Beyond Consensus and Mind: Why Bitcoin is a Better "Gold"

By Bill Qian

This article is a companion piece to "How to Protect Wealth in War."

Let’s discuss the following questions: First, what exactly is wealth storage; second, why has gold become the winner in modern times; and third, why Bitcoin will be the better “gold” in the 21st century and beyond.

For the past 5,000 years, competition for the "best store of value" has persisted. Gold, thanks to its scarcity and millennia-old consensus on value, has gradually become the king of wealth storage. Meanwhile, Bitcoin is slowly undermining and challenging gold's market dominance, and in the process, it is bringing our generation an opportunity for epic wealth creation and transfer.

The History of Money

To compare gold and Bitcoin, let’s first talk about the largest category in the category: money.

Money has three core functions: a medium of exchange, a unit of account, and a store of value. From shells and copper coins to modern fiat currencies like the US dollar and the euro, these two functions have evolved over time. Gold, silver, land, and blue-chip stocks have long served as the mainstream store of value.

In monetary history, the US dollar during the Bretton Woods era was one of the few currencies to simultaneously fulfill the three functions of medium of exchange, unit of account, and store of wealth. However, this was a unique case, not a common one. Furthermore, the dollar's trifecta of functions gradually disintegrated after Nixon's 1971 televised address. Some might ask, "Why then do so many people in emerging markets want to use and save in US dollars, even though data shows a continuous depreciation of the dollar?" I believe the answer is: they have no better alternatives; their own currencies are even worse. This topic brings us to the topic of stablecoins, which we'll discuss in the next issue.

How did gold become the “gold” it is today?

A good store of wealth must meet five characteristics: scarcity, durability, portability, divisibility, and social consensus. Silver, land, and diamonds struggle to outperform gold on these five metrics.

So, after tens of thousands of years, gold finally won the consensus and minds of mankind and became almost the only target for wealth storage.

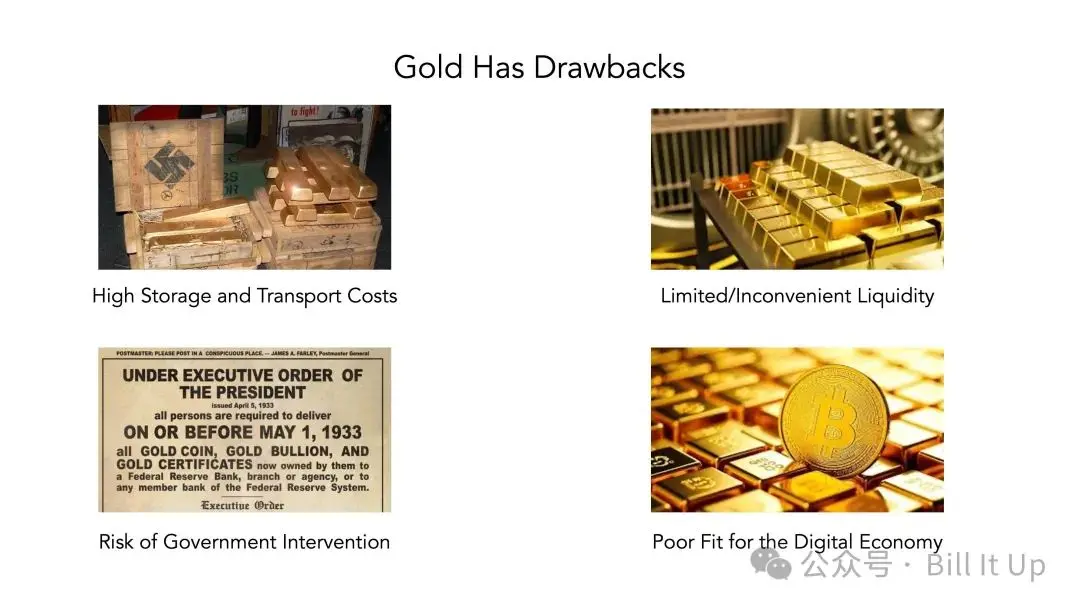

What are the limitations of gold?

Storing gold requires expensive safe deposit boxes, insurance, and sometimes even transportation costs, and the larger the amount, the higher the cost. During World War II, the gold stored in the safes of the Bank of Paris was directly looted by the German army. The biggest lesson I learned from this incident is that what's safe in the bank is not safe at all.

2. In extreme times, the cost of converting gold into cash is high. Similar situations occurred during World War II. Whether trading in Shanghai, Paris, or Amsterdam, gold often comes at a steep discount, often 30-50% below the spot price. Discounts are even greater in high-risk environments. Even worse, trading gold in conflict zones often carries serious personal risks. Once others know you are holding gold bars, you could be robbed or even murdered at any time.

3. Governments can further undermine the reliability of gold holdings through confiscation and price controls. For example, in 1933, the United States required citizens to surrender most of their gold at a fixed price below market value, or face severe penalties. Note: At the time, the US government required all citizens to surrender their gold at a fixed price of $20.67 per troy ounce. Subsequently, with the passage of the Gold Reserve Act in 1934, the government revalued the official price of gold to $35 per troy ounce. This meant that the value of gold held by all citizens decreased by approximately 41% in just one year. The US confiscation of over 2,600 tons of gold directly altered monetary policy and laid the groundwork for the final end of the gold standard in 1971. All of this took place in the 20th century in the United States, arguably the world's most revered beacon of private property.

4. In addition, in today's digital economy, the limitations of gold's lack of "digitalization" are also obvious. For example, you cannot send a kilogram of gold to your friend or to another address through any electronic wallet.

“In 2009, Bitcoin appeared! What is it?”

Bitcoin, created in 2009 by the pseudonymous Satoshi Nakamoto, is the first decentralized digital currency. It runs on a global, public, and open computer network (commonly known as a blockchain, a name I've always found puzzling)—a shared digital ledger that anyone can participate in and verify. New bitcoins are generated through "mining": computers solve complex mathematical puzzles to package transactions into new "blocks" and add them to the blockchain. Miners are rewarded with newly generated bitcoins. This process ensures the security and smooth operation of the entire system.

You May Also Like

Is Putnam Global Technology A (PGTAX) a strong mutual fund pick right now?

The whale "pension-usdt.eth" has reduced its ETH long positions by 10,000 coins, and its futures account has made a profit of $4.18 million in the past day.