Dogecoin Setup Signals Massive Breakout: DOGE Season Not Started Yet

TL;DR

- Dogecoin consolidates in a bull flag pattern, with a breakout target at $0.24 resistance level.

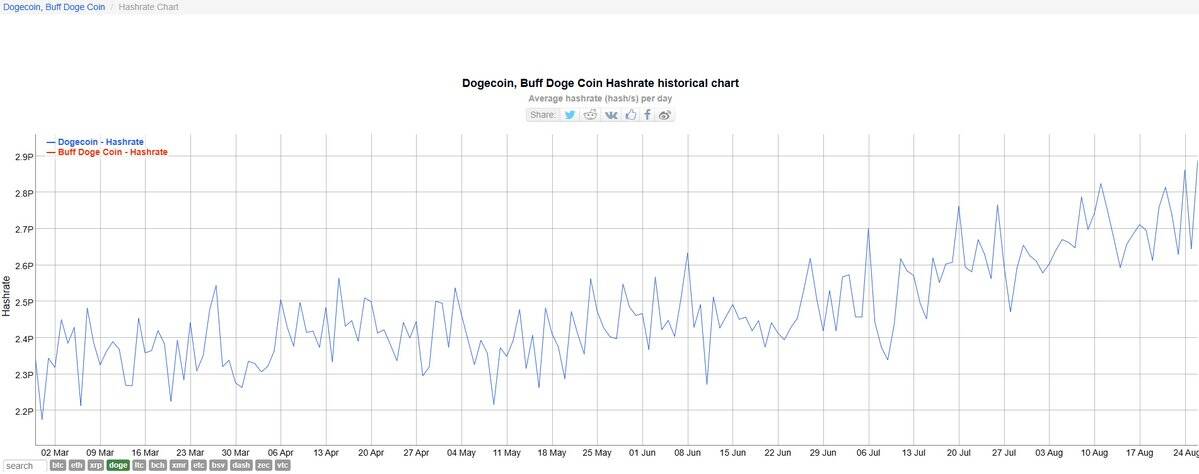

- Its hashrate surged above 2.9 PH/s, marking the strongest network security in its history.

- Thumzup Media to acquire Dogehash, expanding Dogecoin’s mining base with 2,500 ASIC rigs.

Long-Term Cycles Point to Familiar Setup

Dogecoin (DOGE) was priced at $0.22 at press time, showing a 1% daily gain and a 2% increase over the week. Trading volume in the past 24 hours stood at $2.27 billion.

Past cycles highlight the token’s explosive history. In 2017, DOGE rallied about 9,000%. During the 2020–2021 cycle, gains exceeded 26,000%. Both rallies came after long consolidation phases, where the price moved sideways for extended periods before breaking higher.

Since 2021, DOGE has traded mostly between $0.05 and $0.30, forming a multi-year base. Indicators on the weekly chart show a pattern similar to those seen ahead of previous surges. Trader Tardigrade said: “Dogecoin season has not started yet,” pointing to the view that the asset is still in an early phase.

On the 4-hour chart, DOGE has developed a bull flag, with consolidation between $0.218 and $0.222 following a sharp upward move. This type of structure often precedes continuation when the price breaks out of the range.

Trader Tardigrade noted:

The $0.24 zone remains the immediate resistance to watch.

Hashrate Climbs to Record High

Dogecoin’s network strength has reached a new peak. The hashrate, which measures the total computing power securing the blockchain, rose from an average of 2.2–2.4 PH/s in March to more than 2.9 PH/s in late August.

Analyst KrissPax reported:

-

- Source: X

The official Dogecoin account responded:

Earlier this month, the Qubic blockchain community voted to redirect hashpower toward DOGE for a potential 51% attack. That incident drew attention to the importance of mining power in maintaining network security.

Corporate Moves in Mining Sector

Thumzup Media Corporation, a Nasdaq-listed company, confirmed it will acquire Dogehash, a mining operation based in North America that focuses on Scrypt assets such as Dogecoin and Litecoin.

Dogehash operates around 2,500 ASIC miners and is expected to scale capacity before year-end. Once completed, the merger would make the combined entity one of the largest Dogecoin mining operations, adding to the network’s industrial base.

The post Dogecoin Setup Signals Massive Breakout: DOGE Season Not Started Yet appeared first on CryptoPotato.

You May Also Like

LMAX Group Deepens Ripple Partnership With RLUSD Collateral Rollout

Pastor Involved in High-Stakes Crypto Fraud