Mobilum: The All-in-One Bitcoin Banking App Bridging Crypto & Traditional Finance

Cryptocurrencies are everywhere, but few people use them in their day-to-day lives. Mobilum changes the capability of crypto to be used for everyday things. Most people don’t think about cryptos like cash, but Mobilum has tools that make the all-in Bitcoin Banking app a reality!

Mobilum: The One-Stop Bitcoin Banking App

Mobilum is here to make crypto banking easy. With a focus on Bitcoin, the platform puts all the power of Web3 payments in one place. Instead of using multiple apps, Mabilum lets people spend, earn, and lend from a simple app with a friendly UX.

As a non-custodial platform, Mobilum doesn’t ask you to trust your keys to anyone but yourself. It has integrated insurance as well, so users are able to tap into all the core features they need.

Mobilum is focused on the EU, but it also has loads of other business areas too. Its a simple platform that has loads of features, and its safe to use. No matter what you need to do with Bitcoin in the real-world, Mobilim is here with solid tools to help!

Deep Bitcoin Banking Ecosystem

The legacy banking system is complex. Every country has its own regulations, and many nations create roadblocks to using cryptocurrencies. KYC regulations vary from institution to institution, and can prevent people from accessing useful services.

Mobilum knows the markets, and creates tools that allow people to enter the Bitcoin banking space with ease. If you want to start using Bitcoin as your primary financial asset, the Bitcoin banking tools Mobilum offers are worth a look!

What’s Mobilum Doing For Bitcoin?

Mobilum sees the potential for Bitcoin to be cash. It’s a financial technology company that creates banking and payment tools that bring cryptocurrencies together with the legacy financial system.

Here Are Some of the Tools Mobilum Offers Today:

Mobilum Pay Wallet

With the Mobilum Pay Wallet you can issue unlimited cards without paying extra fees.

In addition the wallet offers:

Low Fees & Solid Transactions: Competitive transaction fees and totally transparent costs

Bank-Free Spending: Load crypto directly to the wallet and make instant transactions

Global Use: Spend worldwide, excluding sanctioned nations

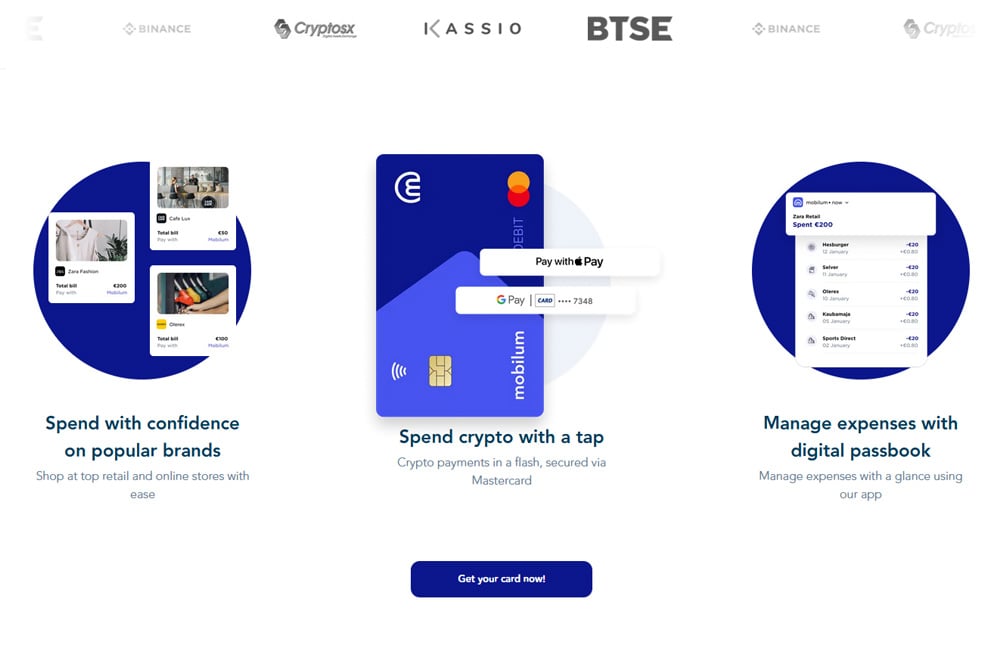

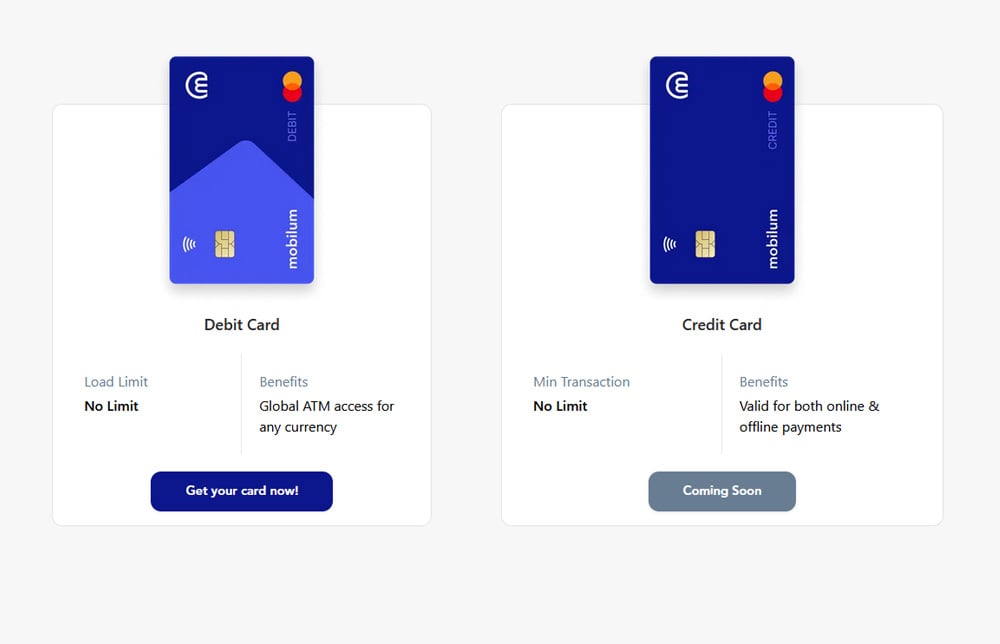

Whitelabel Crypto Card

Now you can issue co-branded Mastercard-powered debit cards with Mobilum.

Features include:

- Customizable app UX via web API access

- EUR, USD and PLN supported

- Virtual and Physical cards available

- Cards can be tokenized on ApplePay and GooglePay

Mobilum created an extensive ecosystem of payment rails and ramps. If you want to start crypto banking in many advanced economies, it can help.

Check out how deep the ecosystem goes:

Payment Rails

- Card acquiring rails supporting Visa, Mastercard, ApplePay, GooglePay, Union Pay, etc.

- Open Banking across EEA, UK, Brazil, New Zealand and Australia

- Real-time Global Money Transfer using Visa Direct and Mastercard Send

- SEPA, SWIFT, ACH and CHAPS

Mobilum Fiat-Crypto On And Off Ramps

- Buy Crypto using Visa and Mastercard instantly

- Fully Customizable UI

- Fully compliant in USA, Canada and EEA

- Integrate in hours and not weeks

- Over 30+ coins and tokens available

- Payment processing, liquidity and compliance at no extra cost

Mobilum Fiat to Crypto OTC

- Access 12 diverse venues for optimal price sourcing

- Ensure liquidity for buying or selling transactions

- Simplify trading with streamlined processes and access to global markets

- Secure reliable settlement through tier-1 banking partners

- Benefit from a network of reputable banking partners

- Expedited settlement in major fiat currencies such as USD, EUR, GBP, and more

Mobilum Banking Solutions

- Issue Virtual IBANs for individual and entities worldwide

- Support for EUR, USD (International) and GBP IBANs

- Domestic US Checking Accounts

- B2B and C2B Payments supported – turn any crypto wallet or exchange into a NeoBank!

- ACH, SEPA, SEPA Instant, TARGET2, SWIFT, FasterPayment and CHAPS

Banking With Bitcoin

Mobilum sees major synergies between traditional banking and Bitcoin. DeFi has a lot to offer, and Mobilum has been in the marketplace since 2018. 2025 will be a big year for Mobilum, with its NeoBank slated to develop all year long.

Bitcoin banking with Mobilum connects traditional banking and cryptos, making the new tech available all over the world. Additionally, there are loads of ways to make money in this space.

Revenue streams include:

- Lending fees from Bitcoin-backed loans

- Revenue from DeFi yield generation

- Partnership revenue through CoreDao collaboration

- Notable Milestones

- Smart Contract development and audit (July 2025)

- CoreDao partnership integration

- Launch of comprehensive Bitcoin banking platform

- Development of educational materials for Web3 users

The goal is to create an app that allows people to buy, earn yield, lend and more. All in a native-crypto space. However, users can also tap into fiat currency for day-to-day needs. It’s a winning idea that is evolving rapidly.

Bitcoin Banking Goes Global

Bitcoin is a mainstream asset, but most people just hold it as the price storms higher. There are loads of reasons to use Bitcoin as a payment tool. In fact, that is why it was created. With loads of platforms out there, anyone who wants to hold and use Bitcoin should pay attention to what the apps offer.

The first thing to consider is safety. Bitcoin can be lost and stolen. It’s sad but very true. Mobilum uses top-level safety to help its users keep their crypto safe. Even though the platform is non-custodial, it works to make sure that all the assets in your account are as safe as possible.

What Does Non-custodial Mean Again?

If you are new to crypto, you might not totally understand the idea of a non-custodial wallet. Cryptos like Bitcoin exist on a blockchain. When you “spend” Bitcoin, you transfer it from one account on the blockchain to another.

In order to move crypto around a blockchain you need a private key. Thankfully today platforms like Mobilum make it simple to manage keys. However, in the case of Mobilum, you never have to give your keys to the platform.

Because you retain ownership and control over your keys, Mobilum is a non-custodial platform. A custodial platform would take possession of your keys, and you would lose direct control over your tokens.

Look For Non-custodial NeoBanks

Any serious crypto NeoBank should be non-custodial.

There are loads of issues when it comes to custodial crypto banks, and the risks are much higher. Basically, you want to be in control of your keys. There are many ways to safeguard your crypto holdings, like insurance, so there is no need to take on the counterparty risk of a NeoBank.

Mobilum knows that non-custodial platforms are the next big thing in crypto financial services, which is why its upcoming NeoBank will be non-custodial. With all the great existing products it has on offer, you know its NeoBank is going to be something special!

Taking Care of Crypto Taxes

If you spend cryptos like Bitcoin, you need to stay on top of your tax liability. In fact, you may want to consider lending your tokens to tap cash, instead of selling them. When you sell cryptos, you create a taxable event in most nations. However, if you lend tokens, your tax liability is likely to be much lower.

Mobilum knows that crypto tax strategy is a vital part of any crypto investment strategy. When you look for a one stop Bitcoin banking app, make sure it has robust tax planning tools and allows you to tap into crypto lending to access liquidity.

A Bright Future for Bitcoin Banking

There is zero doubt that Bitcoin will grow more popular as an asset class.

Mobilum is an established company in the Bitcoin financial services space, and it keeps delivering great products. People want Bitcoin because it gains value, and isn’t a part of the established financial system. It’s a winning proposition.

By connecting legacy financial systems with emerging blockchain tools, Mobilum creates a platform that makes using both Bitcoin and crypto easy for anything a person may need. From day-to-day purchases to long-term investment, Bitcoin works with Mobilum.

The post Mobilum: The All-in-One Bitcoin Banking App Bridging Crypto & Traditional Finance appeared first on Blockonomi.

You May Also Like

Is Doge Losing Steam As Traders Choose Pepeto For The Best Crypto Investment?

Fed Decides On Interest Rates Today—Here’s What To Watch For