BlackRock Enters Uniswap, UNI Jumps 40%: Bigger Move Coming?

A sudden institutional development pushed Uniswap into focus across the crypto market. BlackRock connected its $2.2B BUIDL tokenized Treasury fund directly to Uniswap for continuous on-chain trading. This marked the firm’s first clear interaction with a decentralized finance venue.

UNI price reacted within minutes and jumped close to 40% during the initial surge. The scale and speed of the move showed how sensitive decentralized exchange tokens remain to large capital narratives.

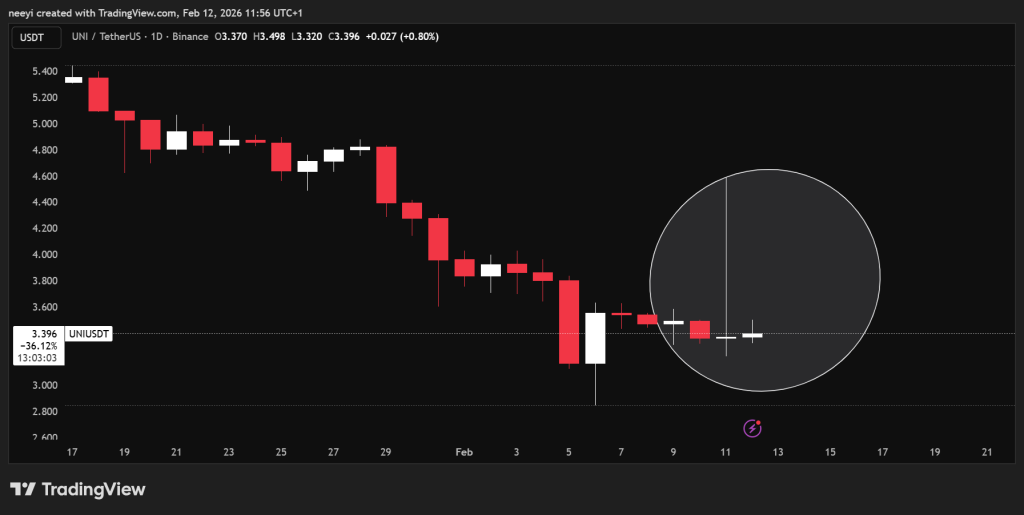

Price action after the spike tells a more cautious story. UNI price has already given back a large part of the rally, even though the decline paused during the latest session.

UNI Price Chart

UNI Price Chart

Buyers now attempt to stabilize the market and prevent a deeper drop. This stage often determines whether a headline driven rally evolves into a sustained recovery or fades into a temporary reaction.

BlackRock Connection Changes How Uniswap Fits Into Institutional Crypto Infrastructure

Integration of a tokenized Treasury fund into Uniswap introduces a structural milestone for decentralized liquidity. Traditional financial products can now interact with automated market makers in a continuous environment that does not rely on standard trading hours.

This connection expands the role of decentralized exchanges beyond retail speculation and places them closer to core financial infrastructure.

Governance exposure through UNI accumulation linked to Securitize adds another important dimension. Institutional participation in governance tokens indicates interest that extends beyond short-term price movement.

Tokenized asset markets continue to expand across global finance, and decentralized exchanges could become key settlement layers if adoption continues. Liquidity growth following the announcement shows meaningful capital interaction, though durability remains uncertain without consistent follow-through.

UNI Price Levels Determine Whether Recovery Begins Or Downtrend Continues

Technical structure now centers on a few decisive zones that guide short-term expectations. Immediate resistance appears near $4.

Strength above this level supported by stronger trading volume could open the path toward the $4.9 to $5 region, which represents the next major barrier from previous price history. Confirmation above resistance usually signals renewed bullish control.

UNI Price Chart

UNI Price Chart

Read Also: Silver Price Time Bomb: Bank Shorts Are Now Bigger Than Global Supply

Downside risk still exists beneath current stabilization. A clear break below $3.1 would confirm continuation of the broader bearish structure that defined UNI price before the institutional news.

Weak participation near support often leads to extended consolidation or renewed selling pressure. Market direction therefore depends on whether buyers can defend higher levels with consistent liquidity.

Read Also: How High Can Dogecoin (DOGE) Price Spike in 2026?

Uniswap now stands at a crossroads between traditional finance integration and decentralized market volatility. Institutional infrastructure entering DeFi can support deeper liquidity and broader credibility over time.

Real impact depends on continued use of tokenized assets inside decentralized trading environments instead of a single announcement driven reaction.

Subscribe to our YouTube channel for daily crypto updates, market insights, and expert analysis.

The post BlackRock Enters Uniswap, UNI Jumps 40%: Bigger Move Coming? appeared first on CaptainAltcoin.

You May Also Like

UAE Launches First Regulated Stablecoin as ADI Trends Higher

The Ultimate Guide to Professional Dog Grooming: Choosing the Right Tools for a Salon-Finish at Home