Big Data in Finance Statistics 2026: Market Impact

The financial world is transforming, driven by the vast power of Big Data. From optimizing operational processes to predicting market trends, data has become the cornerstone of modern financial decision-making. Financial institutions are increasingly leveraging data analytics to gain deeper insights into customer behavior, improve risk management, and innovate their services. Today, understanding how Big Data is revolutionizing the finance industry is crucial for staying ahead of the curve. This article delves into the key statistics and insights on how Big Data is shaping the future of finance.

Editor’s Choice

- The financial analytics segment will grow from $11.41 billion in 2025 to about $12.71 billion in 2026, continuing its rapid expansion.

- North America’s Big Data analytics market, led by U.S. BFSI adoption, was about $178.3 billion in 2025 and is projected to exceed $600 billion by 2035.

- AI-driven compliance and monitoring solutions are increasingly adopted in finance, significantly cutting manual effort and reducing regulatory risk and related costs for institutions.

- Real-time financial data processing in leading banks has delivered up to 20% fraud-loss reduction and around 15% optimization in idle cash via AI-powered analytics.

- Global Big Data analytics solutions overall are forecast to climb from roughly $447.7 billion in 2026 to over $1.17 trillion by 2034, sustaining more than 12% CAGR.

Recent Developments

- Blockchain in financial services is estimated to surpass a $16 billion market value, with up to 67% of firms accelerating adoption for transparency, compliance, and cost efficiency.

- Over 98% of financial services organizations use cloud services, and about 60% of banks have moved at least 30% of critical workloads to the cloud.

- Around 68% of banks globally use cloud-native platforms for core operations, while 82% of financial firms adopt hybrid or multi-cloud strategies.

- Public cloud in banking and financial services is projected to reach about $92.7 billion, driven by risk modeling, analytics, fraud detection, and compliance workloads.

- Use of Platform-as-a-Service in financial institutions grew by 48%, and 89% now use SaaS for CRM, payments, and data analytics.

- Institutional tokenized assets could enable 24/7 trading of previously illiquid assets, with up to $4 trillion in asset issuance and settlements tokenized by 2030.

- Automated KYC solutions powered by blockchain have reduced onboarding times from 26 days to under 5 minutes, saving over $175 million annually for financial firms.

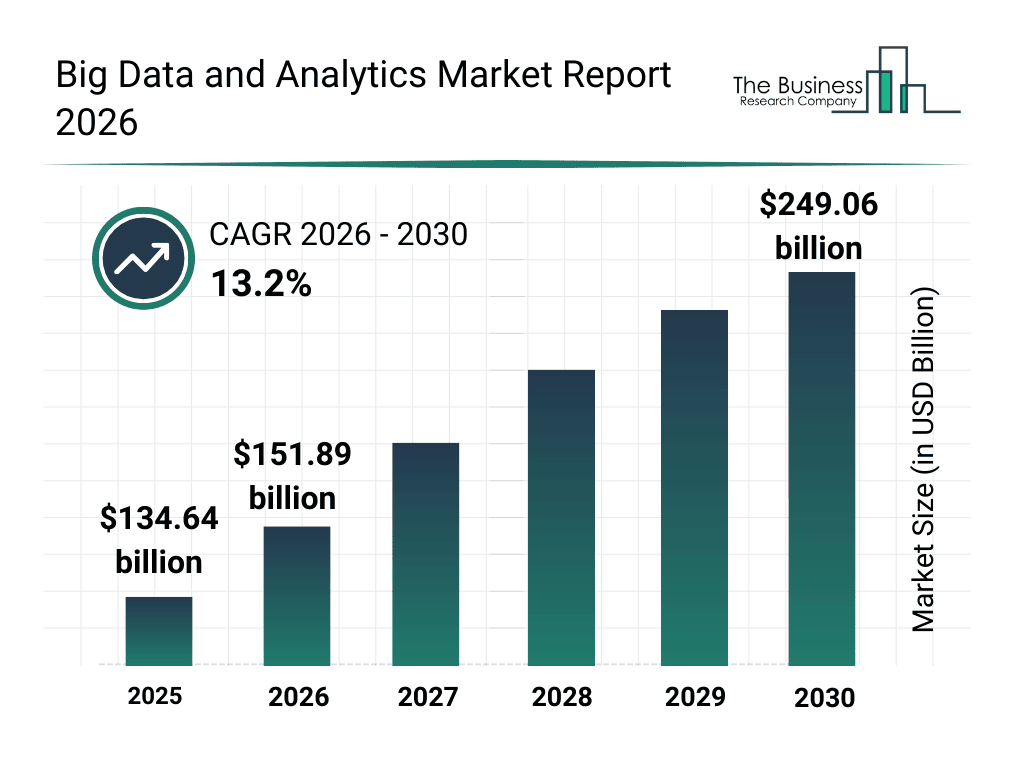

Big Data and Analytics Market Growth Forecast

- The global Big Data and Analytics market stands at $134.64 billion in 2025.

- The market will grow to $151.89 billion in 2026, driven by strong enterprise adoption.

- By 2027, the market will reach approximately $171.94 billion.

- The industry will expand to around $194.64 billion in 2028.

- Market size will climb to roughly $220.34 billion in 2029.

- The sector will hit $249.06 billion by 2030, nearly doubling from 2025 levels.

- The market will grow at a 13.2% CAGR between 2026 and 2030.

(Reference: The Business Research Company)

(Reference: The Business Research Company)

Benefits of Big Data and Analytics in Finance

- Finance leads BA adoption at 85% of organizations, vs 65% using predictive analytics and 40% using prescriptive analytics.

- Big Data/BA cut finance decision time by 33% (from 12 hours to 8 hours) in a cross-sector study.

- Finance reports the highest decision-making impact score at 4.6/5 (Likert mean) from analytics use.

- Analytics-driven finance organizations reported 18% operational efficiency improvement (survey result).

- Digital-first banking customers show 88.4% retention (higher than multi-channel averages).

- AI-powered digital experiences contributed to a 14% retention increase across major U.S. banks.

- Digital identity verification reduced onboarding drop-off rates by 31% in banking onboarding flows.

- Customer data platforms (CDPs) are used by 62% of U.S. banks to unify retention efforts.

Big Data Adoption in Banking and Financial Institutions

- 93% of U.S. financial executives are excited about tech change opportunities vs 86% global average.

- 65% of U.S. institutions are actively deploying AI vs 61% globally, linked to Big Data analytics.

- 42% of U.S. institutions plan a >50% AI investment increase in 2026.

- 98% of financial services organizations use some cloud services, enabling Big Data scalability.

- 82% of financial firms adopt hybrid/multi-cloud strategies for Big Data infrastructure.

- 72% of Asia-Pacific banks adopt hybrid cloud models for Big Data analytics scalability.

- 60% of APAC banks are expected to have AI-driven Big Data platforms by 2026.

- 78% Big Data adoption rate among large financial companies (10,000+ employees).

- 50.1% overall average Big Data adoption rate across financial organizations by size.

- 91% of U.S. banks use AI-powered Big Data systems for fraud detection.

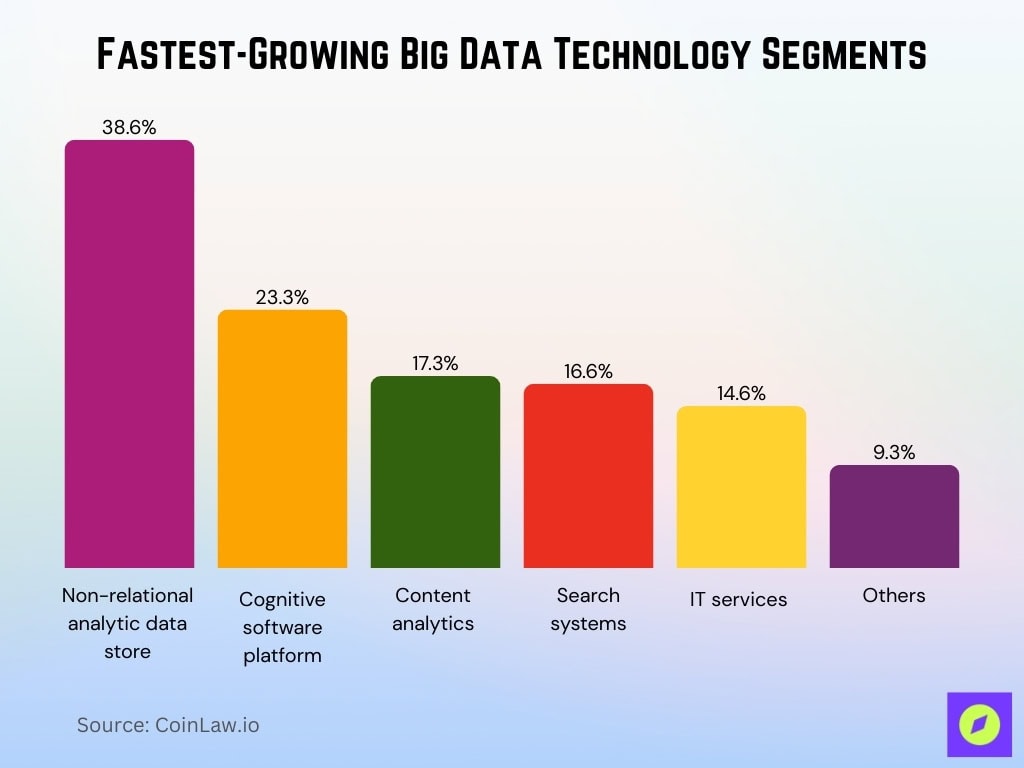

Fastest-Growing Big Data Technology Segments

- Non-relational analytic data stores lead growth with a remarkable 38.6% CAGR, reflecting surging demand for scalable NoSQL and distributed databases.

- Cognitive software platforms follow with a strong 23.3% CAGR, driven by AI-powered analytics and machine learning adoption.

- Content analytics is expanding at a solid 17.3% CAGR, fueled by the explosion of unstructured data from text, images, and video.

- Search systems are projected to grow at 16.6% CAGR, highlighting the need for faster data discovery across massive datasets.

- IT services supporting big data initiatives are expected to rise at 14.6% CAGR, as organizations outsource implementation and management.

- The “Other” big data technologies category shows comparatively modest growth at 9.3% CAGR over the five-year period.

(Reference: Market.us Scoop)

(Reference: Market.us Scoop)

Use of Big Data for Risk Management and Fraud Detection

- 90% of financial institutions use AI-powered Big Data for fraud detection and financial crime prevention.

- 87% of global financial institutions deploy AI-driven Big Data fraud detection systems.

- 99% of U.S. banks implement AI Big Data in major operations, including fraud detection.

- AI fraud detection reduces false positives by up to 80% in major U.S. banks.

- Banks using Big Data analytics achieve up to 30% reduction in loan default rates.

- Real-time Big Data monitoring reduces cybersecurity breaches by 37% in multinational banks.

- Big Data predictive analytics improves risk forecasting accuracy by 30-35%.

- U.S. banks lose $32 billion annually to fraud, mitigated by Big Data analytics.

AI and Machine Learning Integration with Big Data in Finance

- AI now drives 89% of global trading volume through advanced algorithms and real-time data analysis.

- 90% of finance functions will deploy at least one AI-enabled technology solution.

- 80% of enterprises will use generative AI applications in production environments.

- 76% of global bank executives say AI adoption is critical for competitive survival.

- 70% of Tier 1 customer queries are handled by AI chatbots in North American banks.

- 65% of global financial institutions use ML algorithms for portfolio management.

- 54% of U.S. bank customer interactions are fully automated via AI systems.

- Robo-advisors projected to manage $2.06 trillion in assets worldwide.

- AI-driven credit risk modeling improves loan approval accuracy by 34%.

Tangible Benefits Businesses Expect from Big Data Initiatives

- 22% of respondents cite better fact-based decision-making as their top priority.

- 22% of organizations expect improved customer experience from big data initiatives.

- 15% prioritize increased sales to drive revenue growth.

- 11% anticipate a reduced risk to strengthen strategic resilience.

- 11% expect to launch new product innovations.

- 10% focus on achieving more efficient operations for optimization.

- 10% aim to deliver higher-quality products and services.

Customer Analytics and Improved Financial Services

- 82.4% average global banking customer retention rate in 2026.

- Digital-only banks achieve 87.9% retention rate due to superior analytics-driven personalization.

- 88.4% retention among digital-first banking customers using behavior analytics.

- Banks using AI personalized insights report 12.3% higher retention rates.

- 71% of U.S. banking customers cite CX quality as the top loyalty driver from analytics.

- AI-driven predictive analytics reduced churn by 18% in mid-sized U.S. banks.

- 54% of U.S. consumers want personalized financial experiences from data analytics.

- Banks with CX scores above 85% have 2.4x higher retention rates.

Real-time Stock Market Insights and Financial Models

- High-frequency data system predicts abnormal fluctuations 4.6 minutes ahead with 84.2% accuracy.

- H.BLSTM model achieves 0.001 mean absolute percentage error in real-time stock forecasting.

- The algorithmic trading market is valued at $25.04 billion with 15.4% CAGR growth.

- Predictive analytics models achieve 65-75% accuracy in investment forecasting.

- 80-95% accuracy in customer behavior prediction via AI predictive analytics.

- 84.2% prediction accuracy for market risks using big data intensity models.

- Algorithmic traders reduce bid-ask spreads by 0.28 basis points.

- Cloud-based algo trading accounts for 54.47% of global spending.

Big Data Adoption Rates by Company Size

- Large companies (10,000+ employees) show 78% Big Data adoption rate.

- Big companies (1,000+ employees) report 48% adoption rate.

- Mid-sized companies (100+ employees) at 43% adoption rate.

- Overall average adoption rate across all sizes is 50.1%.

- Financial services lead with 91% Big Data analytics adoption.

- Large banks captured 62.74% of Big Data analytics outlays.

- Large organizations have up to 60% adoption of big data analytics.

- Community institutions grow at 25.23% CAGR in Big Data capabilities.

Regulatory Challenges and Compliance in Big Data Utilization

- 37.8% of financial institutions cite regulatory concerns as the top AI/Big Data challenge.

- 48% report data quality as the primary compliance obstacle for Big Data initiatives.

- 40.5% face legacy system integration challenges impacting Big Data compliance.

- 257 daily regulatory changes tracked by organizations from 1,300+ bodies.

- Average non-compliance cost reaches $14.82 million per incident.

- RegTech market grows to $21.8 billion at 15.7% CAGR.

- 61% of institutions implement AI/ML for Big Data with a compliance focus.

- 8% prioritize regulatory guidance for Big Data strategy advancement.

- RegTech spending triples to $204 billion, over 50% of compliance budgets.

Frequently Asked Questions (FAQs)

91% of U.S. banks use AI-powered Big Data systems for fraud detection.

Global institutions save $5 billion annually through Big Data analytics for fraud.

Institutions using Big Data report 23% higher profits.

Big Data systems achieve 99.7% accuracy in identifying fraud risks.

Conclusion

As we look ahead, it’s clear that Big Data is playing a transformative role in the finance industry. From driving real-time insights in the stock market to enhancing customer experiences and ensuring regulatory compliance, Big Data analytics is reshaping financial services at every level. With advancements in AI, machine learning, and quantum computing on the horizon, the future of finance will be more data-driven than ever. However, navigating the regulatory challenges and ethical considerations of Big Data will be critical as the industry continues to evolve. Financial institutions that successfully harness the power of Big Data will be well-positioned to lead in this rapidly changing landscape.

The post Big Data in Finance Statistics 2026: Market Impact appeared first on CoinLaw.

You May Also Like

MetaPlanet Bitcoin Strategy Defies $654M Loss with Bold 2025 Acquisition Plans

LayerZero, RAIN drive $321M token unlocks this week