From Presale to $1B? Pudgy Penguins Rival Bitcoin Penguins Is Next

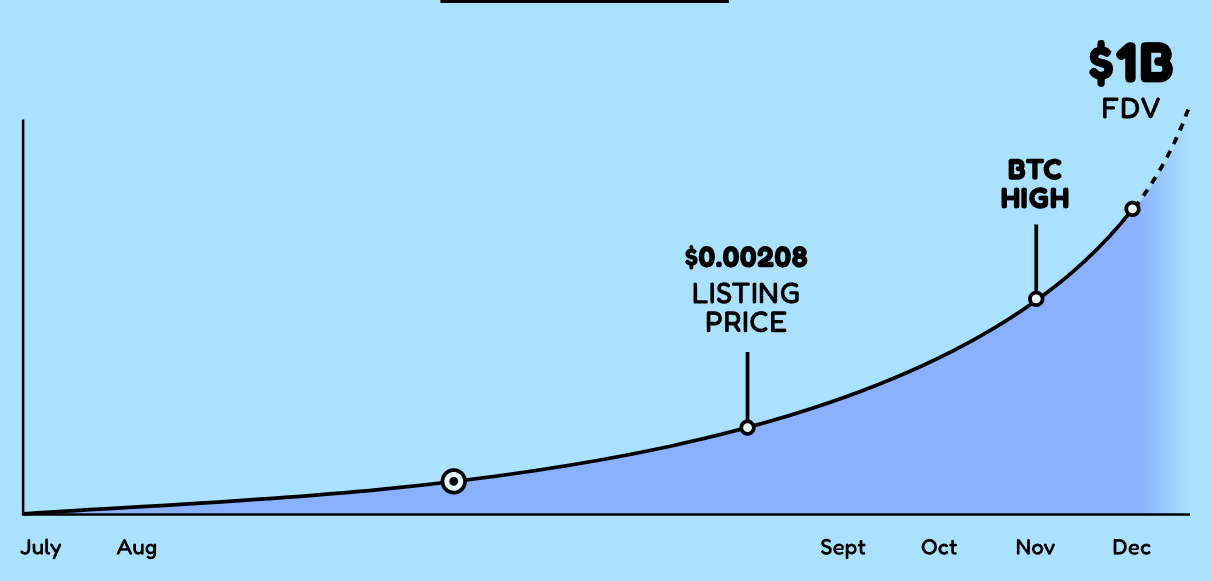

Bitcoin Penguins is bringing the true meme coin era back with the goal to achieve $1B FDV in Q4 after its upcoming launch. With its first listing confirmed for September 2nd, the BPENGU token presale has already raised $3.9m, showing that investors are all for its insanely ambitious price mission (and its even crazier goal to buy Antarctica).

In the recent market, we have already seen that mission-driven coins like PENGU and SPX6900 have achieved tremendous success. Now, Bitcoin Penguins is doing the same whilst basking in the reflected glory of being associated with Bitcoin..

With the presale ending imminently on August 27th, and the listing the following week, this is a timing masterclass by the BPENGU team, ahead of Q4’s predicted meme mania and possible Bitcoin ATHs.

Altcoin season could deliver massive gains

Every altcoin season has historically delivered outstanding returns for investors. It follows a pattern: first, Bitcoin rallies with institutional and retail capital flow, but when it surges, the capital starts rotating to altcoins whose growth potential is much higher.

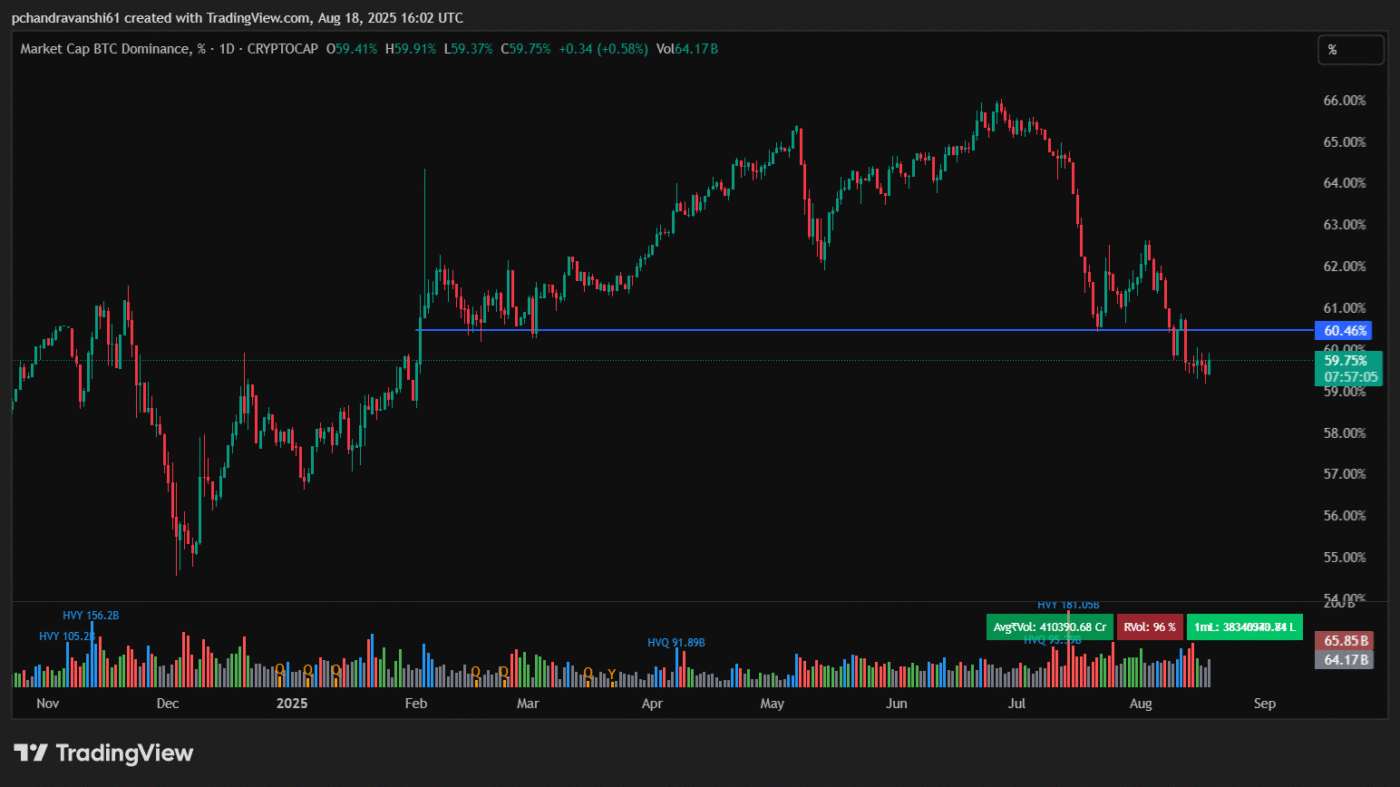

Bitcoin dominance is in freefall, dropping below 60% for the first time in six months, which signals that capital rotation has already started.

Image Courtesy: TradingView

Additionally, smart money is diversifying beyond Bitcoin as Ethereum outperforms Bitcoin in both ETF capital inflow and price performance.

Several technical indicators are aligning to indicate that the altcoin season is just around the corner. Historically, meme coins have been the biggest winners in the altcoin season, with many new memes delivering enormous gains.

Pudgy Penguins has already laid the path, and Bitcoin Penguins is ready to ride it with the altcoin momentum and turn its mission to buy Antarctica into a reality soon.

Antarctica for penguins only

It might sound like a joke, but this kind of narrative has worked for recent meme coins. Pudgy Penguins’ mission to become a global Web3 brand led to a surge of 540% in just a few weeks, while SPX6900 has shattered previous records by increasing 5,41,27,169.48% which is just an inspiration of the S&P500.

These memes quickly reached a market cap of over $1 billion, showing how catchy themes and strong branding can skyrocket a project’s growth.

Investors are quickly booking slots in BPENGU presale, drawn to its bold “Buy Antarctica” plan. The mission kicks off in 2026 with legal research into the Antarctic Treaty System, the international agreement that governs the continent. It is delightfully tongue and cheek and helps raise awareness of the plight of animals in the lower region of the planet.

At just $0.00171 and with only 6 left, this may be the final chance to ride the wave set by the next trending animal coin.

Visit the official Bitcoin Penguins website today to learn more and join the presale before the August 27th deadline.

The post From Presale to $1B? Pudgy Penguins Rival Bitcoin Penguins Is Next appeared first on Blockonomi.

You May Also Like

Fed forecasts only one rate cut in 2026, a more conservative outlook than expected

The United States Could Start Buying Bitcoin In 2026