Analyst Predicts Ethereum’s Next Big Move After Recent ATH

The second-largest cryptocurrency by market capitalization has gained over 7% in the past week, with traders and analysts suggesting that the move could be the start of a new wave for alternative digital assets.

Analysts Expect Pullbacks Before Further Upside

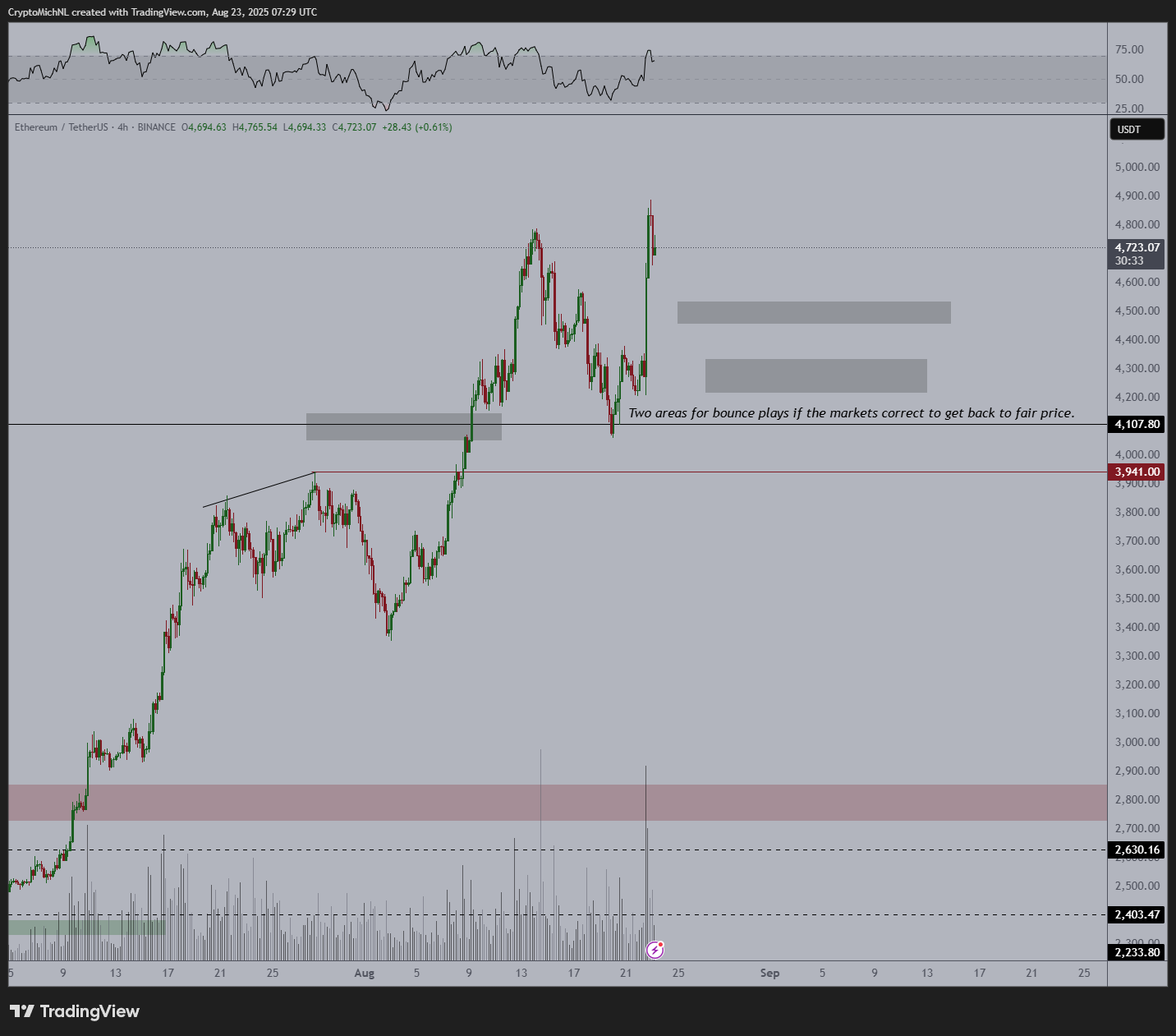

Crypto analyst Michaël van de Poppe highlighted the recent breakout on Ethereum, noting that while the surge signals strength, he expects some corrections along the way. In his latest market update, he pointed to two potential zones where ETH might retrace before resuming its uptrend, cautioning that the asset is unlikely to rise in a straight line.

This perspective comes as technical indicators also suggest some cooling may be needed. The Relative Strength Index (RSI) sits around 61, showing that ETH is approaching but not yet in overbought territory. Meanwhile, the MACD has recently peaked, hinting at the possibility of short-term consolidation.

Market Performance

At the time of writing, Ethereum is trading at $4,742.02 with a 24-hour trading volume exceeding $61.5 billion. Its market capitalization stands at over $572 billion, cementing its dominance in the altcoin space.

READ MORE:

Pi Network Promises Millions – But Who’s Really Winning in 2025

The intraday chart shows ETH recently spiking above $4,750 before stabilizing just under that level. The surge pushed momentum indicators higher, but traders are watching closely to see if the asset holds its gains or retraces into support zones near $4,500 and $4,200.

Broader Altcoin Impact

Ethereum’s rally has fueled speculation of a broader altcoin breakout. Historically, strong ETH price moves have often preceded wider gains across the altcoin sector, as liquidity and investor interest flow into smaller-cap assets.

Outlook for Ethereum

If Ethereum maintains its momentum, analysts suggest that a test of the $5,000 psychological barrier could follow in the weeks ahead. However, short-term corrections remain likely, with $4,200–$4,500 seen as healthy support zones.

The market is now focused on whether ETH can sustain its breakout and lead a new wave of gains for altcoins, potentially setting the stage for one of the strongest runs in the second half of 2025.

The information provided in this article is for informational purposes only and does not constitute financial, investment, or trading advice. Coindoo.com does not endorse or recommend any specific investment strategy or cryptocurrency. Always conduct your own research and consult with a licensed financial advisor before making any investment decisions.

The post Analyst Predicts Ethereum’s Next Big Move After Recent ATH appeared first on Coindoo.

You May Also Like

Franklin Templeton CEO Dismisses 50bps Rate Cut Ahead FOMC

FCA komt in 2026 met aangepaste cryptoregels voor Britse markt