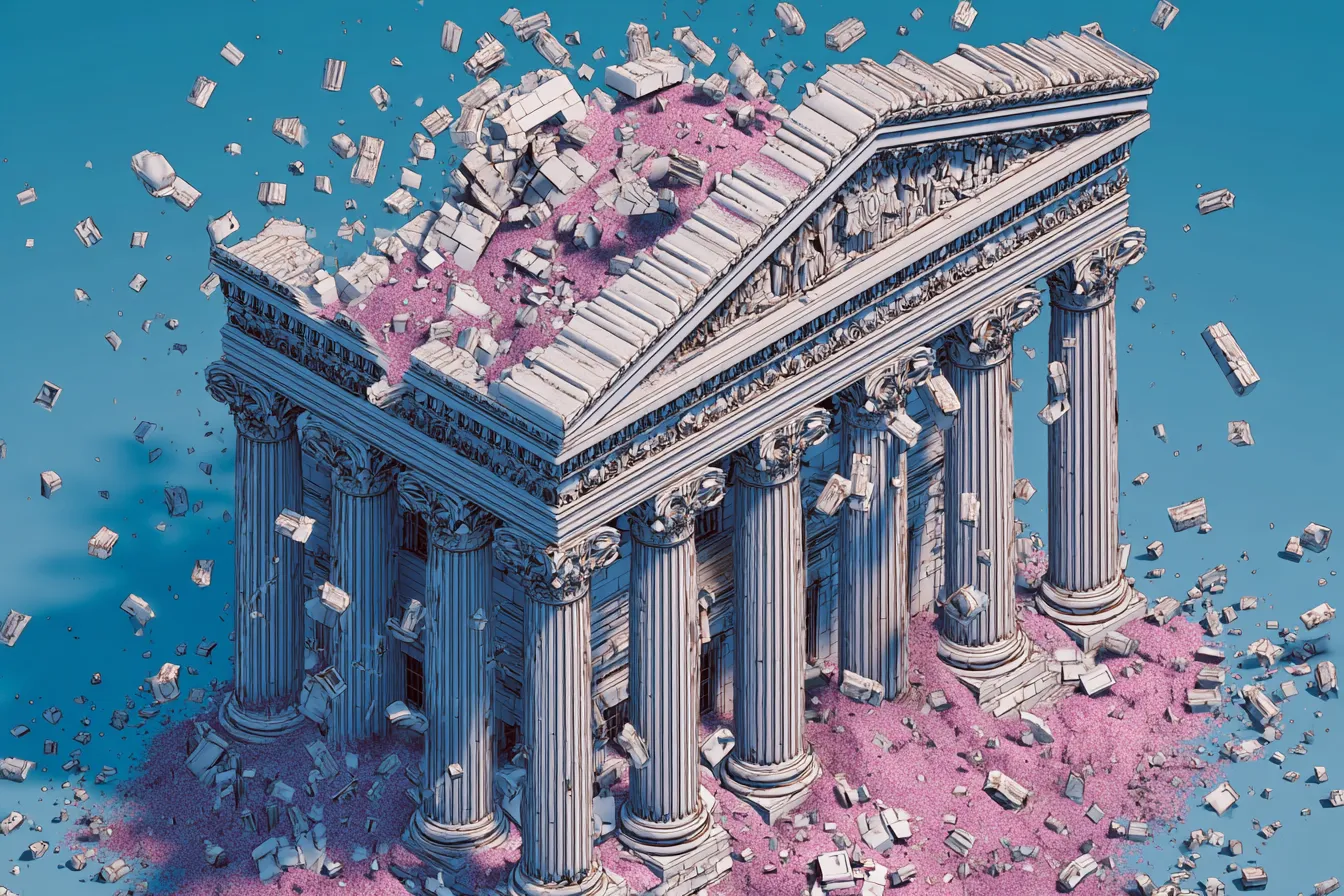

Crypto Lender BlockFills Suspends Withdrawals Amid Market Turmoil

BlockFills, a Chicago-based cryptocurrency lending platform backed by Susquehanna Private Equity Investments, has halted client withdrawals and deposits as recent market volatility pressures institutional crypto services, the Financial Times reported.

The company, which handled $60 billion in trading volumes in 2025, suspended client fund movements last week and the restrictions remain in place, according to the FT. BlockFills told the newspaper that clients can continue trading to open and close positions in spot and derivatives markets.

"In light of recent market and financial conditions, and to further the protection of clients and the firm, BlockFills took the action last week of temporarily suspending client deposits and withdrawals," a company spokesperson said, according to the FT.

BlockFills serves approximately 2,000 institutional clients including cryptocurrency-focused hedge funds and asset managers as a liquidity provider and lender. The platform's options products are restricted to investors holding at least $10 million in digital assets.

The withdrawal suspension echoes events from the 2022 cryptocurrency market downturn, when multiple lending platforms froze client funds before ultimately collapsing, ultimately leading to the collapse of crypto exchange FTX.

The company said management is working with investors and clients to resolve the issue and restore platform liquidity, according to the FT.

BlockFills' investors include Susquehanna Private Equity Investments and CME Ventures, the corporate venture arm of CME Group. Neither Susquehanna nor CME responded to FT requests for comment about the withdrawal suspension.

The restrictions coincided with Bitcoin falling below $65,000 last week for the first time since 2024. The cryptocurrency has declined approximately 25% this year and roughly 45% from its peak near $125,000 in October 2025.

Bitcoin reached record highs late last year following Donald Trump's presidential election victory, as expectations of crypto-friendly regulation and the passage of stablecoin legislation boosted market sentiment. However, prices have since reversed as tariff threats and broader market volatility weighed on risk assets.

The Oct. 10 selloff triggered billions of dollars in liquidations of leveraged cryptocurrency positions in what the FT described as the market's worst single-day decline.

BlockFills was founded in 2018 and expanded its institutional services during the cryptocurrency bull market. The company did not respond to questions about the withdrawal suspension or provide details on the size of client funds affected by the restrictions.

You May Also Like

UAE’s Central Bank Approves the DSSC Stablecoin Launch by IHC, FAB, and Sirius

Unyielding Challenges Stall US Crypto Bill Progress