9 Best Crypto Arbitrage Scanners in 2026 to Automate Your Trading Strategy

Crypto arbitrage scanners are automated tools that scan multiple cryptocurrency exchanges in real time to identify arbitrage opportunities. They can alert traders to profitable opportunities and even execute trades on their behalf with the use of advanced crypto trading bots.

Crypto arbitrage is the process of buying a cryptocurrency on one exchange and selling it on another exchange for a higher price. This is possible because cryptocurrency prices can vary between exchanges, sometimes by a significant margin.

In this article, we are going to examine the 9 best crypto arbitrage scanners and explore their key features, pricing structures, bot customization, and more.

The best crypto arbitrage scanners in 2026:

- ArbitrageScanner – The leading crypto arbitrage scanner in the market

- Cryptohopper – An AI-powered trading bot platform

- Crypto.com – Crypto exchange with automated arbitrage trading feature

- Bitsgap – Streamlined automated trading strategies

- Coinrule – A beginner-friendly platform for arbitrage traders

- TradeSanta – Crypto arbitrage finder with native iOS and Android apps

- 3Commas – Native app marketplaces for automated crypto trading strategies

- Pionex – Crypto exchange with powerful trading bot features

- Blackbird – Open-source crypto arbitrage bot for advanced users

The 9 best crypto arbitrage scanners: Top automated tools for profitable trading in 2026

The following list includes the best cryptocurrency arbitrage scanners currently available in the market. We compared them based on exchange coverage, network scanner, screener features, pricing structure, mobile app support, and more.

1. ArbitrageScanner – The leading crypto arbitrage scanner in the market

ArbitrageScanner is a comprehensive cryptocurrency arbitrage trading tool that covers both centralized and decentralized exchanges. It boasts an extensive list of features and capabilities that can be of interest to traders seeking arbitrage opportunities. Here’s an overview of its key attributes:

Exchange coverage: ArbitrageScanner supports a wide range of exchanges, encompassing more than 75 centralized exchanges (CEX) and over 25 decentralized exchanges (DEX). Additionally, it operates on 10 different blockchains, making it one of the most versatile tools available.

Blockchain network scanning: The platform scans 10 major blockchain networks, including Ethereum, BNB Chain, Polygon, Avalanche, Arbitrum, Optimism, Fantom, Gnosis, Klaytn, and Aurora. This feature enables users to identify price disparities between tokens on different networks, potentially creating arbitrage opportunities.

Cross-chain arbitrage: ArbitrageScanner claims to be the only scanner supporting cross-chain arbitrage. This type of arbitrage can offer higher profit margins compared to intra-chain arbitrage by taking advantage of price differences between different blockchain networks.

Screener feature: The platform offers a customizable screener feature, allowing users to define their criteria for identifying arbitrage opportunities. Users can specify exchanges, coins, trading pairs, and profit thresholds, and the platform will send notifications when matching opportunities arise. This feature can be suitable for beginners with small balances who want to make multiple daily trades.

Pricing plans: ArbitrageScanner offers four subscription plans, with prices ranging from $69 to $795 per month. The cheapest plan includes a 30-day trial period, while higher-tier plans come with additional benefits such as turnkey scanner setup, voice curator support, and access to a closed community. The platform also provides free arbitrage training to all users.

Supported exchanges: The platform supports a variety of DEXes and notable centralized exchanges like Binance, Bybit, OKX, KuCoin, Coinbase, Crypto.com, and more.

Key features of ArbitrageScanner:

- Supports over 100,000 crypto assets, 75+ CEX, and 25+ DEX.

- Scans DEXes across 10 different blockchains.

- Automatically identifies arbitrage bundles and sends customizable notifications.

- Enables arbitrage trading without holding coins in your portfolio.

- Notifies users about cross-chain arbitrage opportunities.

- Focuses solely on notifications and does not access users’ crypto.

- Users with Pro plans and above gain access to a VIP Manager and private chat with experienced arbitrage traders.

- ArbitrageScanner operates through Telegram, making it accessible to users on various devices.

Learn more in our ArbitrageScanner review.

2. Cryptohopper – An AI-powered trading bot platform

Cryptohopper is an AI-powered trading bot designed for cryptocurrency markets, utilizing advanced algorithms and strategies to execute trades on behalf of users. Here’s an in-depth look at its features:

Automated trading: Cryptohopper operates by connecting to various cryptocurrency exchanges, enabling it to access and trade within users’ accounts. It is engineered to enhance efficiency and profitability by automating a range of trading activities.

Customizable parameters: Users have the flexibility to tailor the bot’s behavior according to their preferences. They can set parameters such as trading pairs, buy/sell signals, and stop-loss levels. Additionally, users can make use of trading templates for added convenience.

Market monitoring: The bot continually tracks market conditions and executes trades based on the predefined settings. It can deploy strategies rooted in technical analysis and incorporate signals from third-party sources. Cryptohopper is also equipped to conduct triangular arbitrage scans and leverage Binance’s arbitrage scanner data.

User-friendly interface: Cryptohopper offers a web-based interface that empowers users to monitor ongoing trades, access historical data, and make adjustments to their settings. This user-friendly interface simplifies the trading experience.

Backtesting: For strategy evaluation, Cryptohopper provides a backtesting feature that allows users to assess trading strategies using historical market data. This aids traders in making informed decisions based on past performance.

Mobile access: Cryptohopper offers mobile apps for both Android and iOS platforms, ensuring that users can manage their trades on the go.

Pricing: Cryptohopper offers a starting price of $29 per month, making it accessible for traders with varying budgets. Additionally, it provides a 3-day free trial, allowing users to explore its capabilities before committing. However, users can buy plans all the way up to $129 per month for additional perks such as more event-based triggers and extra technical indicators.

Supported exchanges: Cryptohopper is compatible with a wide range of exchanges, including Binance, KuCoin, Coinbase, Kraken, Huobi, Bybit, Crypto.com, OKX, and more.

Key features of Cryptohopper:

- Access to up to 75 trading bots for comprehensive market scanning.

- Unified terminal for managing multiple exchange accounts efficiently.

- Advanced price trailing features to optimize trading strategies.

- Utilizes AI for data-driven trading decisions.

- Offers copy trading and trading templates for strategy replication.

- Supports dollar-cost averaging, market-making, short selling, and arbitrage trading options.

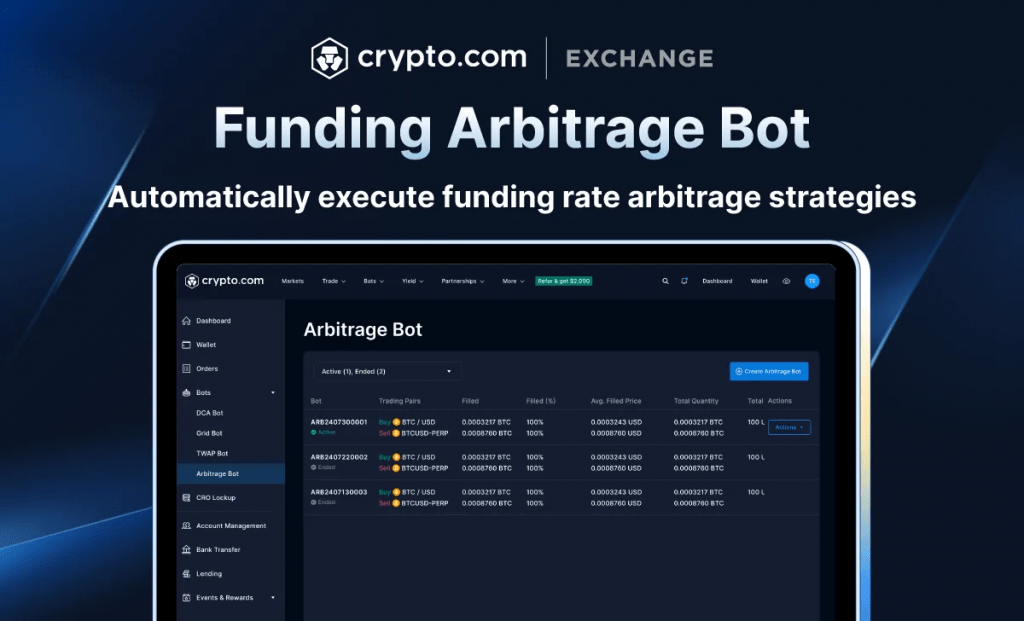

3. Crypto.com – Crypto exchange with automated arbitrage trading feature

Crypto.com is a well-established cryptocurrency exchange that offers a diverse suite of automated trading tools, including an arbitrage trading bot. With a focus on seamless integration, the platform enables users to leverage arbitrage strategies directly within the Crypto.com ecosystem, eliminating the need for third-party tools.

Automated arbitrage trading: Crypto.com’s arbitrage bot is designed to capitalize on market inefficiencies by executing trades based on two core strategies: Positive carry (long spot, short perpetual contract) and Reverse carry (short spot, long perpetual contract). By automating these strategies, traders can potentially secure profits from price differences within the Crypto.com exchange.

User-friendly interface: The platform makes it easy for users to set up and deploy arbitrage bots. Within the “Trading Bots” section, users can quickly create a bot for their preferred trading pair, specify the trade amount, and let the system handle execution. This intuitive process allows both beginners and experienced traders to take advantage of automated trading with minimal complexity.

Arbitrage opportunities: Unlike traditional arbitrage scanners that identify price discrepancies across multiple exchanges, Crypto.com’s arbitrage bot focuses on intra-exchange arbitrage within its own ecosystem. By leveraging perpetual contracts and spot trading pairs, traders can execute arbitrage strategies without needing to transfer funds across different platforms, reducing risks related to withdrawal delays and fees.

Additional automated trading tools: Beyond arbitrage trading, Crypto.com provides a range of automation tools tailored for various market conditions. These include a DCA bot for systematic investment strategies, a Grid bot for profiting from market fluctuations, and a TWAP bot for executing large orders efficiently. These tools enhance traders’ ability to automate their strategies within the Crypto.com platform.

Mobile access: Crypto.com ensures seamless accessibility with its fully-featured mobile apps for iOS and Android. This allows traders to monitor their arbitrage bots, make adjustments, and execute trades on the go, ensuring that they never miss a potential opportunity.

Pricing: A major advantage of Crypto.com’s arbitrage bot is that it is completely free to use for all Crypto.com users. Unlike third-party arbitrage scanners that charge subscription fees, Crypto.com integrates arbitrage trading directly into its platform without additional costs. This makes it an attractive option for traders looking to implement arbitrage strategies without incurring extra expenses.

Key features of Crypto.com:

- Integrated arbitrage bot with automated trading execution.

- Supports both positive carry and reverse carry strategies.

- Intra-exchange arbitrage reduces risks from withdrawal delays and fees.

- Additional DCA, Grid, and TWAP bots for diverse trading strategies.

- User-friendly setup within the Crypto.com “Trading Bots” section.

- Fully accessible via iOS and Android mobile apps.

- Completely free to use, with no additional costs for arbitrage trading.

4. Bitsgap – Streamlined automated trading strategies

Bitsgap is a comprehensive cryptocurrency trading platform and bot designed to simplify and automate trading strategies in the crypto market. Below is an overview of its key features and functionalities:

Automated trading: Bitsgap streamlines trading by automating trades for users through API key connections to their exchange accounts. It offers users the flexibility to customize parameters such as trading pairs, indicators, and stop-loss levels according to their preferences.

Market monitoring: The platform’s trading bot continuously monitors the cryptocurrency market and executes trades based on predefined settings. This automation helps users stay on top of market movements without constant manual oversight.

Unified interface: Bitsgap provides a unified interface that consolidates multiple exchanges, offering users easy access to real-time market data and performance tracking. This centralized view simplifies portfolio management and trading across various exchanges.

Arbitrage opportunities: Bitsgap goes beyond basic trading by actively scanning for price disparities among more than 30 digital assets, enabling users to capitalize on arbitrage opportunities when market conditions favor it.

Demo trading mode: Bitsgap offers a demo trading mode for users looking to test their strategies risk-free. This feature allows traders to simulate trades and evaluate their strategies without risking real funds.

Pricing: Bitsgap is one of the cheapest arbitrage scanners on the market, with plans ranging from $26 for the Starter plan to $135 for the Pro plan.

Supported exchanges: Binance, KuCoin, Coinbase, Kraken, Huobi, Bybit, Crypto.com, OKX, and more.

Key features of Bitsgap:

- Create GRID and DCA (Dollar-Cost Averaging) strategies using trading bots.

- Smart orders for controlling risk-to-reward ratios.

- Customizable order types, including Stop Loss, Take Profit, Trailing Take Profit, and OCO (One Cancels Other) orders.

- Supports various order types, including limit, market, and scaled orders.

- Provides a trading terminal that connects to popular exchanges.

- Access to pre-made trading bot strategies for added convenience.

- Pricing starts at $23 per month, making it accessible to traders with different budgets.

- Offers a 7-day free trial period for users to explore its features.

- Accessible through a web app, ensuring platform availability on various devices.

5. Coinrule – A beginner-friendly platform for arbitrage traders

Coinrule is a user-friendly automated platform designed to simplify cryptocurrency trading, making it accessible to traders of all levels of expertise. Here’s a detailed overview of its features:

Simplified trading: Coinrule aims to streamline cryptocurrency trading by allowing users to create and execute trading strategies without requiring coding skills or advanced technical knowledge. It offers a selection of pre-made template strategies, and users can also build their own based on their specific criteria.

Visual interface: Users can define trading rules and conditions using a visual interface, making it easy to implement their strategies. The platform employs an “if this, then that” logic, enabling users to set events or market conditions that trigger specific actions, such as buying, selling, or executing other trade orders. This approach simplifies strategy creation and execution.

Wide exchange support: Coinrule operates on various cryptocurrency exchanges, including Binance, KuCoin, Coinbase, Kraken, BitMEX, Crypto.com, OKX, and supports a diverse range of trading pairs, providing traders with flexibility and choice in their trading activities.

Leverage trading: Coinrule goes beyond standard trading by offering the option to use leverage in crypto strategies. This feature allows traders to increase their exposure to the markets, potentially magnifying both profits and losses.

Pricing: The paid plans for Coinrule range from $29.99 to $449.99 per month. It’s worth noting that Coinrule has one of the best free account plans around. The so-called Starter plan comes with 2 live rules, 7 template strategies, and up to $3,000 in monthly trading volume, and it is free forever. This makes Coinrule the best free crypto arbitrage scanner in our oppinion.

Key features of Coinrule:

- Create trading rules based on popular indicators like RSI, SMA, and more.

- Up to 50 live trading rules to manage multiple strategies simultaneously.

- The “Pro” plan includes unlimited template trading strategies.

- Execute up to 10,000 orders per rule, providing ample capacity for active trading.

- Supports both market and limit orders, giving users control over execution.

- Offers a starting price of $29.99 per month, making it accessible for various budgets.

- Provides an indefinitely long free trial to allow users to explore its functionality.

- Offers an Android mobile app for on-the-go trading.

6. TradeSanta – Crypto arbitrage finder with native iOS and Android apps

TradeSanta is a crypto arbitrage platform designed for both beginner and advanced traders, offering a seamless experience across desktop, web browsers, and mobile devices. With an intuitive interface and a broad selection of automation tools, the platform simplifies arbitrage trading while providing advanced customization options for users seeking to fine-tune their strategies.

Unified interface: TradeSanta’s interface allows users to manage multiple trading bots, track real-time market data, and adjust settings effortlessly. The dashboard presents all essential trading information in a clear and organized format, making it easy to monitor active trades, view portfolio performance, and fine-tune strategies without unnecessary complexity.

Automated trading capabilites: The platform’s automated trading capabilities include a range of bot options such as grid bots, DCA bots, and arbitrage bots, allowing traders to take advantage of different market conditions. Additionally, TradeSanta enhances automation with trailing stops and integrations with social trading signals, helping users optimize their trades with minimal manual intervention.

Multi-device accesibility: TradeSanta ensures accessibility on all devices, supporting iOS, Android, and desktop platforms. Users can manage their trades from anywhere, switching between desktop and mobile devices without losing progress. The mobile apps maintain the full functionality of the web platform, making it easier to execute and monitor trades on the go.

Pre-configured trading templates: Traders can choose from over 25 pre-configured trading templates, which offer a simplified approach for those who prefer to use proven strategies. These templates help reduce the learning curve, enabling users to start trading quickly without the need for extensive setup or programming knowledge.

Exchange support: The exchange support on TradeSanta includes major cryptocurrency platforms such as Binance, Kraken, Coinbase, OKX, HTX, and Bybit. Through API integration, users can connect their exchange accounts securely and execute arbitrage strategies without manually placing trades.

Pricing: TradeSanta’s pricing starts at $25 and goes up to $90 per month with no long-term contract requirements. The platform also offers a free trial, allowing users to explore its features before committing to a paid plan.

Key features of TradeSanta:

- Unified interface for managing multiple bots and tracking market data.

- Automated trading with support for grid, DCA, and arbitrage bots.

- Fully accessible on desktop, iOS, and Android devices.

- 25+ pre-configured trading templates for an easy setup.

- Supports multiple trading signals, including MACD, RSI, and Bollinger Bands.

- API integration with major exchanges like Binance, Kraken, Coinbase, and more.

7. 3Commas – Native app marketplaces for automated crypto trading strategies

3Commas is a highly regarded trading platform among crypto arbitrage enthusiasts, offering a suite of tools and features designed to support users in their trading endeavors. Here’s a comprehensive overview of its offerings:

Automated trading: 3Commas empowers users to configure automated trading bots with precise parameters, including options like leverage settings. However, it’s important to note that using leverage in the crypto market carries a high risk and could result in substantial losses.

Smart trading terminals: The platform provides two smart trading terminals, namely SmartTrade and Terminal, catering to both automated and manual trading strategies. These terminals offer flexibility in executing trades.

Copy trading: 3Commas introduces a “Copy Trading” feature, allowing users to follow successful traders and integrate their strategies seamlessly with trading bots.

Demo account: For risk-free practice, 3Commas offers a “Demo” account where users can simulate trades without using real funds. This is an excellent way for beginners to gain experience.

Portfolio management: Users can efficiently manage their portfolios with the platform’s portfolio management tools, ensuring a comprehensive view of their assets and performance.

Customizable alerts: The platform includes customizable alerts, enabling users to stay informed about market movements and potential opportunities.

Backtesting: To refine trading strategies, 3Commas offers backtesting capabilities, allowing users to evaluate their strategies using historical data. This is valuable for identifying potential triangular arbitrage opportunities.

Developer-friendly: 3Commas opens up opportunities for developers by permitting them to leverage the platform’s infrastructure to create and publish their own apps in the 3Commas marketplace.

Pricing: The free plan is free forever, allowing users to make use of simple bot strategies free of charge. Paid plans start at $49/month for the Pro plan and $79/month for the Expert plan. There’s also an option for a custom plan that’s available to those who might find the constraints of the Expert plan too limiting.

Supported exchanges: Supports a wide range of exchanges, including Binance, KuCoin, Coinbase, Kraken, Huobi, Bybit, Crypto.com, OKX, and more.

Key features summary:

- Smart trading terminals for both automated and manual trading.

- A variety of trading bots, including Options bot, HODL bot, and GRID bot, with preconfigured settings.

- Seamless integration of trading signals into bots.

- Copy trading functionality for following successful traders.

- Advanced analytics and charting tools for in-depth market analysis.

- The 3Commas Apps marketplace, where users can deploy their own trading apps.

- Pricing starts at $49 per month, making it accessible for traders with different budgets.

- Offers an ongoing free trial option for users to explore its features.

- Available on Android and iOS platforms, providing mobile accessibility.

8. Pionex – Crypto exchange with powerful trading bot features

Pionex is a cryptocurrency exchange designed with automation at its core, offering a wide range of built-in trading bots to help users optimize their trading strategies. It combines the functionality of a traditional exchange with automated trading tools that cater to both beginners and experienced traders. Below is an overview of its main features and capabilities:

Automated trading: Pionex offers 16+ built-in trading bots, allowing users to automate their strategies directly within the exchange without the need for external integrations. Its two primary bots are the DCA (Dollar-Cost Averaging) Bot, which helps newcomers steadily build positions over time, and the Rebalancing Bot, which enables users to create custom indexes and automatically maintain portfolio allocations.

Market options: Users can trade cryptocurrencies in the spot markets to directly buy and sell assets, or use futures markets to speculate on price movements. Pionex also provides interest-bearing options such as Ethereum staking, allowing users to earn passive income from their holdings.

Advanced trading tools: The platform supports leverage and margin GRID bots, including reverse and leveraged reverse grid options. Traders can also implement stop-loss, take-profit, and trailing orders within a single trade, offering flexible risk management for different market conditions.

Interface and accessibility: Pionex combines automated and manual trading in a unified interface that includes swap trading and a clean dashboard for managing strategies. The platform is accessible through web and mobile apps for both Android and iOS, ensuring users can manage trades on the go.

Funding and deposits: Pionex supports both crypto and fiat deposits, providing flexibility for users entering or exiting the market. Its premade bot strategies are tailored for bullish, bearish, and sideways market scenarios, helping traders adapt to changing market conditions.

Pricing: Pionex is free to use, with no monthly subscription required. The exchange charges standard trading fees similar to other major exchanges.

Supported exchanges: Pionex (native platform).

Key features of Pionex:

- Pionex supports both spot and futures trading, allowing users to trade crypto assets directly or speculate on future price movements.

- The platform comes with built-in automated trading bots, including DCA, GRID, and Rebalancing bots designed for different strategies and market conditions.

- Traders can manage risk effectively with stop-loss, take-profit, and trailing order options within a single trade.

- Pionex also offers leverage and margin GRID bots, including reverse and leveraged reverse grid configurations for advanced users.

- The platform is accessible on both Android and iOS devices, making it easy to manage trades from anywhere.

- Users can earn passive income by staking Ethereum and using other interest-bearing features available on the exchange.

9. Blackbird – Open-source Bitcoin arbitrage bot for advanced users

Blackbird is a long-standing open-source arbitrage bot built specifically for Bitcoin traders who want full control over their strategy. Instead of offering a graphical dashboard or plug-and-play setup, Blackbird is designed for developers and advanced users who are comfortable working with code, APIs, and command-line tools. It gives traders direct control over execution logic and infrastructure without relying on third-party automation platforms.

Market-neutral arbitrage: Blackbird uses a long/short strategy to open opposing positions on two exchanges at the same time. By going long on one exchange and short on another, it aims to lock in price differences while minimizing overall market exposure. This approach removes the need to transfer funds between exchanges, which is often slow and costly.

API-based execution: The bot connects to supported exchanges via API keys and automatically monitors spreads. Once the configured threshold is reached, it opens positions and tracks them until the spread converges. Users manage all parameters through the local blackbird.conf file, where they define trading pairs, fee structures, exposure limits, and arbitrage thresholds.

Developer-focused setup: Blackbird runs locally and requires manual configuration and deployment. There is no built-in interface, mobile app, or hosted service. This makes it more suitable for technically skilled users who want to customize logic, integrate additional tools, or modify the source code directly.

Project status: While Blackbird remains functional and widely referenced in arbitrage discussions, it has not seen major feature updates in recent years. It primarily supports Bitcoin markets and may require maintenance adjustments depending on exchange API changes.

Key features of Blackbird:

- Fully open-source and free to use.

- Implements market-neutral arbitrage using a simultaneous long and short strategy.

- Eliminates the need to transfer funds between exchanges.

- Supports exchange APIs such as Bitfinex, Kraken, Gemini, and others.

- Advanced configuration through a local blackbird.conf file.

- Detailed trade logging for performance tracking and analysis.

- Active GitHub repository with community contributions.

Overview of the best crypto arbitrage scanners

In the table below, you’ll find a brief overview and comparison of the main features of these platforms.

| Starting price | Free trial | Mobile apps | Supported exchanges | |

|---|---|---|---|---|

| ArbitrageScanner | $69/month | Yes, 30 days | Works through Telegram | DEXes, as well as Binance, Bybit, OKX, KuCoin, Coinbase, Crypto.com, etc. |

| Cryptohopper | $24.16/month | Yes, 3 days | Android and iOS | Binance, KuCoin, Coinbase, Kraken, Huobi, Bybit, Crypto.com, OKX, etc. |

| Crypto.com | Free | Yes, forever | Android and iOS | Crypto.com |

| Bitsgap | $26/month | Yes, 7 days | Web App | Binance, KuCoin, Coinbase, Kraken, Huobi, Bybit, Crypto.com, OKX, etc. |

| Coinrule | $29.99/month | Yes | Android | Binance, KuCoin, Coinbase, Kraken, BitMEX, Crypto.com, OKX, etc. |

| TradeSanta | $25/month | Yes, 3 days | Android and iOS | Binance, Kraken, Coinbase, OKX, HTX, Bybit, etc. |

| 3Commas | $49/month | Yes, forever | Android and iOS | Binance, KuCoin, Coinbase, Kraken, Huobi, Bybit, Crypto.com, OKX, etc. |

| Pionex | Free | / | Android and iOS | Pionex |

| Blackbird | Free | / | None | Bitfinex, Kraken, Gemini |

Types of arbitrage opportunities in crypto

Arbitrage trading in the cryptocurrency market involves taking advantage of price differences for the same asset on different exchanges or within the same exchange. There are several types of arbitrage trading in crypto:

- Spatial arbitrage: This is the most common form of arbitrage and involves buying an asset on one exchange where the price is lower and simultaneously selling it on another exchange where the price is higher. Spatial arbitrage seeks to profit from price disparities across different exchanges.

- Temporal arbitrage: Temporal arbitrage takes advantage of price differences for the same asset at different times. Traders may buy an asset when its price is lower during a specific time period, such as during market dips or at times of lower trading volume, and sell it when the price increases.

- Statistical arbitrage: Statistical arbitrage involves using statistical analysis and mathematical models to identify arbitrage opportunities. Traders look for patterns, correlations, or deviations from historical price movements to make trades. It often involves pairs trading, where one cryptocurrency is bought while another is simultaneously sold based on statistical relationships.

- Triangular arbitrage: Triangular arbitrage is a more complex form of arbitrage that involves exploiting price differences among three different cryptocurrencies on the same exchange. Traders exchange one cryptocurrency for another and then back into the original currency, ideally making a profit in the process.

- Cross-exchange arbitrage: Cross-exchange arbitrage takes advantage of price disparities for the same asset on different exchanges. It can be done manually by traders or through automated trading bots that execute trades across multiple exchanges simultaneously.

- Futures arbitrage: This type of arbitrage involves trading futures contracts on the same or different exchanges. Traders aim to profit from the price difference between the futures contract and the spot price of the underlying asset. It often requires careful consideration of funding rates and contract expirations.

- Cash-and-carry arbitrage: Cash-and-carry arbitrage, also known as carry trade, involves simultaneously buying a cryptocurrency spot and short-selling its corresponding futures contract. This strategy aims to profit from the difference between the spot price and the futures price.

- Risk arbitrage: Risk arbitrage seeks to profit from the price difference of an asset that is involved in a merger, acquisition, or other corporate event. Traders take positions based on the expectation that the asset’s price will converge to a specific level once the event is completed.

The bottom line

From the comprehensive exchange coverage of ArbitrageScanner to the user-friendly approach of Coinrule, the automated trading power of Cryptohopper, and the feature-rich Bitsgap platform, there are options to suit a wide range of trading preferences and experience levels.

Ultimately, the best crypto arbitrage scanner for you will depend on your individual trading goals, preferences, and risk tolerance. Before diving in, take the time to explore each platform’s features and try out free trials where available.

It is worth noting that the potential profitability of arbitrage trading depends on liquidity and market adoption of the assets you are trading. Smaller cap coins are usually not supported on major exchanges and don’t have a lot of liquidity, making them ill-suited for arbitrage strategies. On the other hand, the best cryptocurrencies to buy right now are generally worth considering for arbitrage trading.

You May Also Like

Trump adviser demands Fed economists be 'disciplined' for arguing with presidential tactic

Trump admin appeals after judge orders slavery exhibit returned to Philadelphia museum