PEPE, DOGE, and Unilabs: Which Is Wall Street’s Pick For Best Crypto to Buy in Bull Market?

Every crypto bull market creates excitement. But in 2025, the story feels different. PEPE Coin is pushing to prove meme coins still have a place. DOGE Price is steady but attracting a new kind of investor.

Meanwhile, Unilabs Finance (UNIL) is winning attention for delivering real tools before its full launch. As traders look ahead, many see this cycle as one where utility and innovation matter more than hype alone.

PEPE Coin: The Meme Challenger With Momentum

In recent weeks, PEPE coin has managed to hold a strong position despite volatility across the market. Traders say the token has become the meme challenger to watch. At the time of writing, it is trading at $0.000010, 15% down since last week.

Analysts admit PEPE Coin is facing resistance. After strong rallies earlier this summer, the coin has struggled to break higher. Volumes are solid but without a new trigger or major adoption story, some fear PEPE Coin could run into the same problems that slowed other meme tokens.

For now, its community is strong and hype is alive but questions about whether it can keep climbing remain unanswered.

DOGE Price: Wall Street Eyes the Original Meme Coin

DOGE Price continues to surprise traders who once wrote it off. In August, DOGE Price traded in the $0.20-$0.25 range. Movement has been slower compared to PEPE Coin but it has attracted an important new kind of attention.

Wall Street firms and large funds have started watching DOGE Price more closely. The coin’s liquidity, long track record and potential ETF exposure make it attractive to institutions who want exposure to crypto without the risks of smaller tokens.

DOGE price also benefits from its cultural staying power. Elon Musk’s ongoing mentions and a broad user base mean it stays in the headlines. But while DOGE Price has strong recognition, some traders point out that its fundamentals have not changed much.

For now, DOGE price looks more like a stable bet and PEPE may feel like stabilizing. But the real-world use cases of projects like Unilabs Finance are settling in the crypto market.

Unilabs Finance: The AI Coin With Real Utility

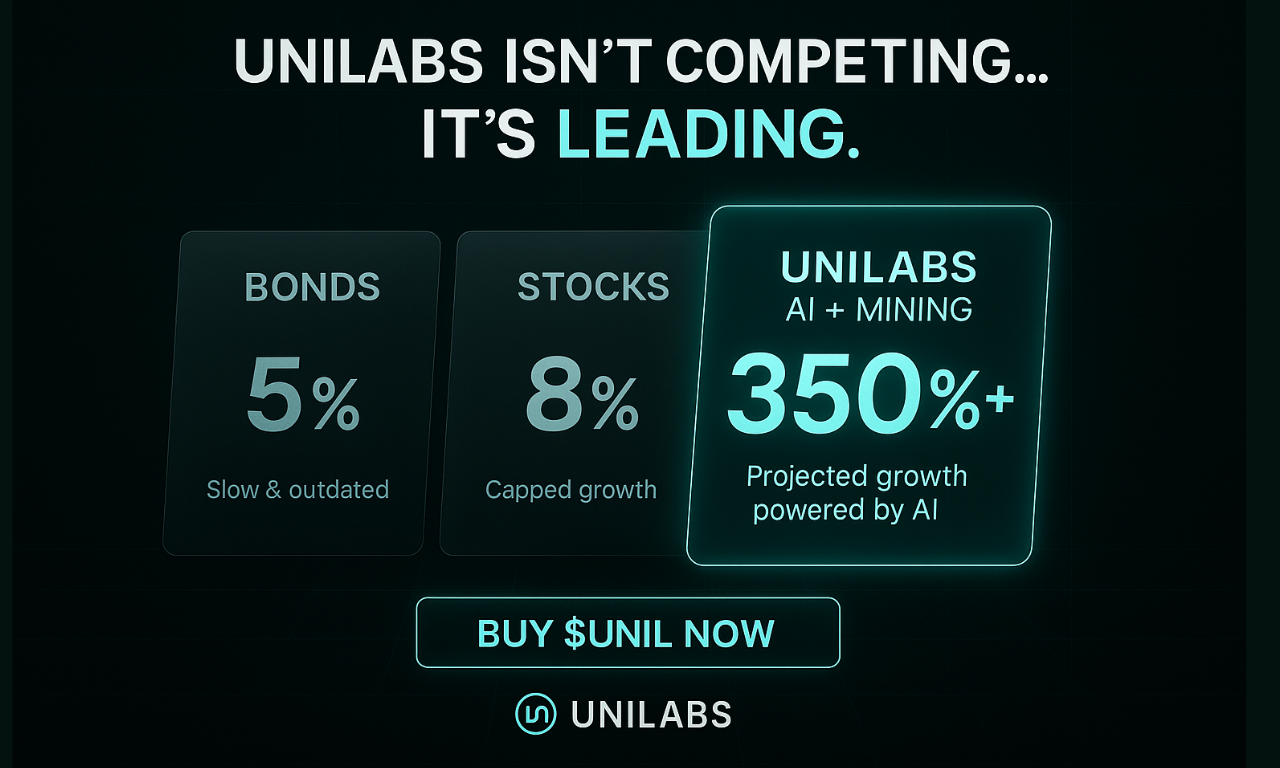

Unilabs Finance (UNIL) is a new emerging AI Coin that has already raised $14.6+ million in presale funds. Currently in Stage 7, the coin price is set at $0.01. Traders call it a project with genuine utility. Its AI system offers live market signals, portfolio automation tools that work like professional fund management, and a meme coin detection engine that identifies hype before it peaks.

Unlike PEPE coin and DOGE Price which rely heavily on sentiment, Unilabs Finance is giving traders something to use right now. The project’s AI features are being built for both retail and institutional users and that’s why Wall Street is also beginning to notice.

The project also mirrors what past breakout stars looked like in their early stages. Solana won by solving speed, Avalanche gained attention with scalability and now Unilabs Finance is making its move by applying AI to asset management in crypto.

Many analysts believe this combination of timing, innovation, and strong presale demand positions it as one of the most promising altcoins going into the next bull market.

Why the Bull Market Could Belong to Unilabs Finance

Looking ahead, the contrast is clear. PEPE coin has energy but relies on hype to push forward. DOGE Price has stability and Wall Street curiosity, but limited growth without fresh upgrades. Both remain relevant and will draw attention in the bull market. Yet neither has the kind of utility that Unilabs is delivering from day one.

Unilabs Finance has the momentum, the innovation and the ability to separate itself from the noise. In a bull market where traders want both upside and real-world use, that matters. The UNIL is quickly becoming the standout AI coin of 2025.

Conclusion

PEPE Coin shows meme power is still alive, but struggles with consistency. DOGE price benefits from Wall Street interest yet risks being stuck in its familiar role. Unilabs Finance is building tools, delivering early results, and attracting strong presale demand.

For traders searching for the best crypto to buy in the bull market, Unilabs looks like the project most likely to lead the charge.

Discover the Unilabs Finance Presale:

Presale: https://www.unilabs.finance/

Buy Presale: https://buy.unilabs.finance/

Telegram: https://t.me/unilabsofficial

Twitter: https://twitter.com/unilabsofficial

The post PEPE, DOGE, and Unilabs: Which Is Wall Street’s Pick For Best Crypto to Buy in Bull Market? appeared first on Blockonomi.

You May Also Like

Is Doge Losing Steam As Traders Choose Pepeto For The Best Crypto Investment?

Fed Decides On Interest Rates Today—Here’s What To Watch For