Monero Usage Holds Firm Despite Exchange Delistings, TRM Labs Finds

- Monero usage remains above 2022 levels despite being delisted by major exchanges and banned in regulatory hubs like Dubai.

- Darknet adoption is rising with 48% of new 2025 marketplaces supporting Monero exclusively, while Bitcoin remains the primary choice for ransomware payments.

- Researchers identified that specific node clusters could potentially monitor transaction propagation, posing a risk to user anonymity despite on-chain encryption.

Monero is still being used at scale, even after years of delistings, regulatory bans, and a high-profile attempt to disrupt the network, according to new research from TRM Labs.

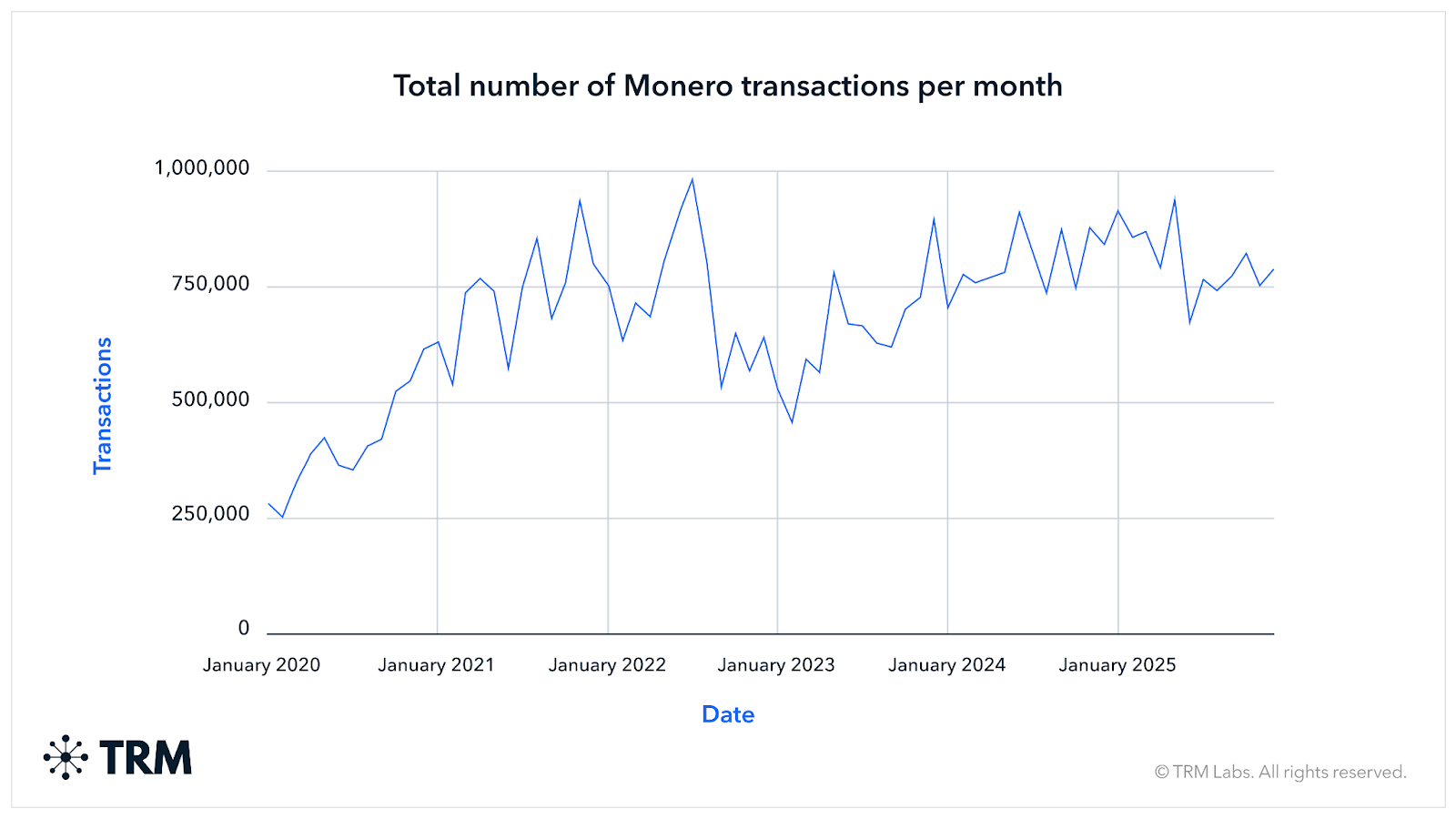

TRM said Monero transaction activity in 2024 and 2025 stayed above pre-2022 levels, a sign that demand held up even as access through major exchanges narrowed.

Source: TRM

Source: TRM

Related: Bitcoin Back in the Red as Analysts Warn $60K is “Liquidation Trigger”

Monero Keeps Up

In 2024, Crypto News Australia reported that large platforms, including Binance and Kraken, moved to delist or phase out the privacy coin on compliance and traceability grounds, with Kraken removing Monero in Ireland and Belgium.

Monero also faced a separate stress event a year later, when it was hit by a 51% attack linked to Qubic. The platform reorganised blocks and converted mined XMR into USDT, then used the proceeds to buy back and burn QUBIC tokens in a loop designed to make QUBIC more scarce.

As if that wasn’t enough, this month, Dubai’s financial regulator banned privacy coins such as Monero and Zcash from licensed platforms in the Dubai International Financial Centre, making things more complicated for this particular niche.

Interestingly though, TRM said Bitcoin (BTC) remains the dominant currency for real-world ransom settlements even though ransomware groups often request Monero and sometimes offer discounts for it.

Darknet markets appear to be moving more aggressively toward Monero, however. TRM found that 48% of newly launched darknet marketplaces in 2025 supported only Monero, a higher share than in earlier years.

TRM also flagged a possible weak point that sits outside Monero’s cryptography. While the protocol obscures sender, recipient, and amount on-chain, the report examined how Monero transactions propagate across the network. It found roughly 14% to 15% of nodes showed unusual timing patterns and hosting concentration, behaviour consistent with operators running clusters of connected nodes that can observe how transactions spread.

That does not prove the network is compromised, but it could reduce anonymity at the margins if an observer can consistently see transactions early enough to infer where they originated.

Read more: Memecoin ‘Capitulation’ May Signal Surprise Rebound, Santiment Says

The post Monero Usage Holds Firm Despite Exchange Delistings, TRM Labs Finds appeared first on Crypto News Australia.

You May Also Like

Valour launches bitcoin staking ETP on London Stock Exchange

Guillermo Del Toro’s ‘Frankenstein’ To Play In Some IMAX Theaters