XRP Reserves Fall on Binance While Price Stays Near Lows

According to data shared by CryptoQuant, Binance’s XRP reserve has declined to approximately 2.57 billion XRP, with both the 50-day and 100-day simple moving averages trending downward.

The structure clearly reflects a sustained reduction in spot reserves.

Despite occasional short-term upticks, the broader direction remains lower.

Spot Supply Is Shrinking

The current setup shows:

- XRP steadily leaving exchanges

- A reduction in readily available sell-side supply

- Tightening spot market liquidity

Under normal market conditions, falling exchange reserves are considered constructive for price. When assets move off exchanges into private wallets, it typically signals accumulation or reduced immediate selling intent.

However, XRP’s price is hovering around $1.40, near recent lows following a sharp decline. The key observation is that price has fallen even as reserves declined.

Derivatives Pressure Appears Dominant

This divergence suggests that spot supply reduction is not the main driver of current price weakness. Instead, the pressure likely originates from the derivatives market.

If leveraged positions are being unwound or risk appetite remains subdued, futures-driven selling can outweigh the positive impact of shrinking spot supply. In this case, XRP withdrawals may reflect long-term positioning, while short-term price action is being dictated by leverage dynamics.

A Setup for Volatility

If reserves continue falling while demand eventually returns, the market structure could favor a short squeeze scenario. With fewer coins available on exchanges, even moderate buying pressure could produce amplified price reactions.

For now, however, declining reserves have not yet translated into upward momentum. Until derivatives pressure subsides and spot demand strengthens, price may continue searching for a clear accumulation zone.

The structure is tightening. Whether it resolves to the upside depends on when demand re-enters the market.

The post XRP Reserves Fall on Binance While Price Stays Near Lows appeared first on ETHNews.

You May Also Like

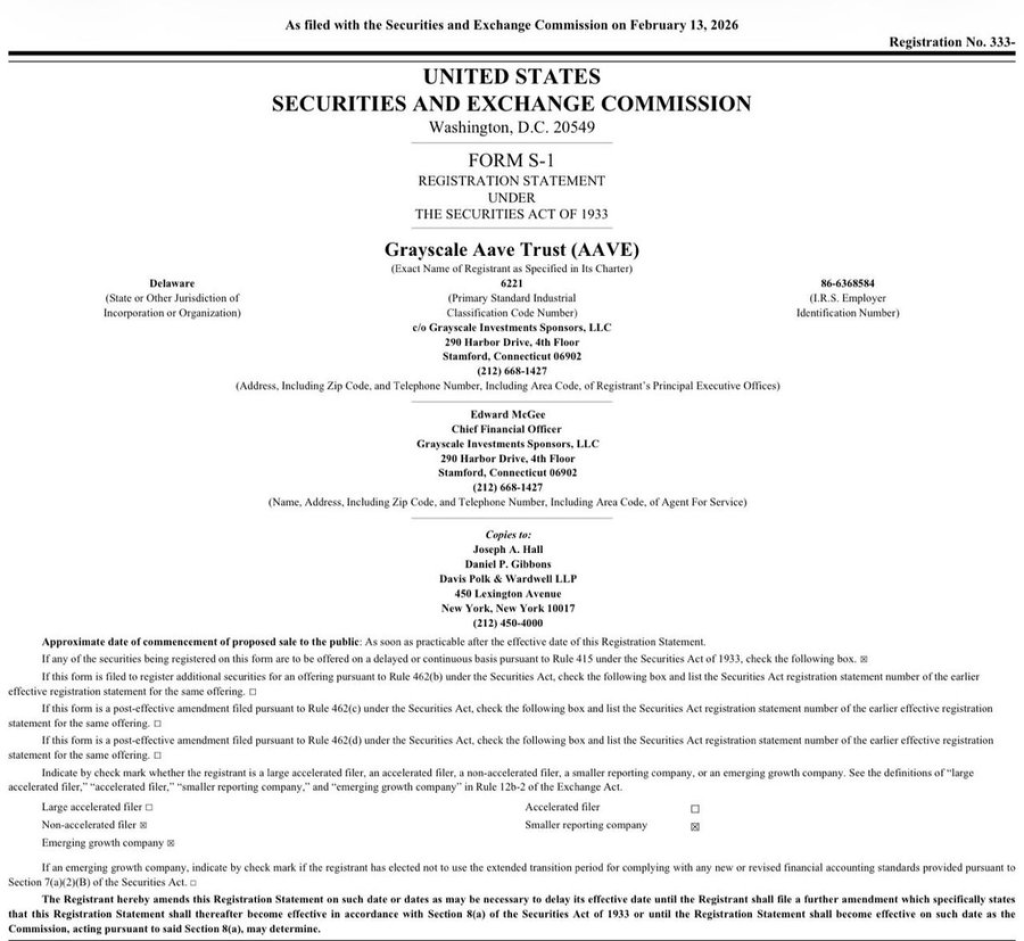

Will SEC Approve the First DeFi ETF? AAVE Filing Sparks Big Question

Wall Street Giants Lead Crypto Hiring Surge: JPMorgan, Citi & More