Truth Social Files With SEC to Launch Bitcoin and Ether ETFs on Nasdaq

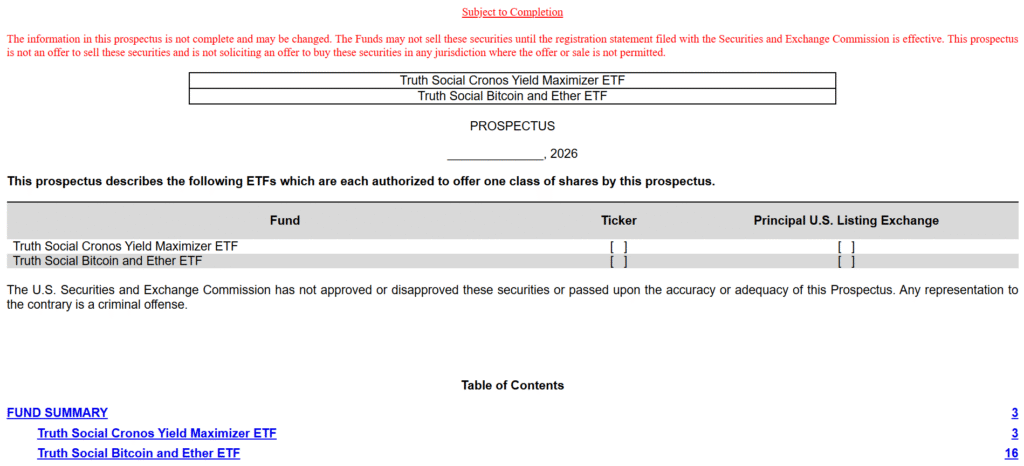

- Trump-tied Truth Social submitted an application to the U.S. Securities and Exchange Commission to list two crypto ETFs.

- The two ETFs will track the price of Bitcoin and Ether and are sponsored by FMWA Funds.

The parent company of Truth Social filed a document with the Securities and Exchange Commission for listing two cryptocurrency exchange-traded funds. The documents indicate that the two funds will track the price movements of Bitcoin and Ether tokens. FMWA Funds is the sponsor of the two ETFs and will be responsible for ensuring that they meet the requirements for listing on the Nasdaq exchange. The two ETFs will issue and redeem shares in exchange for baskets of crypto price data.

The Strategic Funding of Truth Social

The filings reveal that there are specific funds that will capture exposure to Bitcoin and Ether. In addition to the prominent use case of the crypto ETF, the company has also filed for another fund called the Truth Social Cronos Yield Maximizer ETF. This second filing provides more insight into the company’s strategy for digital assets, which is more complex than the simple spot exposure. The filing outlines a yield-focused fund that is tied to the Cronos ecosystem. The fund will be reviewed according to the standard ETF review procedure. The sponsors must fulfill SEC and Nasdaq requirements before the launch. The filings provide information about risks associated with digital assets.

Bitcoin and Ether are the most widely traded tokens in terms of market capitalization, and they are commonly selected for institutional investment products. The new ETFs demonstrate the interest of investors in regulated investment products offering exposure to digital assets. The SEC has approved ETFs linked to future contracts of Bitcoin with stringent compliance requirements. Ether futures ETFs have also gained a similar status. SEC approval is still pending for spot Bitcoin and Ether ETFs. Truth Social’s applications add to the grid of competing applications in the SEC queue.

Regulatory Environment and Market Dynamics

The SEC is currently assessing different spot crypto ETF proposals submitted by different issuers. The SEC is concerned with market surveillance, anti-fraud measures, and trading mechanisms. Some of the proposals have included agreements on market surveillance with regulated exchanges. The SEC has raised concerns over manipulation and liquidity risks in the crypto markets. Some advocacy bodies have called for regulatory clarity to boost investor confidence.

The Truth Social filing shows the demand for crypto investment products that are accessible. Sponsors require SEC approval before they can market to U.S. investors. ETF supporters say that regulated products are essential for mainstream adoption. Critics point out the volatility and custody issues. The filings describe the distribution and the role of the authorized participants.

Highlighted Crypto News:

Brazil Introduces Bill to Accumulate 1 Million Bitcoin Over Five Years

You May Also Like

Husky Inu (HINU) Completes Move To $0.00020688

Tether quietly stacked 27 tons of gold, now it’s wiring $150M to sell it to crypto users