Harvard Endowment Trims Bitcoin ETF, Opens $86.8M Ethereum Position

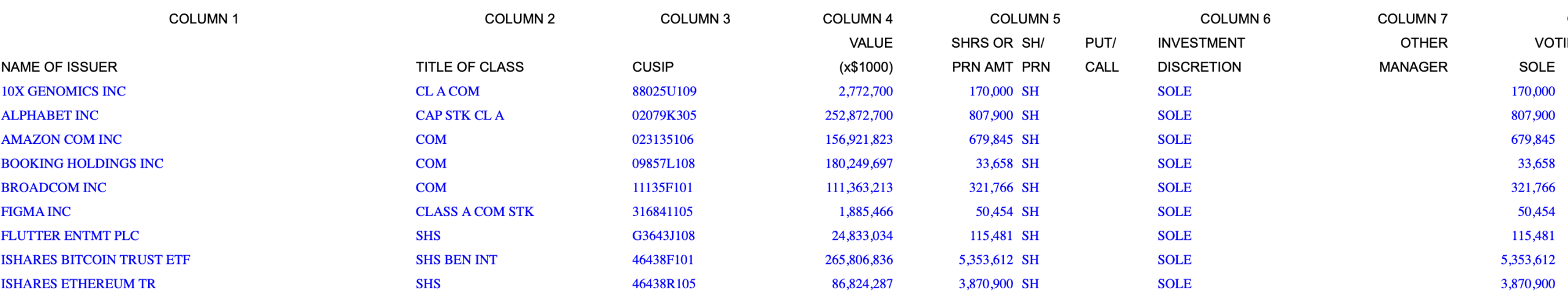

According to a Form 13F filing submitted to the U.S. Securities and Exchange Commission on February 13, 2026, Harvard Management Company (HMC) made notable adjustments to its digital asset exposure during the fourth quarter of 2025.

The university’s endowment manager reduced its stake in the iShares Bitcoin Trust (IBIT) by 21% while initiating an $86.8 million position in the iShares Ethereum Trust (ETHA), marking its first publicly disclosed allocation to an Ether-linked ETF.

Bitcoin Position Reduced, Still Largest Holding

HMC sold approximately 1.48 million shares of IBIT during Q4. Its total holding declined from 6.81 million shares, valued at $442.8 million at the end of Q3, to 5.35 million shares worth $265.8 million as of December 31, 2025.

Source: http://edgar.secdatabase.com/87/119312526051702/filing-main.htm

Source: http://edgar.secdatabase.com/87/119312526051702/filing-main.htm

Despite the reduction, IBIT remains Harvard’s largest publicly disclosed equity holding. The $265.8 million position exceeds its reported stakes in companies such as Alphabet, Microsoft, and Amazon.

First Allocation to Ethereum

At the same time, HMC acquired 3.87 million shares of the iShares Ethereum Trust (ETHA), establishing an $86.8 million position. The move signals a shift toward broader digital asset diversification rather than exclusive exposure to Bitcoin.

The adjustment suggests the endowment is increasingly viewing crypto as a multi-asset allocation rather than a single-asset theme.

Portfolio Context

Harvard’s endowment stands at approximately $57 billion. The $265.8 million Bitcoin ETF position represents roughly 12.8% of its reportable U.S. equity assets and around 1% of its total endowment.

While modest relative to the overall portfolio, the scale of the allocation places digital assets among the endowment’s most significant disclosed public equity exposures.

Strategic Implication

The rebalancing reflects diversification rather than exit. Harvard reduced its Bitcoin exposure but maintained it as a core position while expanding into Ethereum, indicating a broader institutional view of crypto as a developing asset class rather than a single-product allocation.

The post Harvard Endowment Trims Bitcoin ETF, Opens $86.8M Ethereum Position appeared first on ETHNews.

You May Also Like

What’s driving the euro to outperform USD for 2nd year in a row?

Trump Family-Backed American Bitcoin Keeps Stacking Bitcoin, Holdings Pass 6,000 BTC