Bitcoin Price Crash to $39K? This Bear Market Bottom Metric Says the Pain Isn’t Over

Bitcoin is trading around $68K right now, but a CryptoQuant chart making the rounds is putting a much lower number back on the table: $39K. The logic comes from one of the most watched on-chain “line in the sand” metrics in crypto cycles — realized price.

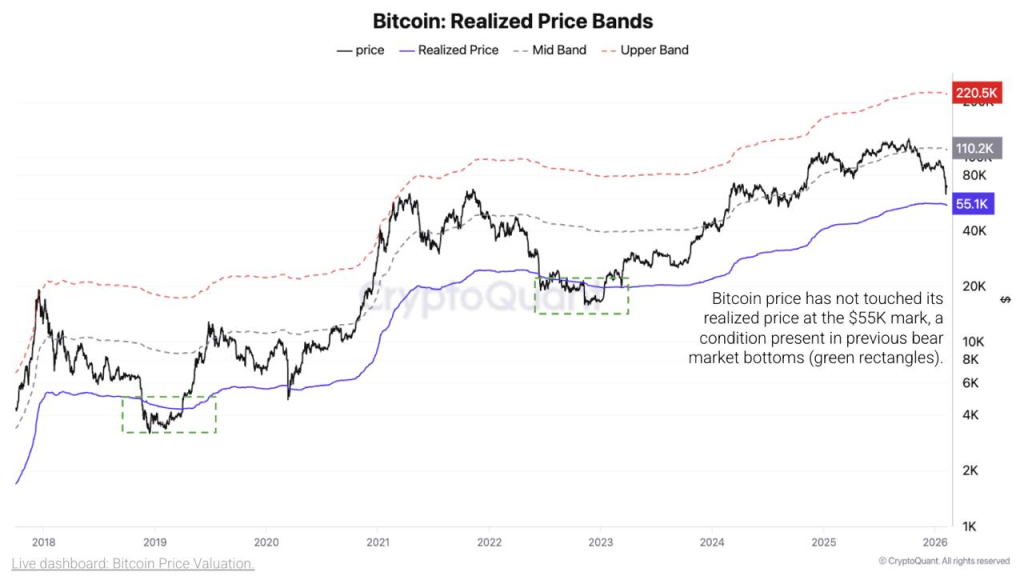

What the BTC chart is showing

The chart plots Bitcoin’s market price (black) against realized price (blue), plus a set of bands above it. On the right side, the realized price level sits near $55.1K.

The key observation: in prior bear market bottoms, Bitcoin didn’t bottom until price came down to realized price (the green-highlighted zones on older cycles). In the current cycle, price has not tagged that realized-price line yet.

Those dashed bands matter for context, too. They act like valuation zones across cycles:

- The realized price acts like a “cost basis anchor” for the market.

- The higher bands map out hotter valuation zones that usually show up in full-risk-on phases.

Source: X/@coinbureau

Source: X/@coinbureau

What “realized price” means in plain English

Realized price is basically Bitcoin’s average on-chain cost basis: it values each coin at the last price it moved on-chain, then averages that across the supply. Put simply, it estimates what the market, as a whole, paid for its BTC.

Why traders care: when Bitcoin trades above realized price, the average holder is in profit. When it trades at or below realized price, the market is under stress and capitulation dynamics show up more often.

It’s not a magic bottom button, but it’s one of the cleaner “where does pain peak” gauges that tends to matter most during deep drawdowns.

How realistic is $55K… and the $39K flush?

From $68K to $55K is a drop of about 19%. That’s completely plausible in crypto terms, especially during a volatility spike or a broader risk-off move.

The more extreme number comes from the historical note baked into the post: in past cycles, Bitcoin pushed 24–30% below it before the final low printed.

If realized price is ~$55K:

- 24% below is about $41.8K

- 30% below is about $38.5K

That’s where the $39K headline comes from. It’s basically a “full capitulation” scenario where the market overshoots the average cost basis before stabilizing.

The reality check: a drop to $39K would require a much more aggressive unwind than a normal pullback. It would likely need a sharp liquidity event, a macro shock, or a broad deleveraging wave that forces sellers to dump into a thin bid.

Read also: AI is Coming For Your Stocks – Here’s What You Need to Know

The levels that matter from here

If this realized-price framework is the lens, then the map is straightforward:

- $68K (current area): market still holding above the “pain line,” but not far enough to dismiss a deeper reset.

- $60K: a psychological and structural zone that tends to get defended first.

- $55K (realized price): the key level CryptoQuant is flagging as the classic bear-market bottom condition.

- $42K–$39K: the “overshoot” zone if panic selling drives a final flush below realized price.

If Bitcoin holds above the low $60Ks and keeps bouncing, the realized-price tag may never happen this cycle. If momentum breaks and $60K fails decisively, realized price becomes the next major magnet.

Bottom line: $55K is the realistic stress-test level. $39K is the capitulation tail-risk level that becomes relevant only if the market gets forced into a hard reset.

Read also: Bitcoin at $60K Could Be the Deal of the Decade

Subscribe to our YouTube channel for daily crypto updates, market insights, and expert analysis.

The post Bitcoin Price Crash to $39K? This Bear Market Bottom Metric Says the Pain Isn’t Over appeared first on CaptainAltcoin.

You May Also Like

The Role of Blockchain in Building Safer Web3 Gaming Ecosystems

- Immutable Ownership of Assets Blockchain records can be manipulated by anyone. If a player owns a sword, skin, or plot of land as an NFT, it is verifiably in their ownership, and it cannot be altered or deleted by the developer or even hacked. This has created a proven track record of ownership, providing control back to the players, unlike any centralised gaming platform where assets can be revoked.

- Decentralized Infrastructure Blockchain networks also have a distributed architecture where game data is stored in a worldwide network of nodes, making them much less susceptible to centralised points of failure and attacks. This decentralised approach makes it exponentially more difficult to hijack systems or even shut off the game’s economy.

- Secure Transactions with Cryptography Whether a player buys an NFT or trades their in-game tokens for other items or tokens, the transactions are enforced by cryptographic algorithms, ensuring secure, verifiable, and irreversible transactions and eliminating the risks of double-spending or fraudulent trades.

- Smart Contract Automation Smart contracts automate the enforcement of game rules and players’ economic exchanges for the developer, eliminating the need for intermediaries or middlemen, and trust for the developer. For example, if a player completes a quest that promises a reward, the smart contract will execute and distribute what was promised.

- Anti-Cheating and Fair Gameplay The naturally transparent nature of blockchain makes it extremely simple for anyone to examine a specific instance of gameplay and verify the economic outcomes from that play. Furthermore, multi-player games that enforce smart contracts on things like loot sharing or win sharing can automate and measure trustlessness and avoid cheating, manipulations, and fraud by developers.

- Cross-Platform Security Many Web3 games feature asset interoperability across platforms. This interoperability is made viable by blockchain, which guarantees ownership is maintained whenever assets transition from one game or marketplace to another, thereby offering protection to players who rely on transfers for security against fraud. Key Security Dangers in Web3 Gaming Although blockchain provides sound first principles of security, the Web3 gaming ecosystem is susceptible to threats. Some of the most serious threats include:

Knocking Bitcoin's lack of yield shows your ‘Western financial privilege’

Macro analyst Luke Gromen’s comments come amid an ongoing debate over whether Bitcoin or Ether is the more attractive long-term option for traditional investors. Macro analyst Luke Gromen says the fact that Bitcoin doesn’t natively earn yield isn’t a weakness; it’s what makes it a safer store of value.“If you’re earning a yield, you are taking a risk,” Gromen told Natalie Brunell on the Coin Stories podcast on Wednesday, responding to a question about critics who dismiss Bitcoin (BTC) because they prefer yield-earning assets.“Anyone who says that is showing their Western financial privilege,” he added.Read more