitability.

Circle put it best: “Any relationship between interest rates and the supply of USDC in circulation is complex, highly uncertain, and unproven.” There is currently no model that can predict how USDC user behavior will react to low interest rates, but history shows that once a rate-cutting cycle begins, it tends to be rapid.

While Circle might be able to offset lower interest rates through growth in a booming economy, the data suggests the company is inherently conflicted with a low-interest rate environment.

Most of the company's revenue comes from reserve income. Interest rate fluctuations will affect the reserve yield, which may in turn change the reserve income. However, because USDC in circulation is affected by uncertain factors such as user behavior, although the impact of interest rates on reserve yields can be predicted, its ultimate impact on reserve income cannot be accurately predicted.

Source: Circle

You May Also Like

Crypto Market Cap Edges Up 2% as Bitcoin Approaches $118K After Fed Rate Trim

Vitalik Buterin Reveals Ethereum’s (ETH) Future Plans – Here’s What’s Planned