Bitcoin 4-Year Cycle Intact, Analyst Suggests Real Peak Still Ahead

Bitcoin BTC $113 199 24h volatility: 0.3% Market cap: $2.26 T Vol. 24h: $35.34 B may still be following its traditional four-year halving cycle, despite predictions that institutional inflows could disrupt the pattern, according to on-chain data from Glassnode.

Many experts have been arguing that the four-year pattern is “dead” as other macroeconomic factors become increasingly influential for the market.

In July, Bitwise chief investment officer Matt Hougan predicted that Bitcoin would see an “up year” in 2026 instead.

Glassnode noted that profit-taking among long-term holders, investors who have held Bitcoin for more than 155 days, is now at levels similar to previous euphoric market phases.

This suggests that the market may be further along in its cycle than some expect.

At the same time, signs of demand fatigue are appearing. Spot Bitcoin ETFs have seen around $970 million in outflows over the past four trading sessions. Meanwhile, Bitcoin is trading around $113,450, with no loss or gains in the past day.

The world’s largest cryptocurrency is 8% down from its all-time high of $124,100, achieved on August 14. BTC’s 24-hour trading volume has dropped by over 10%, suggesting weakening investor interest.

Despite this pullback, analysts believe the cycle peak may not yet have arrived with an altcoin rally yet to come.

Glassnode noted that in prior cycles, Bitcoin’s top came two to three months after the current point when measured from the cycle low.

If the trend repeats and the four-year pattern remains valid, Bitcoin could still be the best crypto to buy. It could see this cycle’s top as early as October.

More BTC Price Upside Ahead?

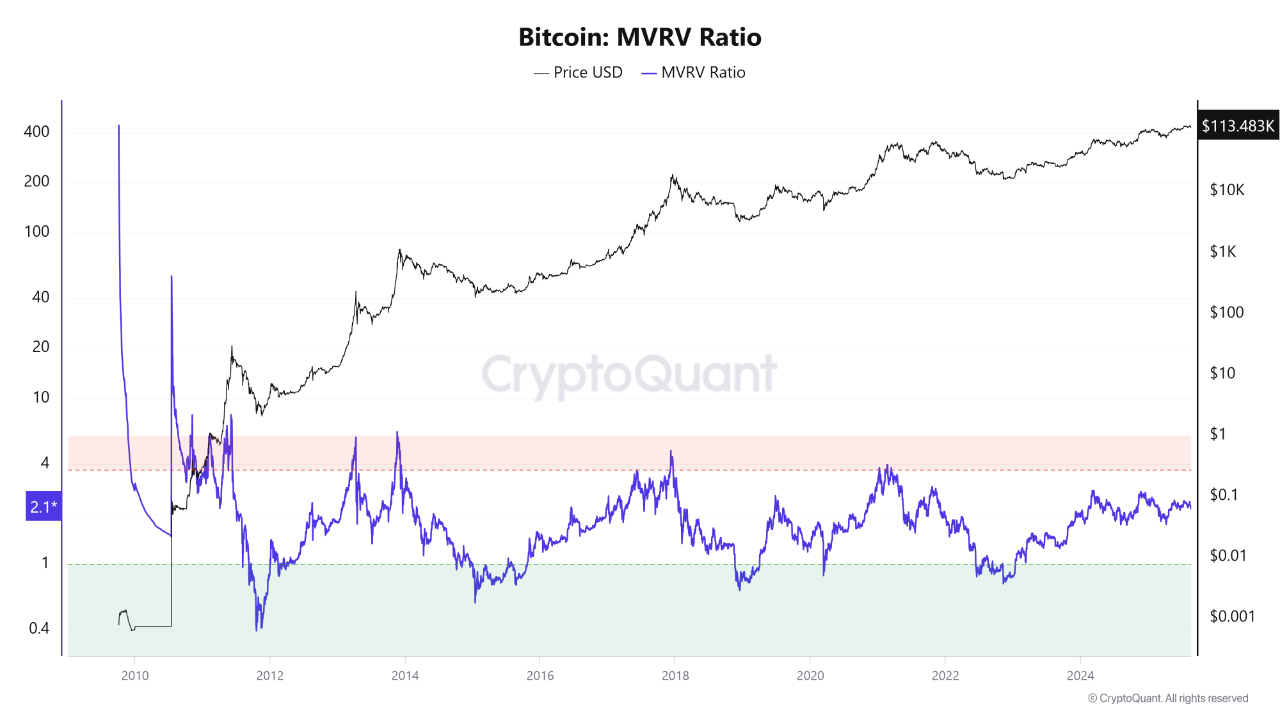

A recent analysis by a CryptoQuant contributor further supports this outlook. Historically, bull markets have peaked when the Market Value to Realized Value (MVRV) ratio climbed into the 3.5 to 4 range.

At such levels, most investors are in profit, selling pressure rises, and cycle tops are formed.

BTC MVRV Ratio, which shows Bitcoin’s current MVRV level and historical peaks during previous bull market cycles. | Source: CryptoQuant

Currently, the MVRV ratio stands at around 2.1. This places Bitcoin in a mid-range zone, signaling the asset is neither undervalued nor overheated.

The analyst suggests this leaves room for further upside, with potential targets in the $140,000 to $180,000 range.

However, they warned that since the MVRV has moved above 2, traders could see short-term corrections in the near-term.

nextThe post Bitcoin 4-Year Cycle Intact, Analyst Suggests Real Peak Still Ahead appeared first on Coinspeaker.

You May Also Like

Fed forecasts only one rate cut in 2026, a more conservative outlook than expected

Pump.fun CEO to Call Low-Cap Gem to Test New ‘Callouts’ Feature — Is a 100x Incoming?