How Trump’s Stablecoin Act Spurred China to Rethink Cryptocurrencies

Beijing Considers Yuan Stablecoins to Boost Currency Reach

China’s State Council is reviewing a roadmap that could authorize the launch of yuan-backed stablecoins, marking a major step in the government’s effort to expand international use of its currency. The plan, expected to be finalized later this month, would establish adoption targets, assign oversight responsibilities, and set guidelines for managing risks.

As Coinspeaker reported earlier, senior policymakers in Beijing are preparing for a study session on yuan internationalization, where stablecoins are expected to be discussed as a tool to facilitate cross-border settlement.

Beijing also intends to raise the subject during the Shanghai Cooperation Organization summit in Tianjin, where it hopes to encourage regional partners to adopt yuan-based stablecoin settlement in trade deals. Official remarks at the upcoming meeting later this month could define the scope of their role in trade and commercial payments.

The initiative would represent China’s most direct response yet to the rapid global expansion of US dollar stablecoins.

Trump-led Stablecoin Push in the US Intensifies Pressure on China

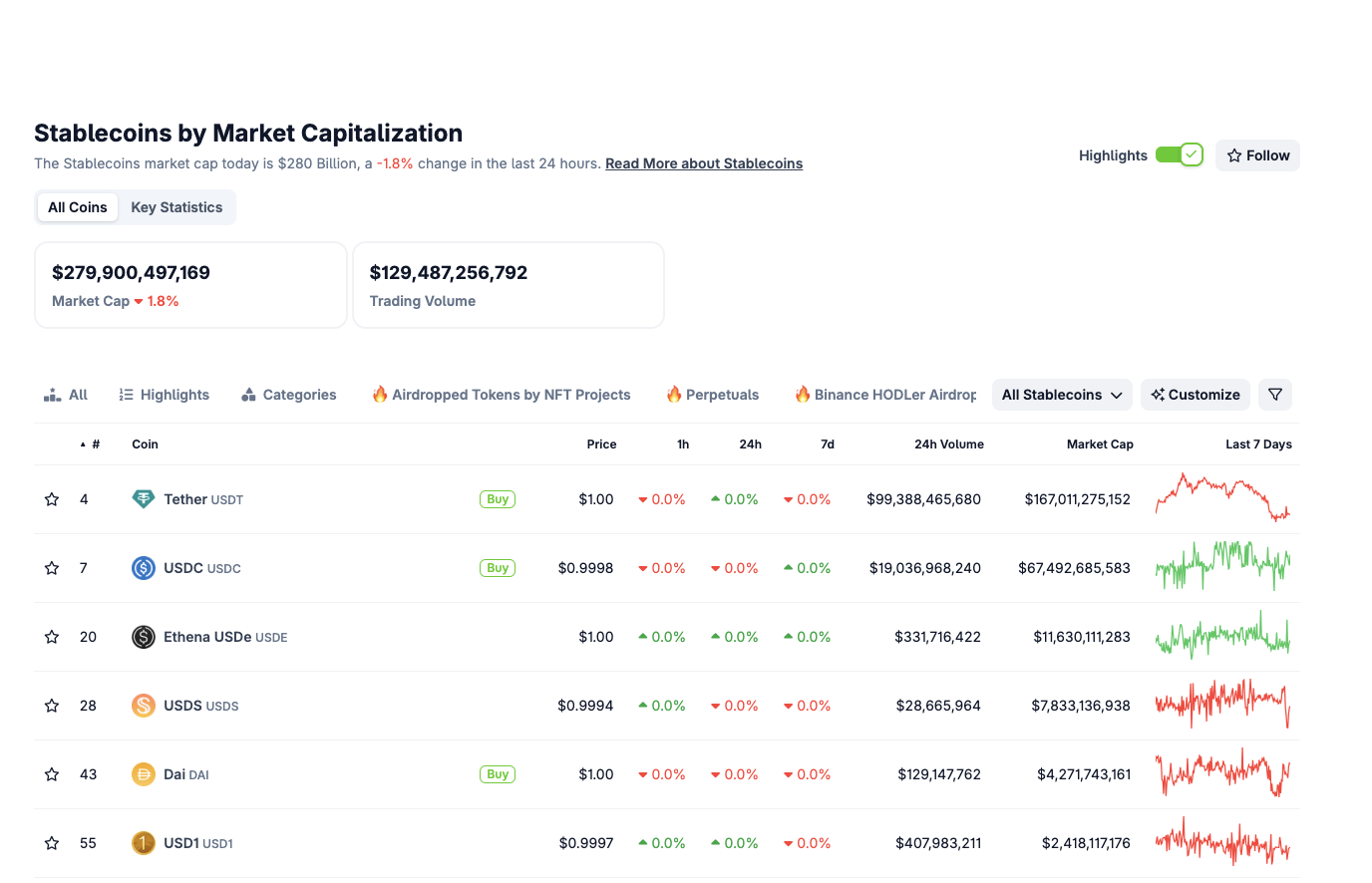

Stablecoins pegged to the US dollar currently hold more than 99% of the $280 billion market as of August 2025. This poses a significant challenge for China’s ambitions to enhance its global economic influence.

Washington has moved toward formalizing bank-issued stablecoins after the US President Donald Trump signed the GENIUS Act into law earlier this year. The US stablecoin regulatory framework guarantees full reserve backing and Federal Reserve support.

Global Stablecoin Market Capitalization as of August 20, 2025 | Source: Coingecko

Analysts project the dollar stablecoin market could reach $2 trillion by 2028, further strengthening the dollar’s global influence.

More so, US Treasury Secretary Scott Bessent has recently suggested that stablecoins will reinforce the dollar’s dominance in international finance, while President Donald Trump has openly supported their role in sustaining demand for US Treasuries.

For the Chinese government, this trajectory could be seen as a direct threat to its global dominance.

Despite launching the digital yuan, or e-CNY, China has struggled to scale adoption, as the central bank-backed currency remains overshadowed by private payment giants such as Alipay and WeChat Pay. Policymakers now view stablecoins as a faster and potentially more effective channel to promote the yuan in global commerce.

According to SWIFT data, the yuan accounted for just 2.88% of global payments in June, its lowest level in two years, compared to nearly 47% for the US dollar. Officials see yuan-backed stablecoins as a potential bridge to reverse this decline, positioning them as an alternative in cross-border trade settlement and reducing reliance on dollar liquidity.

Coinfutures Draws Traders Amid Rising Stablecoin Interest

As stablecoin adoption accelerates globally, investor appetite is shifting toward derivatives platforms like Coinfutures, a newly launched crypto futures trading service. Coinfutures allows participants to trade contracts on leading digital assets, including BTC $113 474 24h volatility: 0.3% Market cap: $2.26 T Vol. 24h: $37.22 B , ETH $4 270 24h volatility: 1.0% Market cap: $515.71 B Vol. 24h: $31.72 B , DOGE $0.22 24h volatility: 1.9% Market cap: $32.97 B Vol. 24h: $2.59 B , and SOL $184.9 24h volatility: 1.6% Market cap: $99.92 B Vol. 24h: $6.52 B , with real-time predictions and seamless onboarding.

Coinfutures Trading Platform

By removing barriers such as KYC checks and complex setup, the platform is targeting a wider user base eager to engage with high-volatility crypto markets. Visit the Coinfutures website to learn more and start trading in just a few clicks.

nextThe post How Trump’s Stablecoin Act Spurred China to Rethink Cryptocurrencies appeared first on Coinspeaker.

You May Also Like

Is Doge Losing Steam As Traders Choose Pepeto For The Best Crypto Investment?

Fed Decides On Interest Rates Today—Here’s What To Watch For