Ethereum Proof-of-Stake Contract Now Holds Over 50% of ETH Supply: Santiment

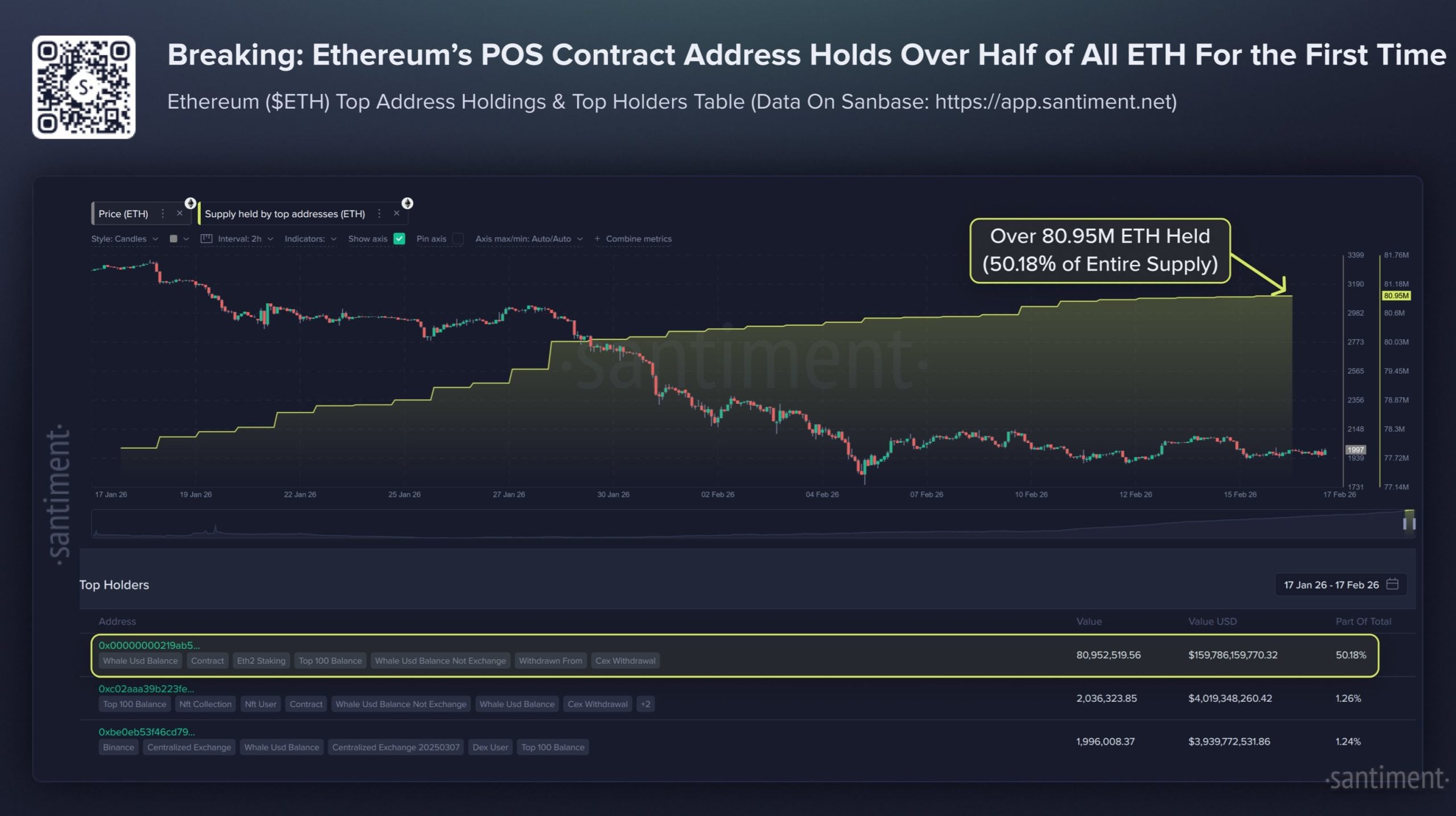

- For the first time in the history of Ethereum, its proof-of-stake contract now holds over half of the network’s ETH supply.

- The contract currently holds 80.9 million Ether tokens, currently valued at $160.4 billion.

Just over three years since it switched to the proof-of-stake (PoS) consensus mechanism, Ethereum has hit a major milestone: for the first time in its history, its PoS contract holds over half of the ETH supply.

Etherscan shows that the PoS address now holds 80.971 million, worth just over $160 billion. This translates to around 50.2% of the entire ETH supply. Data from Santiment shows that the number of ETH held by the contract shot up in January, but the flow has been steady in the past two weeks.

Image courtesy of Santiment.

Image courtesy of Santiment.

According to Santiment, the exact holdings can sometimes slightly vary. This is because when a user stakes their ETH by sending it to this address, those tokens are removed from circulation, which means they can’t sell, transfer or stake it again. If they later decide to withdraw from the PoS address, this ETH is released as newly issued coins on the main network. The system does not pull out the same tokens the user had stashed away in the vault.

“As a result, the existing supply can often differ based on whether only pre-burned or total post-burned coins are being counted,” the blockchain analytics company explains.

Notably, the 80.97 million tokens are more than 50% of Ethereum‘s stated total supply, which is currently at 120.69 million Ether. This is because the calculation is based on the number of ETH issued historically before token burns.

Ethereum Struggles at $2,000 As BlackRock Starts Acquiring Ether for ETF

At press time, ETH trades at $1,985, gaining about 1% in the past day to settle at $239.69 billion in market cap. Trading volume is up 12% to top $21 billion. In the past week, Ethereum has struggled to break past local resistance at $2,100, with multiple attempts rebuffed over the weekend. However, in the past month, the top altcoin has lost over 38% of its value.

The price struggles come despite increasing anticipation of an upcoming Ether ETF by BlackRock. The Wall Street giant launched its first spot Ethereum ETF in mid-2024, and today, it holds 3.2 million Ether, worth $6.6 billion.

BlackRock is now shifting strategy and wants to stake the ETH it holds, and it’s launching a new ETF to be named ETHB. The $14 trillion giant will share 82% of the staking reward with its investors, while it keeps 18% to be shared with Coinbase, the custodian of the new ETF.

“This arrangement creates a financial incentive for the Sponsor to maximize the amount of Ethereum staked by the Trust,” the two companies stated in their filing with the SEC on Tuesday.

]]>You May Also Like

World Order Shift Sparks New Crypto Cycle, Analyst Predicts

Polygon Tops RWA Rankings With $1.1B in Tokenized Assets