Bhutan’s Bitcoin sales enter third straight week with $6.7M BTC offload

Bhutan has sold another 100 Bitcoin worth approximately $6.7 million, according to blockchain analytics platform Arkham Intelligence, which flagged the transaction in a recent post.

- Bhutan sold another 100 BTC worth about $6.7 million, marking its third consecutive week of Bitcoin transfers, according to Arkham Intelligence.

- On-chain data shows structured, repeated deposits to a QCP-linked WBTC merchant address, suggesting gradual treasury management rather than a single large liquidation.

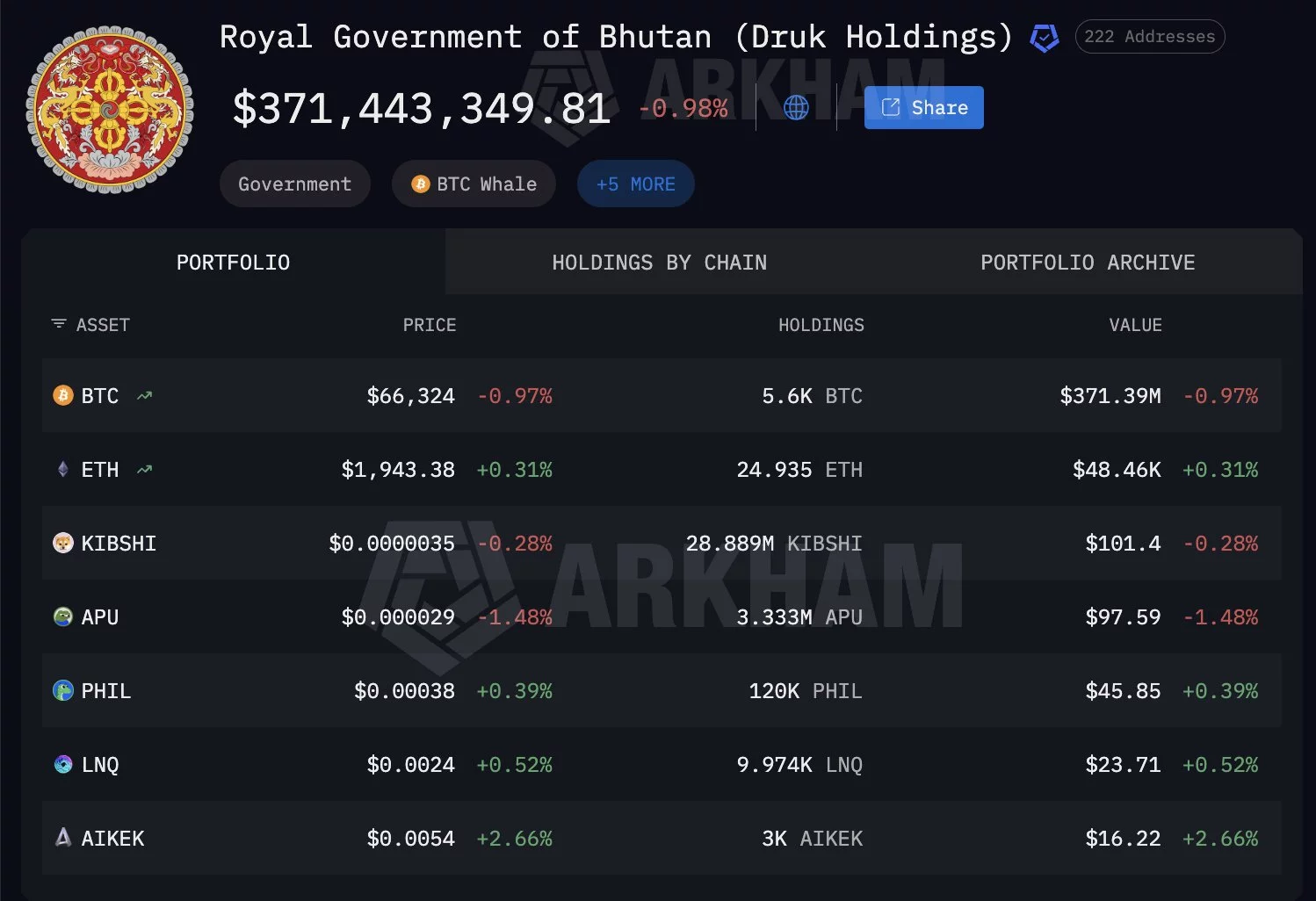

- Despite ongoing sales, Bhutan still holds roughly 5,600 BTC valued at around $372 million, keeping it among the largest sovereign Bitcoin holders.

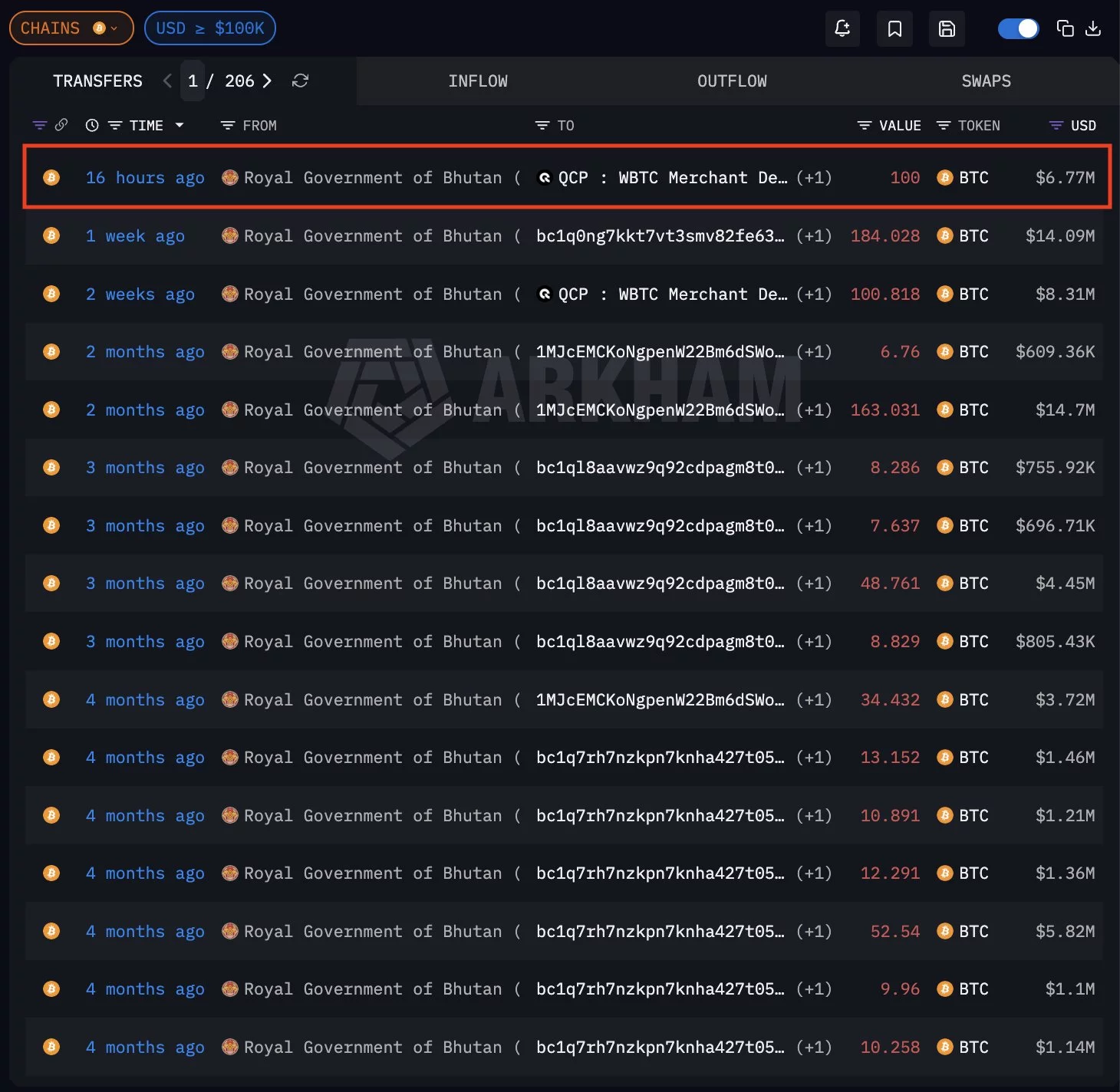

On-chain data shared by Arkham shows the transfer occurred roughly 16 hours prior to the alert, with 100 Bitcoin (BTC) moved from wallets labeled as belonging to the Royal Government of Bhutan to an external address identified as a QCP-linked WBTC merchant deposit.

The transaction is part of what Arkham describes as three consecutive weeks of Bitcoin selling activity.

Bhutan’s weekly Bitcoin selling activity continues

The data indicates Bhutan has been gradually offloading Bitcoin in recent weeks.

Transaction history visible in Arkham’s dashboard shows multiple BTC transfers over recent weeks, including movements of 184 BTC and 100 BTC batches. The consistent pattern of deposits suggests structured selling rather than a single large liquidation.

Moreover, Arkham previously reported that the country sold at least $100 million worth of BTC in September 2025, and the latest transaction suggests that the selling strategy is ongoing.

Bitcoin mining slows down after halving

Bhutan’s Bitcoin reserves are largely tied to its state-backed mining operations. The country had announced plans to scale its mining capacity to up to 600 megawatts in partnership with Bitdeer Technologies.

However, Arkham noted that on-chain mining inflows appear to have slowed following Bitcoin’s April 2024 halving event, which reduced block rewards and increased pressure on mining profitability.

The slowdown may be contributing to Bhutan’s gradual treasury sales.

Despite recent sales, Arkham data shows Bhutan still holds approximately 5,600 BTC, valued at around $372 million, across identified wallets. The holdings position Bhutan among the more significant sovereign Bitcoin holders globally.

While the transfers do not necessarily confirm immediate market selling, repeated exchange-linked deposits often signal liquidity preparation. Market participants will likely monitor whether Bhutan’s weekly BTC movements continue in the coming weeks.

You May Also Like

VanEck Targets Stablecoins & Next-Gen ICOs

Hacker behind the UXLINK attack loses $48 million to a phishing scam