A quick look at Ethena's new stablecoin USDtb: BlackRock BUIDL Fund support may drive a large amount of TradFi funds inflow

Author: Weilin, PANews

On December 16, the DeFi project Ethena Labs announced the official launch of its new stablecoin USDtb. As a blockchain-based US dollar stablecoin, 90% of USDtb's reserve funds are invested in BlackRock's tokenized fund BUIDL, and it cooperates with Securitize, a leading real-world asset tokenization company.

On the first day of launch, according to DefiLlama data, USDtb's TVL reached $64.5 million. Previously, Ethena CEO Guy Young predicted that USDtb's first-month TVL would reach $500 million to $1 billion. He also said that some TradFi entities, although they have not really touched other cryptocurrencies, currently have considerable exposure to what Ethena is doing.

Backed by BlackRock BUIDL Fund to cope with market volatility in the bear market

The newly launched USDtb is a relatively traditional crypto stablecoin that looks almost identical to USDC and USDT. The only difference is that Ethena backs this stablecoin with BlackRock's BUIDL Treasury Fund as collateral. BUIDL is a tokenized fund that invests in assets equivalent to the US dollar, such as cash, US Treasuries, and repurchase agreements. Instead of Ethena managing financial assets, it entrusts them to different banks or different service providers in the real world. Basically, BlackRock and Securitize are responsible for the entire process. Therefore, USDtb has a completely different product principle from Ethena's flagship stablecoin USDe.

USDtb will serve as an alternative stablecoin for Ethena, taking over the funds of USDe in extreme market conditions. Guy Young, CEO of Ethena, recently introduced in the Unchained podcast that USDtb looks very similar to ordinary stablecoins and does not have returns itself, so retail users who buy it will not get returns like using treasury bond funds. He said that the two products actually work in parallel, and in 98% of cases, when the cryptocurrency exchange rate looks more attractive than the traditional financial exchange rate, USDe operates as it does now. Then, to the extent that the environment changes (such as entering a bear market), users always retain the option to close (positions) and enter USDtb and retain the balance sheet in their own products.

As a result, USDtb could help holders of USDe “cope with difficult market conditions.” Ethena Labs said in a Dec. 16 announcement: “Ethena will be able to close the hedge position behind USDe and reallocate its backing assets to USDtb to further mitigate the associated risks.”

The stablecoin is 90% backed by BlackRock's BUIDL and is in partnership with blockchain tokenization firm Securitize. Block Analiticia, one of Ethena's committee members, noted in the approved proposal that stablecoins like USDC will account for the remaining 10% of USDtb's reserves, which can provide additional liquidity on weekends or other periods when the Treasury market is not trading. The "core" part of USDtb's smart contract passed three full audits by Pashov, Quantstamp and Cyfrin in October.

USDtb may drive a large amount of funds to flow from TradFi

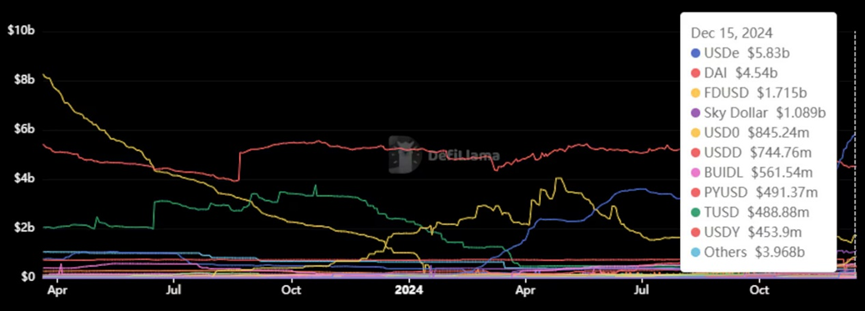

Ethena Lab’s synthetic stablecoin USDe was launched in February this year and has grown rapidly since then, and is now the third largest stablecoin after USDT and USDC. Since November 1, just a month and a half ago, its market value has more than doubled to nearly $6 billion, even surpassing DAI, the long-established DeFi native stablecoin.

The key to USDe's success is the yield it offers. The token offers an annual yield of 27%, which is much higher than the 12.5% offered by DAI and USDS. USDe is created by depositing Bitcoin, Ethereum, or Solana into the Ethena protocol and subsequently opening a short (bearish) position on a futures exchange like Bybit. This creates what is known as a "delta neutral" position, in which the value of the asset and the short position offset each other, keeping the overall price stable.

Currently, since most traders are bullish on cryptocurrencies, they pay Ethena funds to short, and the protocol transfers these funds to USDe holders through staking. As long as this continues, USDe's yield should remain high. But if traders turn bearish, Ethena will not be able to provide such a high yield.

In addition, Staked USDe (sUSDe) launched by Ethena is a yield token that allows users to earn additional income by staking USDe tokens. Through staking rewards and basis trading strategies, sUSDe provides high returns to holders.

Blockworks Research recently tweeted about the different ways Ethena is primarily used. Pendle is the top destination for Staked USDe with over $1 billion in assets, with Aave in second place. Ethena CEO Guy Young recently told the Unchained podcast that about 50% to 60% of Pendle’s TVL is built on sUSDe. Aave has added over 1 billion TVL in a few months.

Back to the new stablecoin USDtb itself, after launching USDtb, Seraphim Czecker, Ethena’s head of growth, said that Ethena’s route is clear:

- Incorporate conservative TradFi into USDtb

- Get them accustomed to USDe

- Help them understand Aave, Maker and other USDe on-chain opportunities

José Maria Macedo, co-founder of blockchain research and development firm Delphi Labs, predicts that USDtb will become the largest tokenized treasury product within a month of its launch. Seraphim Czecker, head of growth at Ethena, said that USDtb has the potential to scale to $100 billion because the company is now able to efficiently allocate capital in bearish market environments by "creating an APY 'floor' around treasury rates." "USDtb will drive a lot of capital from TradFi into our space," Seraphim concluded.

At this point, Ethena has indeed surpassed a bunch of crypto-native protocols in many different metrics. One of which is that it has been one of the highest fee generators. It has surpassed Tether, Uniswap, Ethereum, Jito, Solana, etc. many times and has become an important project for DeFi users to interact with.

You May Also Like

Top Altcoins To Hold Before 2026 For Maximum ROI – One Is Under $1!

UBS CEO Targets Direct Crypto Access With “Fast Follower” Tokenization Strategy