The Week Ahead: Crypto Markets Brace for Nvidia Earnings and Fed Inflation Data

TLDR

- Nvidia reports quarterly earnings Wednesday with investors watching AI demand growth and China trade policy impacts

- Federal Reserve’s preferred inflation measure (PCE) releases Friday, could influence September rate cut decision

- Fed Chair Powell’s dovish Jackson Hole comments boosted rate cut expectations above 80% for September meeting

- Rate-sensitive sectors like homebuilders and banks rallied strongly on interest rate cut hopes

- Market rotation occurring from big tech stocks toward cyclical and value sectors

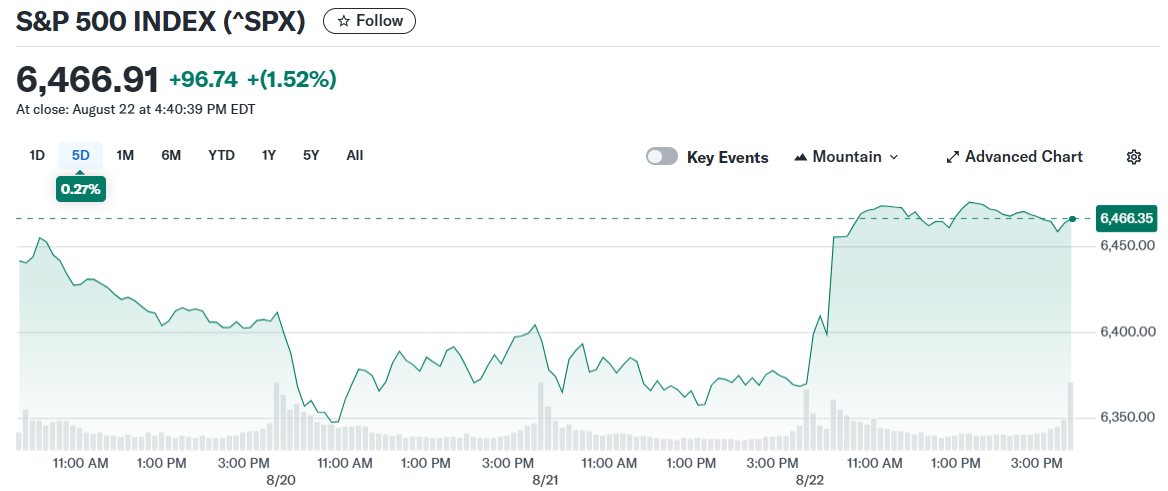

US equity markets prepare for a critical week as Nvidia earnings and key inflation data take center stage. Fed Chair Jerome Powell’s dovish remarks at Jackson Hole have already shifted investor sentiment and rate cut expectations.

Markets surged Friday after Powell signaled potential interest rate cuts in September. The Dow gained 1.5% while the S&P 500 rose 0.3%. Small-cap and cyclical sectors outperformed large-cap technology stocks in the rally.

S&P 500 INDEX (^SPX)

S&P 500 INDEX (^SPX)

Bitcoin currently trades at $112,650 as cryptocurrency markets track broader risk asset movements ahead of the Fed’s policy decision. The digital asset has shown increased correlation with technology stocks during periods of monetary policy uncertainty, making this week’s Nvidia earnings and inflation data particularly relevant for crypto traders.

Bitcoin (BTC) Price

Bitcoin (BTC) Price

Nvidia reports second-quarter earnings Wednesday in what analysts consider the week’s most important event. The AI chipmaker has driven much of the artificial intelligence boom through surging sales. Investors will scrutinize updates on the company’s most advanced product offerings.

The company faces headwinds from China export restrictions worth approximately $8 billion in lost revenue. Nvidia recently made a deal with the Trump administration to share revenue from AI chip sales in China. The chipmaker is also considering new products specifically for the Chinese market pending government approval.

Analysts expect Nvidia to post another sales record despite the China challenges. The company’s performance could indicate whether AI demand remains strong across global markets. Other technology companies reporting earnings include Dell, CrowdStrike, Snowflake, and Autodesk.

Source: Earnings Whispers

Source: Earnings Whispers

The earnings call could provide insights into broader AI adoption trends and enterprise spending patterns. Nvidia’s commentary on data center demand and future product roadmap will be closely watched. The company’s guidance for the current quarter may influence broader semiconductor sector sentiment.

Rate Cut Expectations Drive Sector Rotation

September interest rate cut probability now exceeds 75% following Powell’s Jackson Hole speech. This dovish shift has sparked rotation from big tech stocks into rate-sensitive sectors. Homebuilders, banks, and small-cap companies rallied strongly on lower borrowing cost expectations.

The “Magnificent Seven” tech stocks rebounded Friday but face continued pressure from sector rotation. Cyclical and value sectors are showing outperformance as investors anticipate easier monetary policy. This trend could accelerate if inflation data supports Fed dovishness.

Consumer confidence data releases Tuesday along with durable goods orders for July. Richmond Fed President Tom Barkin will speak both Tuesday and Wednesday. These events could provide additional Fed policy clues before the September meeting.

Banking sector stocks have responded positively to rate cut expectations despite potential margin compression. Regional banks particularly benefit from lower funding costs and increased lending activity. Real estate investment trusts also gained on lower financing expenses.

Inflation Data Could Seal Rate Cut Decision

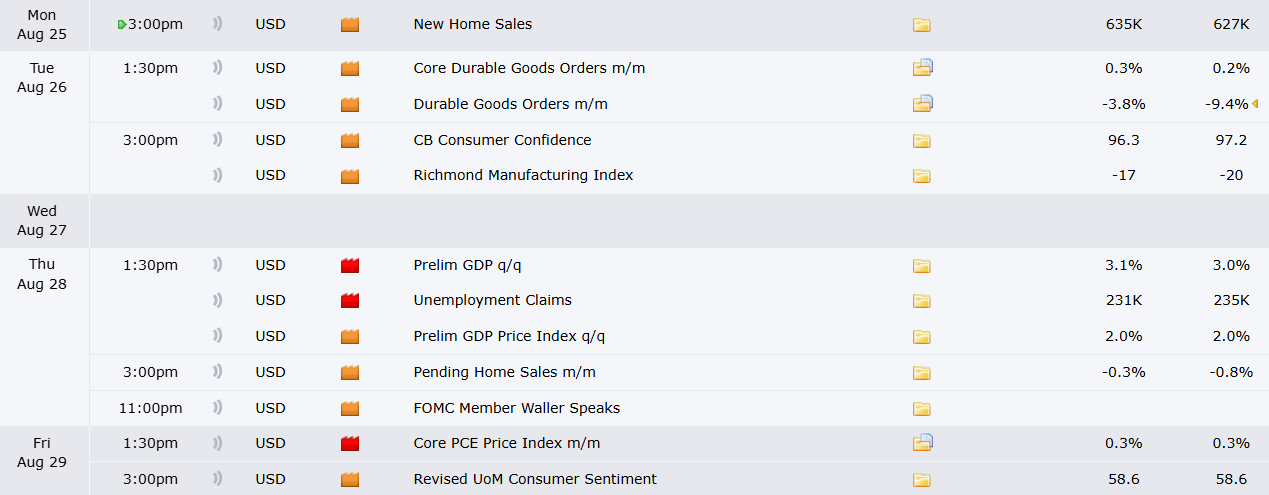

Friday’s Personal Consumption Expenditures (PCE) index represents the week’s other major catalyst. The PCE serves as the Federal Reserve’s preferred inflation measurement. July data could heavily influence the September rate decision timing and magnitude.

Source: Forex Factory

Source: Forex Factory

June PCE showed inflation ticked higher that month creating some Fed concerns. However, earlier July inflation reports indicated price increases were lower than feared. A benign PCE reading would likely cement September rate cut expectations.

The core PCE measure excludes volatile food and energy prices that can distort monthly readings. Fed officials focus primarily on this metric when assessing underlying inflation trends. Current expectations call for modest monthly increases in both headline and core measures.

Additional economic data includes new home sales Monday and pending home sales Thursday. Consumer sentiment surveys and trade balance figures round out the week’s economic calendar. GDP revisions for the second quarter also release Thursday.

These indicators provide insight into economic momentum heading into the Fed’s September meeting. Weak data could support more aggressive rate cuts while strong readings might limit policy easing. The labor market remains a key focus given recent unemployment rate increases.

The week brings earnings from several Canadian banks including Bank of Montreal and Royal Bank of Canada. Marvell Technology and PDD Holdings also report results. These earnings could provide insight into global economic conditions and consumer spending patterns.

Market volatility could increase if earnings disappoint or economic data surprises. Options positioning suggests investors expect heightened price swings around key events. Technical levels in major indices will be tested if fundamental catalysts drive strong moves.

Nvidia announced it expects growing revenue despite China export restriction challenges worth $8 billion in potential lost sales.

The post The Week Ahead: Crypto Markets Brace for Nvidia Earnings and Fed Inflation Data appeared first on CoinCentral.

You May Also Like

Is Doge Losing Steam As Traders Choose Pepeto For The Best Crypto Investment?

Fed Decides On Interest Rates Today—Here’s What To Watch For