Mysterious Whale Revives Ancient BTC—2,300 Coins Shifted in August Alone

After the mega whale unloaded 24,000 BTC on Sunday evening, an old-school player moved 400 BTC on Monday morning from four separate legacy wallets first created back in the summer of 2012. This same entity has repeated this exact play 19 times already this month.

Old-School 2012 Bitcoin Whale Reappears

Bitcoin ( BTC) whales have been hard to miss lately, and following last month’s historic awakening of long-dormant coins, August is proving just as striking. The crypto crowd was rattled last night when a mega whale dumped tens of thousands of bitcoins onto the Hyperunit exchange, linked to Hyperliquid.

By Monday morning, with BTC trading at $111,345 per coin, another 400 vintage bitcoins left wallets set up in July 2012 between block heights 911632 and 911634. At today’s value, those coins were worth $44.55 million, but what really grabs attention is that this same sender has appeared no less than 19 times earlier this month alone.

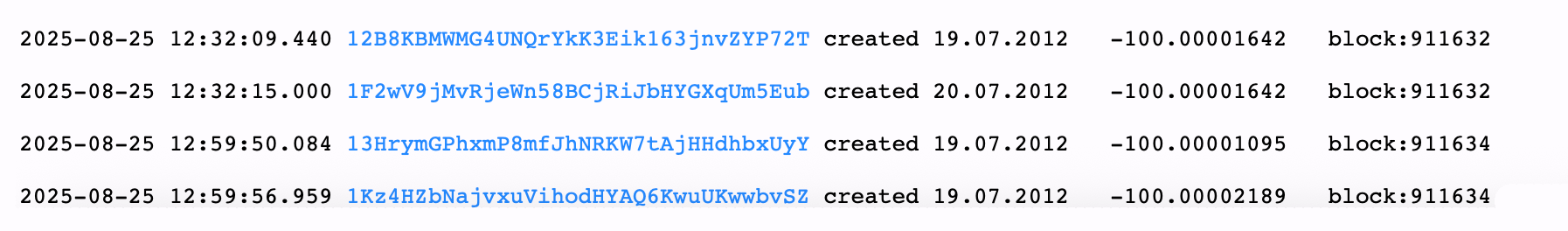

The four transfers from the 2012 wallets on Monday, Aug. 25, 2025.

The four transfers from the 2012 wallets on Monday, Aug. 25, 2025.

The Monday move involved four legacy Pay-to-PubKey-Hash (P2PKH) addresses, each sending 100 BTC into newer native segregated witness wallets using the P2WPKH/P2WSH format. This exact pattern has been mirrored across all 19 of this month’s prior 2012 transfers, with every coin sourced from wallets first set up in June or July of that year.

Data pulled from the blockchain parser btcparser.com shows that 2,300 BTC, valued at $256 million today, has likely been shifted by the same entity. All of these coins remain in their new wallets, with the very first transfer on Aug. 9 still sitting untouched in its P2WPKH/P2WSH address.

The persistence of this patterned behavior hints at a strategy larger than simple liquidation and most likely consolidation to newer wallets. Whether it is repositioning for technological advantages or signaling intent, the repeated activity points to a calculated presence that continues to capture the attention of onchain sleuths.

You May Also Like

CME Group to launch options on XRP and SOL futures

XLM Price Prediction: Stellar Targets $0.26-$0.27 Range by February 2026