Bitcoin Mining Earnings Dip as Hashprice Falls 7.61% in 30 Days

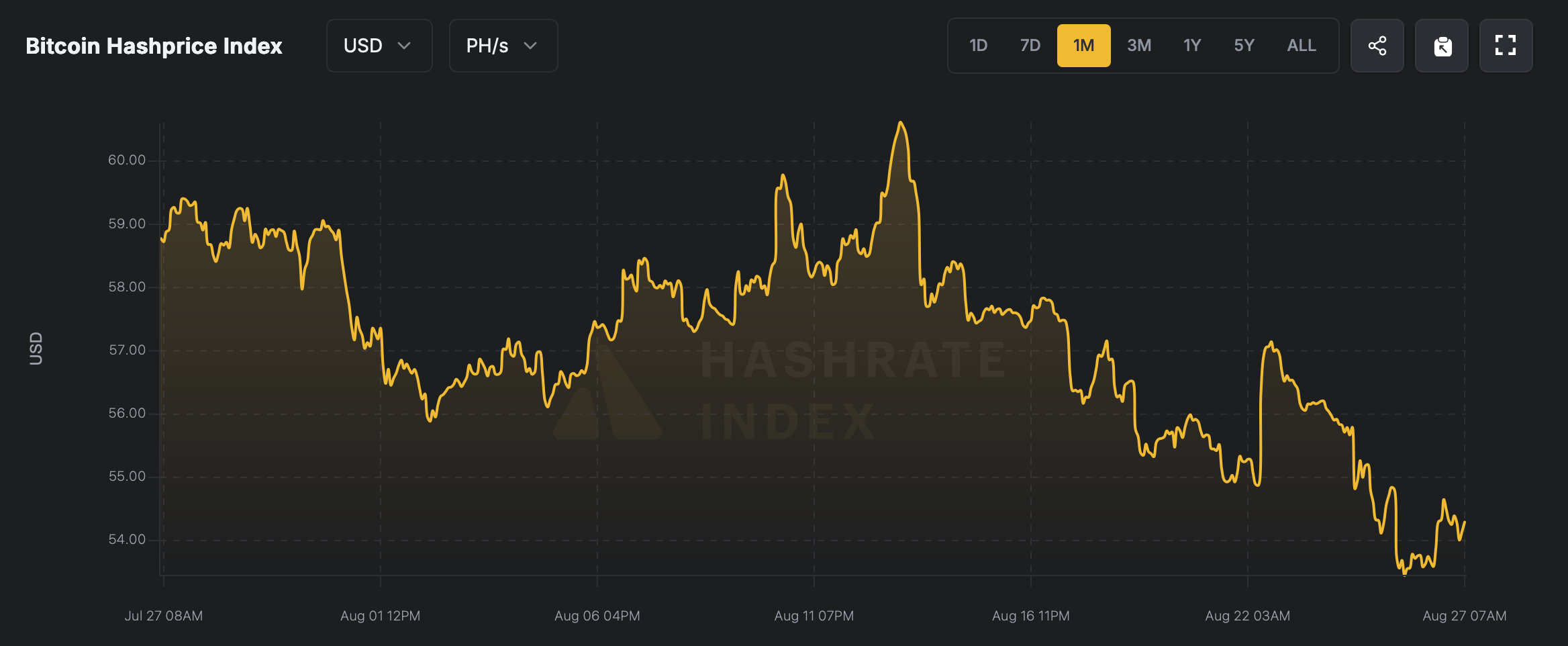

Based on the latest data, bitcoin mining earnings have been sliding, marked by stretches of sharp price swings. Hashprice—the projected return for 1 petahash per second (PH/s) of computing power each day—now sits 7.61% below where it stood on July 27.

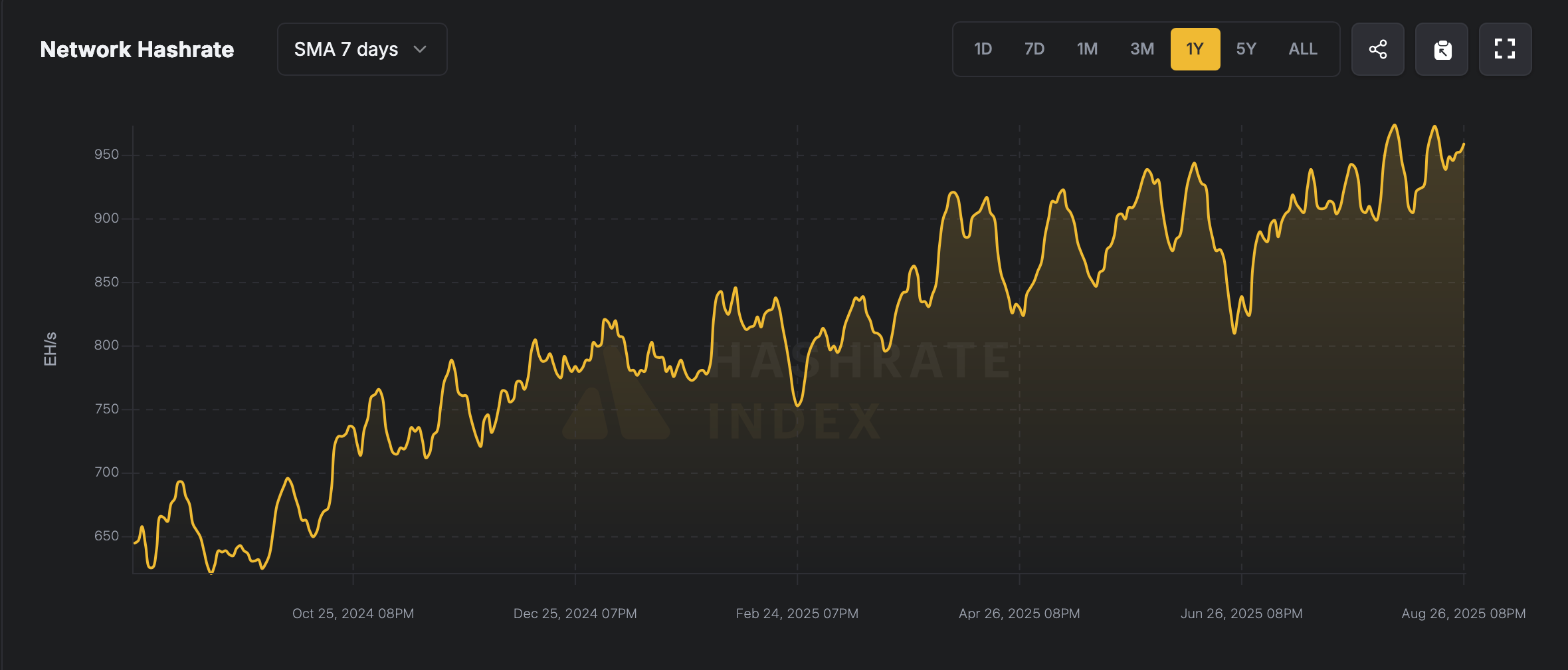

Hashrate Remains Resilient as Block Times Speed Up Ahead of Next Difficulty Hike Projected for Sept. 5

Bitcoin’s mining difficulty is now 129.7 trillion, climbing 0.20% five days ago at block height 911232. Although this increase has slowed miners from finding blocks quickly while revenue declines, the network’s hashrate remains high at 965.77 exahash per second (EH/s) as of Aug. 27, just 11 EH/s shy of its record peak.

Source: hashrateindex.com

Source: hashrateindex.com

Since miners have kept pace steady, blocks have been processed more quickly, and as of 9 a.m. Eastern time Wednesday, average block times sit near nine minutes and 37 seconds. The next difficulty adjustment is expected in roughly 1,300 blocks, landing around Sept. 5, 2025, with a projected increase of +3.93%—though that estimate could very well shift drastically before then.

Source: hashrateindex.com

Source: hashrateindex.com

Revenue, or the projected return from one petahash per second (PH/s) of Bitcoin’s computing power, is currently $54.30 for each day of output at 1 PH/s. Thirty days ago, hashprice was $58.77 per PH/s, leaving miners with a 7.61% decline over the past month. Even so, today’s level remains slightly above the recent low of $53.44.

The current trajectory highlights how miner resilience continues to shape Bitcoin’s network dynamics, balancing profitability pressures with steady hashrate contributions. Most of which may be due to super-efficient machines. As conditions evolve, the interplay between costs, rewards, and computing power will remain central to the Bitcoin network’s long-term stability and growth.

You May Also Like

Lucid to begin full Saudi manufacturing in 2026

Metaplanet Sets Up US Subsidiary To Strengthen Bitcoin Income Business