Dogecoin Price Prediction: DOGE Whales Are Quietly De-Risking – Could a Major Sell-Off Be Just Beginning?

Dogecoin price is holding near $0.21, but the latest on-chain signals are raising red flags – fueling a bearish Dogecoin price prediction.

Throughout August, DOGE has declined across all major timeframes, and the stagnation appears tied to a wave of quiet de-risking by large whale wallets.

These major holders are steadily trimming their positions, sparking fears that a broader sell-off may be just beginning, especially as sentiment across the crypto market shifts toward Fear.

With retail investors growing cautious and whales exiting in silence, the next move for DOGE could be critical.

DOGE Whales Distribution Analysis Reveals Strategic De-Risking

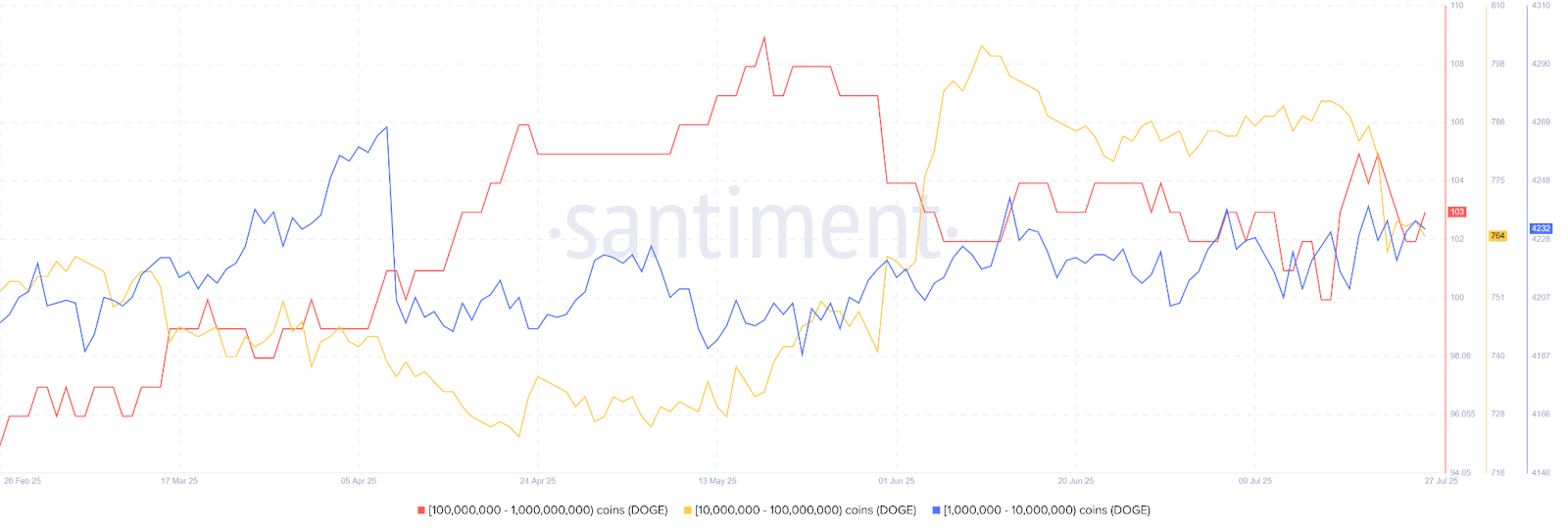

Data from cryptocurrency analytics platform Santiment shows Dogecoin’s supply distribution patterns from February through August 2025 provide strong evidence of portfolio de-risking among the token’s largest stakeholders.

Large Whale Activity (100M-1B+ coins) shows considerable volatility alongside a general downward trajectory since May 2025 peak of $0.248

Source: Santiment

Source: Santiment

The sharp decline from May highs suggests major holders have been systematically reducing their positions.

Similarly, Mid-Tier Whales (10M-100M coins) display volatility throughout the analyzed period, with patterns indicating this segment is also decreasing exposure to DOGE holdings.

Whale transaction count data also support the subtle de-risking behavior among DOGE large holders, potentially foreshadowing a looming Dogecoin sell-off.

June and July witnessed a dramatic spike in whale transaction volumes, followed by a notable decline phase beginning in early August that aligns with supply distribution patterns.

Only three whales executed transactions exceeding $1 million in DOGE value since June’s start, with most August transactions ranging between $100,000-$250,000.

Throughout Q1 2025, DOGE whales regularly accumulated billions of Dogecoin tokens, a pattern not witnessed in recent periods.

Dogecoin Price Prediction: Technical Analysis Hints at a Major Sell-off

The DOGE/USDT price chart shows a vulnerable technical setup that corresponds with the whale distribution data.

DOGE is currently trading at $0.21059, and is testing crucial support levels following rejection from the psychological resistance at $0.255.

The ascending trendline support maintained since June faces severe pressure, which represents the final technical defense before a potential breakdown.

Notably, the RSI indicator at 45.44 also reflects diminishing momentum and suggests the asset transitions from neutral territory toward oversold conditions, indicating minimal buying interest at present levels.

A break below this critical threshold would likely trigger accelerated selling toward the $0.1889-$0.16131 support zones, representing a potential 16-23% decline from current price levels.

Maxi Doge Offers Investors a “Beta” To Dogecoin Amid Sell-off Concerns

While Dogecoin struggles and prices continue to fall, some investors are turning to newer meme coins with stronger momentum.

One standout is Maxi Doge ($MAXI) – a fresh meme token currently in its presale phase.

Launched less than a month ago, Maxi Doge has gained serious attention thanks to its viral branding, high-energy vibe, and potential for major returns.

The project has already raised over $1.55 million, signaling strong community interest.

With hype building fast, Maxi Doge could be one of 2025’s top-performing new crypto projects.

Many early buyers are snapping up $MAXI tokens in hopes of landing 100X gains, just like those who got into Dogecoin early in 2020.

Right now, you can still grab 1 MAXI for just $0.000254 – but this presale price won’t last much longer.

To buy, simply visit the official Maxi Doge website, connect your wallet (like Best Wallet).

You can make your purchase using crypto or a bank card in just seconds.

You May Also Like

Kaspa Price Prediction 2030: Can KAS Reach $1 or Will Traders Chase This 100x Crypto Presale Instead?

SEC greenlights new generic standards to expedite crypto ETP listings