Ethereum Price Faces Crucial Support Levels: Will It Reclaim $2,000 Soon?

Key Insights:

- Ethereum price is attempting to surpass the $2,000 resistance; however, market consolidation is still ongoing.

- Ethereum’s bearish pennant pattern indicates potential downside risk if support levels are broken.

- Accumulation below $2000 could indicate a possible price reversal if support holds.

Ethereum price has been struggling to break key resistance levels, leaving traders unsure of where it will head next. Ethereum has failed several times to breach the $2,000 mark. It continues to show weakness amid overall market volatility.

Analysts remain divided on Ethereum’s prospects. Some expect the ETH price to regain bullish momentum, while others anticipate further declines.

Ethereum Price Struggles to Break $2,000 Resistance

Ethereum price has been trying to breach the crucial level of $2,000 but has been unsuccessful despite multiple attempts. The price has been between $1,850 – $1,900, and there has been a very strong consolidation below key resistance.

Ted, a market analyst, stated that Ethereum’s current price movement shows strong resistance. This resistance has prevented the token from breaking through.

ETHUSDT Daily Chart | Source: Ted, X

ETHUSDT Daily Chart | Source: Ted, X

Ethereum’s failure to break $2,000 is indicative of general market conditions. Bitcoin’s struggles and overall market uncertainty have affected Ethereum’s price action.

It is still stuck within a narrow trading range. The crypto market struggles with macroeconomic pressures. Ethereum also feels the impact of these market dynamics.

Bearish Pennant Indicates Downside for Ethereum Price

The recent Ethereum price action has been in a bearish pennant formation. It implied that the market can experience some more downside pressure.

Trader Tardigrade indicated that the Ethereum price has been trading in a tightening range. This means that the bearish trend has continued.

The bearish pennant showed that Ethereum can be in a state of price breakdown when the support levels are not maintained.

ETHUSD 3D Chart | Source: Tardigrade, X

ETHUSD 3D Chart | Source: Tardigrade, X

The downside target for Ethereum in the event of a breakdown could be around $1,136. This would be a major decline from where it is currently and would confirm the bearish pattern.

ETH price must hold key support at around $1,850 to avoid further losses. If the price does not hold the support, ETH could experience more notable declines in the short term.

Accumulation Under $2,000 May Indicate Reversal

Despite the bearish sentiment, some analysts are bullish. Also, they have suggested that Ethereum is in a period of accumulation below the $2,000 mark.

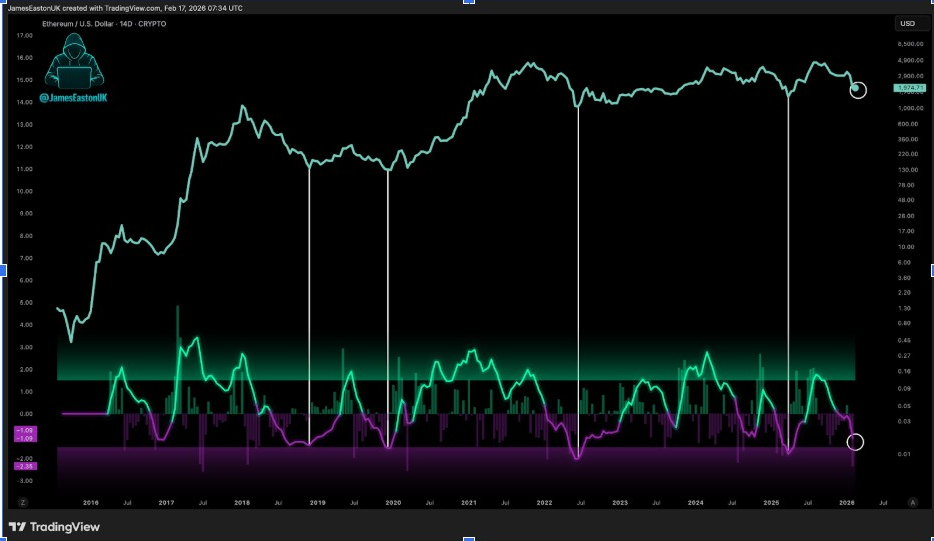

James Easton, an experienced crypto analyst, notes that the market may be preparing for a breakout. He points to accumulation below $2,000 as a signal of a possible rally.

If Ethereum is able to hold around the price of $1,850 to $1,900, it could eventually break over $2,000.

ETHUSD 14D Chart | Source: James, X

ETHUSD 14D Chart | Source: James, X

Ethereum price has demonstrated a pattern of recovery in the past. Also, some believe this may be another case of consolidation in the market before an upward movement.

Ethereum’s near-term price movement depends on its ability to regain $2,000. Establishing solid support above that level will be crucial.

Without a break above $2,000, Ethereum could keep consolidating or face further downside pressure.

Ethereum Key Support Levels and Outlook

Ethereum’s near-term price movement is very reliant on its ability to hold significant support levels. Analyst pointed out that Ethereum must stay above $1,850 – $1,900 to prevent a further decline.

If the top altcoin can hold these levels, it could try to break through $2000 in the coming weeks. However, if the price dips below these values, a more profound drop to $1,500 or below is possible.

ETH price is also affected by the overall state of the market, especially the performance of Bitcoin. If Bitcoin acts as it stabilizes or gains momentum upward, it might give Ethereum a price lift.

However, if Bitcoin is still struggling, Ethereum will follow suit and continue to come under pressure. The coming weeks will be critical for Ethereum. They will determine whether it can reverse its current trend or remain under pressure.

The post Ethereum Price Faces Crucial Support Levels: Will It Reclaim $2,000 Soon? appeared first on The Market Periodical.

You May Also Like

Institute of Museum and Library Services Awards $4.1 Million to Support the Trump AI Action Plan

Humain takes minority stake in xAI