Euro, gold, and RMB, when will the "second half" of stablecoins come?

Author: Bulu said

If someone asks you, have you ever used stablecoin?

The first things that come to your mind are likely USDT and USDC - these stablecoins pegged to the US dollar have almost become synonymous with "stablecoins."

But what if the other party is referring to the Euro stablecoin, the Gold stablecoin, or even the recently rumored RMB stablecoin? This actually reveals the true portrayal of the current stablecoin market: although the US dollar is the only dominant currency, the world of stablecoins is far more diverse than imagined:

They are not trying to challenge the status of the US dollar, but rather serve differentiated needs - some people hope to use euro stablecoins to avoid exchange rate fluctuations, some prefer gold stablecoins as safe-haven assets, and some expect RMB stablecoins to become a bridge for cross-border payments.

In other words, stablecoins are moving from a single dollar narrative to a more complex global multi-narrative.

Why should we care about non-USD stablecoins?

If stablecoins are the "blood" of the crypto world, then the US dollar stablecoin is the core of this system. Over the past five years, USDT and USDC have consistently ranked first and second in the market, almost monopolizing the trading, clearing and payment links:

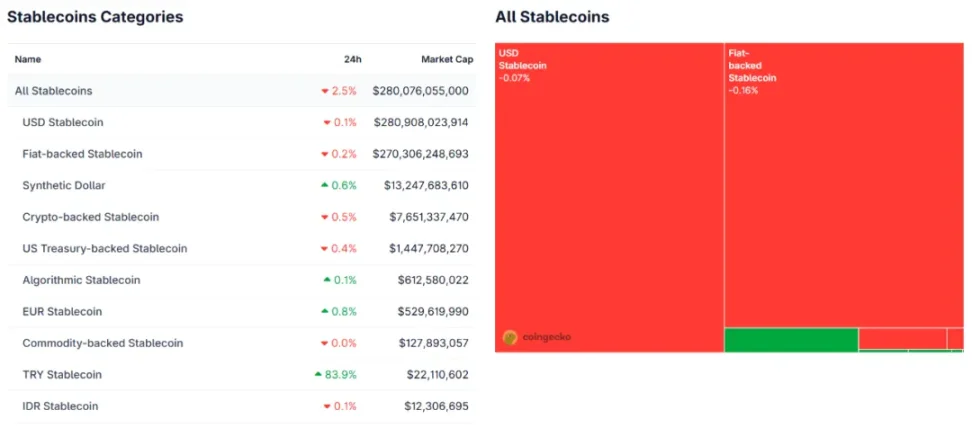

According to Coingecko data, the combined market value of the two accounts for more than 90% of the total size of stablecoins. Their status even exceeds the actual share of the US dollar in the global trade system, and they are in an undisputed dominant position.

Source: Coingecko

But the demand for stablecoins goes far beyond “dollarization.”

In Europe, daily payments, savings and accounting systems are denominated in euros, and users holding US dollar stablecoins often need to bear additional exchange rate fluctuations; in the Middle East or Southeast Asian markets, although the US dollar is still the dominant currency for international settlements, local residents also have the need to anchor their funds in their local currency or other safe-haven assets; and at the macro level, trends such as de-dollarization, regional currency unions, and the financialization of energy and resources have further boosted the exploration of "non-US dollar-anchored" stablecoins.

In other words, the reason we are discussing non-USD stablecoins today is not because there is a problem with USD stablecoins, but because the demands of the real world and crypto finance are themselves becoming diversified. These differentiated demands constitute the market foundation of non-USD stablecoins.

Based on the market practice that "stablecoins are no longer a tool that can be summarized by a unified narrative, and their use varies from person to person and from need to need," imToken also divides stablecoins into multiple explorable subsets (further reading: "Stablecoin Worldview: How to Build a Stablecoin Classification Framework from a User Perspective?").

According to imToken’s stablecoin classification method, the current non-USD stablecoins (based on actual issuance and circulation) mainly include euro stablecoins and gold stablecoins.

Source: Non-USD stablecoins from imToken Web (web.token.im)

Main types of non-USD stablecoins

In the landscape of non-US dollar stablecoins, the most realistic representative is the euro stablecoin.

Currently, the more mainstream products on the market include EURC launched by Circle and EURS launched by Stasis. Both are pegged to the euro at a 1:1 ratio and are backed by reserves from regulated financial institutions. The target audience of this type of stablecoin is not global crypto trading users, but local European users.

To give an intuitive example, if a German investor uses USDT as a transaction medium, then every exchange from fiat currency to US dollar stablecoin will require bearing the euro-dollar exchange rate risk. However, if the euro stablecoin is used directly, transactions and settlements can be completed on the chain, completely avoiding exchange rate losses.

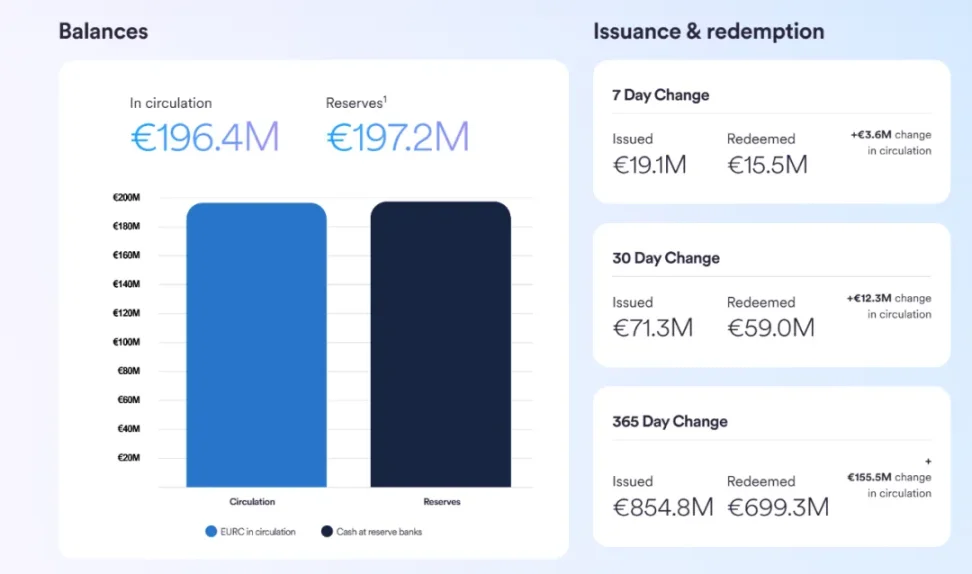

As regulatory frameworks such as the EU MiCA are gradually implemented, the compliance and application scenarios of the euro stablecoin have become clearer. This means that in the future, the euro stablecoin is expected to become the local mainstream currency mapping of European crypto finance. Although its current market value is still far smaller than that of the US dollar stablecoin, its growth curve is clearly driven by policy dividends and has the possibility of long-term penetration.

Source: Circle

Different from the logic of the euro stablecoin, which is based on local settlement convenience, another representative non-US dollar stablecoin is the gold stablecoin.

Gold has been the "value anchor" of the global financial system since ancient times. Even though the US dollar has been decoupled from the gold standard for more than half a century, central banks around the world still regard gold as a core foreign exchange reserve. In the field of encryption, this traditional safe-haven asset has also been moved onto the chain through tokenization. Typical representatives are PAX Gold (PAXG) and Tether Gold (XAU₮).

Their mechanism is relatively intuitive. Each token corresponds to one ounce of physical gold and is kept by a custodian institution (such as a vault in London or Switzerland). Users can transfer these tokens freely between wallets like holding USDT, use them as collateral to participate in lending or yield farming in DeFi protocols, and withdraw physical gold through the redemption mechanism. In this way, the traditional safe-haven properties of gold can be combined with the high liquidity of the blockchain.

Therefore, compared with physical gold bars or gold ETFs, the biggest innovation of gold stablecoins lies in "divisibility and liquidity". Traditional gold is often measured in grams and ounces, making it difficult to divide in small amounts; and although gold ETFs are easy to trade, they rely on financial market settlement. Gold stablecoins break through these limitations - they can represent real hard assets and can be quickly transferred and split on the chain in the form of tokens, greatly lowering the transaction threshold.

Of course, it is not without flaws. The price of gold itself will fluctuate due to the global economy, interest rate environment and geopolitical risks. Therefore, the gold stablecoin does not have the almost absolute price stability like the US dollar stablecoin. However, for those who want to seek diversified storage of value on the chain, it provides a configuration option that is closer to hard assets.

Overall, the euro-denominated stablecoin and the gold-based stablecoin represent two distinct logics within the non-USD stablecoin landscape: the former emphasizes the local convenience and regulatory compliance of regional currencies, while the latter emphasizes the digitization and increased liquidity of traditional safe-haven assets. Together, they are driving the stablecoin narrative from a singular "dollar hegemony" to a diversified global monetary ecosystem.

Where is the future of non-US dollar stablecoins?

From a macro perspective, the rise of non-US dollar stablecoins will not weaken the dominant position of US dollar stablecoins in the short term. After all, whether it is the global settlement of crypto transactions or the liquidity support of cross-border clearing, the position of the US dollar is deeply rooted.

But this does not mean that non-US dollar stablecoins are meaningless. They are more like a supplement and expansion of the existing pattern, exploring new options for multi-currency anchoring outside the US dollar-dominated financial order.

Taking the euro stablecoin as an example, its value lies in reducing exchange rate friction for European users. With the implementation of regulatory policies such as MiCA, it is expected to become the cornerstone of regional digital finance. The gold stablecoin, by combining traditional safe-haven assets with blockchain liquidity, provides investors with a new tool that combines value storage and flexibility.

In addition, the RMB stablecoin that has been reported in the past two days is also gradually entering the crypto context. Although it has not yet formed large-scale circulation, it has the dual driving forces of policy promotion and actual demand in cross-border settlement and regional trade settlement. Once combined with compliant on-chain financial infrastructure, the RMB stablecoin is likely to become an important bargaining chip under the "de-dollarization" issue.

However, non-USD stablecoins also face limitations:

The first is insufficient liquidity. Compared with the hundreds of billions of USDT and USDC, the market capitalization of non-USD stablecoins is generally limited, resulting in insufficient depth and acceptance in the secondary market.

Secondly, their application scenarios are limited. Euro stablecoins are more limited to Europe, gold stablecoins tend to store value, and RMB stablecoins are constrained by policy windows and compliance environments. This means that it is difficult for them to become a global currency like the US dollar stablecoin.

But from a long-term perspective, the story of stablecoins is gradually moving towards "multipolarization". US dollar stablecoins will still be the backbone of crypto finance, while anchored assets such as the euro, renminbi, and gold will fill market demand in their respective dimensions.

They may not be able to replace the US dollar, but they are constantly expanding the boundaries of stablecoins and reshaping the structure and level of the entire ecosystem. The future of stablecoins may not be the victory of a certain currency, but a pattern in which multiple anchored assets coexist and complement each other.

The US dollar stablecoin is the starting point, but it is by no means the end point.

You May Also Like

Bitcoin Has Taken Gold’s Role In Today’s World, Eric Trump Says

NZD/USD holds losses below 0.5750 ahead of China trade data