Top Reasons the Crypto Market May Be Headed for a ‘Reset’—Is a 2022-Style Bottom Forming?

The post Top Reasons the Crypto Market May Be Headed for a ‘Reset’—Is a 2022-Style Bottom Forming? appeared first on Coinpedia Fintech News

Ever since the Bitcoin price slipped below the psychological $100,000 mark, sentiment across the crypto market has steadily deteriorated. The breakdown under $90,000 intensified the shift, pushing market mood from neutral into clear fear territory. Traders are now leaning increasingly bearish on Bitcoin and the broader market, with many beginning to speculate that a deeper reset could be underway.

As volatility rises and confidence weakens, comparisons to the 2022 bottom are starting to resurface. Here are the key reasons why the crypto market may be heading toward a similar reset phase.

Capital Flowing Out of the Markets

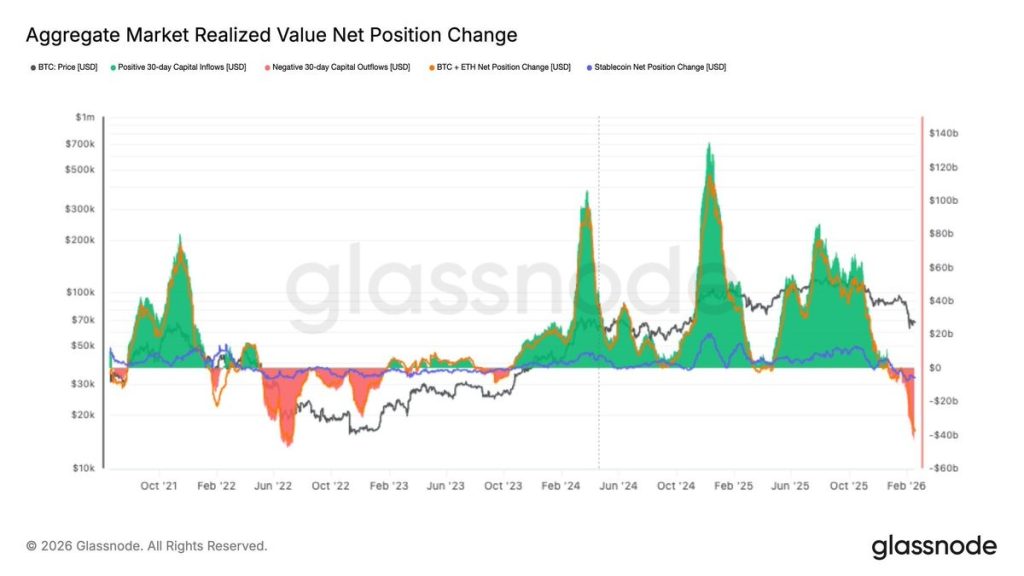

Although the BTC prices have dropped nearly 50% from their ATH above $126K, many fail to mark this rally as a bear market. Moreover, the market participants believe that a strong recovery could be initiated in a short while. However, the Glassnode data suggests that the crypto markets are yet again replicating the 2022-like pattern.

The above chart shows the sustained outflow is once again being seen in the crypto market, which is strongly reminiscent of the 2022 bear market. Since the start of the month, the BTC price has dropped, and the 30-day inflow has dropped as outflows have reached the previous bear market bottom levels. Meanwhile, the stablecoin inflows have also reduced at the same time.

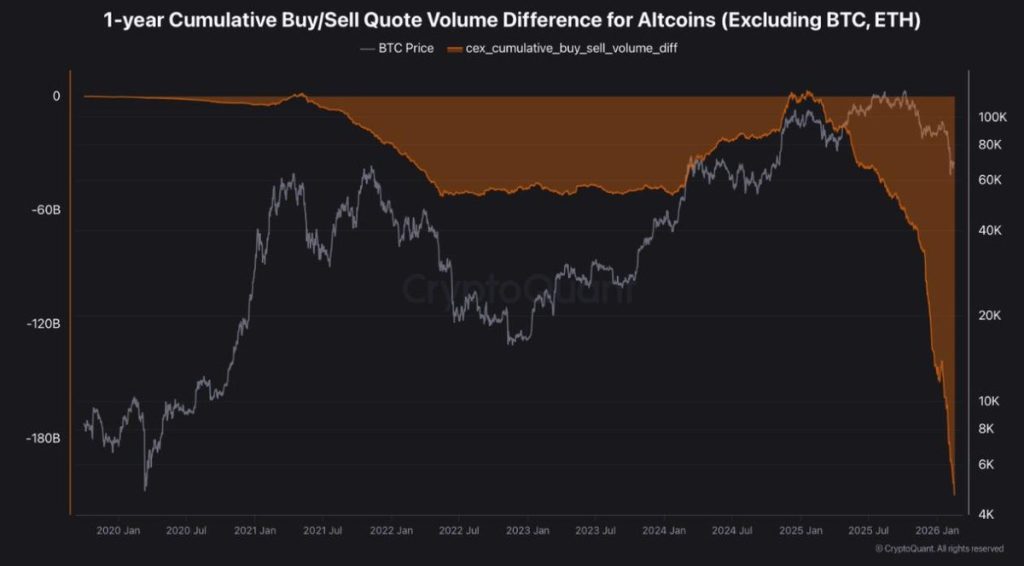

Altcoin Sell-Pressure Just Hit a 5-Year Extreme

This chart shows the 1-year cumulative buy/sell volume difference for altcoins, excluding Bitcoin and Ethereum, alongside BTC’s price. The orange area represents net buying versus selling pressure on centralized exchanges. When it trends downward, it signals sustained net selling in altcoins.

Recently, the metric has plunged sharply into deeply negative territory, marking one of the most aggressive sell-offs in years. This suggests heavy distribution or even capitulation across the altcoin market. Interestingly, similar extreme readings in the past have aligned with broader market bottoms or late-stage corrections. The sharp drop implies risk-off behavior, liquidity withdrawal, and growing fear, conditions often seen during major market reset phases.

When Will the Crypto Markets Undergo a ‘Reset’?

This chart highlights Bitcoin’s long-term price cycles against the 200-week moving average (green line), a key structural support level across every major bear market. The shaded red zones mark the 2011, 2014, 2018, 2022, and a potential 2026 bear phase.

Source:X

Source:X

Historically, Bitcoin has consistently retraced toward or slightly below the 200-week MA during deep corrections before establishing a macro bottom. Each touch of this level has marked high-probability accumulation zones for long-term traders. The current structure suggests price is once again approaching this critical support region. If the 200-week MA holds, it could form the base for the next expansion phase.

A decisive breakdown, however, would signal a deeper structural shift, which may ‘reset’ the crypto market and begin with a recovery phase.

You May Also Like

Protectt.ai Launches New Version of Its AI & Behaviour-Driven Mobile App Security Platform, AppProtectt, in Dubai

Trading time: Tonight, the US GDP and the upcoming non-farm data will become the market focus. Institutions are bullish on BTC to $120,000 in the second quarter.