Strategy (MSTR) Stock: Michael Saylor Says No Bitcoin Sales Even at $8,000

TLDR

- Strategy Executive Chair Michael Saylor stated the company will continue buying bitcoin quarterly “forever” and won’t sell even if prices drop to $8,000, down from current levels above $70,000.

- The company spent $90 million purchasing 1,142 bitcoin during the week ending Feb. 8 at an average price of $78,810, bringing total holdings to 714,644 bitcoin.

- Strategy currently holds an unrealized loss of $5.2 billion with bitcoin below $70,000 and an average purchase price of $76,056 per bitcoin.

- Saylor explained that Strategy’s convertible debt structure has no margin-call triggers, and the company has enough cash to cover dividends and debt payments for the next 2.5 years.

- At $8,000 per bitcoin, Strategy’s bitcoin holdings would roughly equal its net debt of $4-6 billion, at which point the company would refinance rather than sell its bitcoin reserves.

Strategy Executive Chair Michael Saylor doubled down on his bitcoin commitment this week. He told CNBC the company won’t sell its bitcoin holdings even if prices crash to $8,000.

Strategy Inc, MSTR

Bitcoin currently trades above $70,000. That means Saylor is talking about a potential 88% decline from current levels.

The comments come as Strategy faces mounting pressure. The company’s bitcoin holdings now show an unrealized loss of $5.2 billion.

Strategy owns 714,644 bitcoin at an average purchase price of $76,056. With bitcoin trading below $70,000, the math isn’t pretty.

But Saylor remains unfazed. He said Strategy plans to buy bitcoin every quarter “forever.”

The company proved that commitment during the week ending Feb. 8. Strategy spent $90 million acquiring 1,142 bitcoin at an average price of $78,810.

Those purchases came at the week’s highest prices. Bitcoin had tumbled close to $60,000 before bouncing back above $70,000.

Strategy’s stock fell 1.8% Tuesday after a brief two-day rally. The stock had jumped 29.4% over those two days following a drop to its lowest price since May 1, 2024.

Shares have declined 9.2% in February. That follows a brutal seven-month losing streak through January where the stock plunged 63%.

The $8,000 Threshold Explained

Saylor’s $8,000 figure isn’t random. It represents the point where Strategy’s bitcoin value would roughly equal its net debt.

The company carries between $4 billion and $6 billion in net debt. At $8,000 per bitcoin, Strategy’s 714,644 bitcoin would be worth approximately $5.7 billion.

CEO Phong Le explained the scenario. If bitcoin fell 90% to $8,000, the company would explore restructuring options or issuing additional equity or debt.

But here’s the key difference from margin loans. Strategy’s debt consists mainly of long-dated convertible notes with maturities extending to 2032 and beyond.

These instruments carry low interest rates between 0% and 1%. They don’t include margin maintenance covenants tied to bitcoin’s price.

That means no automatic liquidation triggers. Unlike retail traders or hedge funds, Strategy won’t face forced sales.

The company has 2.5 years of cash runway to cover dividends and debt payments. Saylor said Strategy would simply refinance the debt if bitcoin prices collapsed.

Volatility as a Feature

Saylor called bitcoin volatility both a “bug” and a feature. He explained that digital capital could be two to four times more volatile than traditional assets like gold or stocks.

Strategy’s stock amplifies bitcoin’s moves. It falls faster when bitcoin declines but rises faster when bitcoin gains.

Saylor targets investors with a four-year or longer horizon. He called anyone with a shorter timeline a “trader.”

He expects bitcoin to at least double the S&P 500’s performance over that timeframe. The strategy relies on bitcoin’s fixed supply cap of 21 million and growing institutional demand.

Strategy doesn’t fund purchases solely with excess cash. The company issues convertible senior notes and other debt instruments to finance acquisitions.

If bitcoin appreciates, the company’s holdings strengthen its balance sheet. If bitcoin declines, the debt doesn’t automatically trigger asset sales.

Strategy also generates operating cash flow from its business intelligence software division. That revenue remains modest compared to its bitcoin exposure.

The company navigated similar volatility in 2022 when bitcoin fell below $20,000. It added collateral to a Silvergate loan rather than liquidate holdings.

Strategy’s approach treats bitcoin as a treasury reserve asset, not a trading position. Saylor frames it as a long-term store of value superior to cash or sovereign bonds.

The post Strategy (MSTR) Stock: Michael Saylor Says No Bitcoin Sales Even at $8,000 appeared first on CoinCentral.

You May Also Like

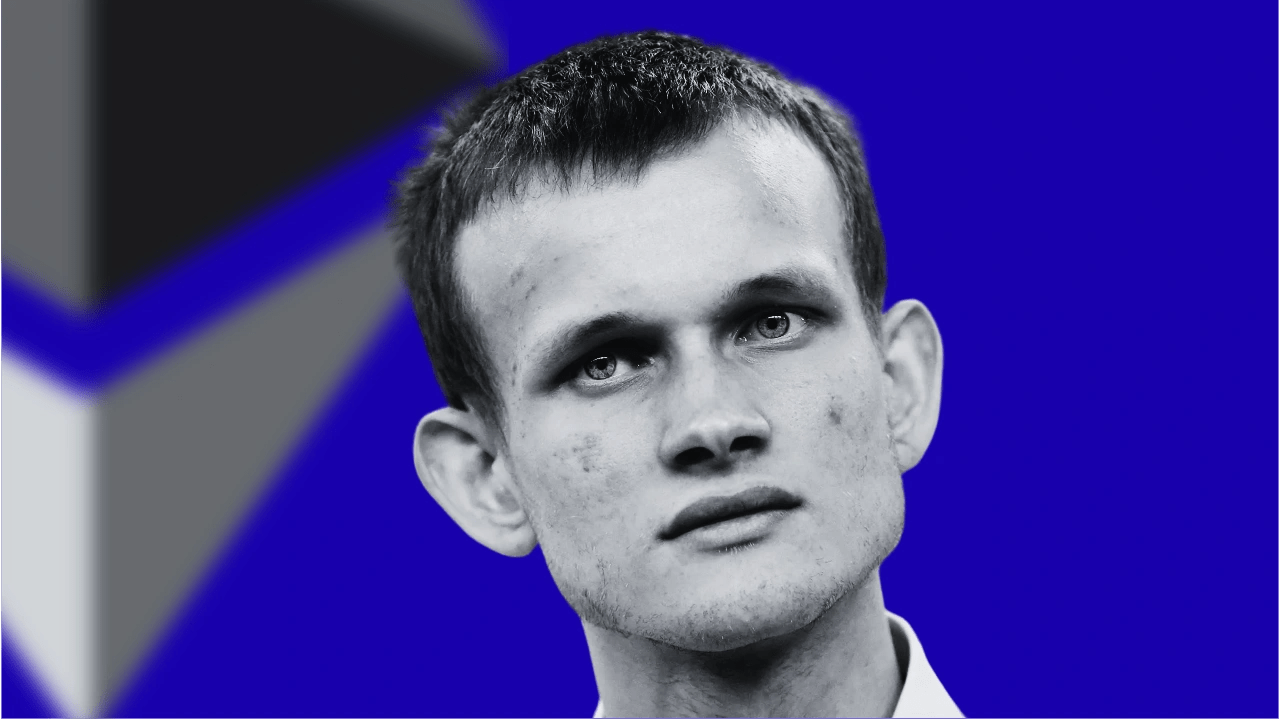

Vitalik Buterin is not happy about the current trajectory of prediction markets

River (RIVER) Plunges 19.4% as Post-ATH Correction Deepens to 83.6%