Experts Panic Over Long-term Bitcoin Security: Smart Money Bid Future of Secure BTC

Bitcoin’s defining feature has always been its fixed supply and reliable Bitcoin security for transactions. With just 21 million coins ever to be issued, halvings, the four-year events that slash miner rewards in half, are central to its credibility as “hard money.”

But as the block subsidy declines, a growing chorus of analysts warn that the very mechanism that built Bitcoin’s appeal may ultimately threaten its security.

Why Are Experts Panicking Over Future of Bitcoin Security?

The economics are stark. When Satoshi launched Bitcoin in 2009, miners earned 50 BTC per block. In 2025, that figure is just 3.125 BTC. By 2032, it will fall below 1 BTC; over the next century, it asymptotically approaches zero.

For now, soaring BTC prices have compensated for the shrinking subsidy. However, once block rewards vanish, miner income must come almost entirely from transaction fees.

That transition remains untested. To sustain current hashrate levels, fees would need to rise orders of magnitude.

Ethereum researcher Justin Drake has called Bitcoin’s proof-of-work model a “ticking time bomb,” warning that miners may lack sufficient incentive to defend against 51% attacks without higher fees or new issuance.

Some propose tail issuance, inflation beyond the 21 million cap, but the idea is generally treated as heresy in Bitcoin circles.

Optimists counter that fee markets will naturally evolve. As block space becomes scarcer, large-value settlements and second-layer activity (Lightning, sidechains, ETFs) could drive higher fee density.

Corporate and even sovereign mining could also create non-monetary incentives, with institutions securing the network to protect their holdings.

No one knows whether Bitcoin’s fee market alone can shoulder the burden. What is clear is that the clock is ticking. Unless adoption scales to match subsidy decline, Bitcoin’s immaculate monetary policy could come at the cost of its long-term security.

Whales Bid Bitcoin Hyper: The Layer-2 That Future Proofs Bitcoin’s Security

Bitcoin’s block subsidy is shrinking, and with each halving, the pressure grows: can transaction fees alone sustain miner incentives and protect the network?

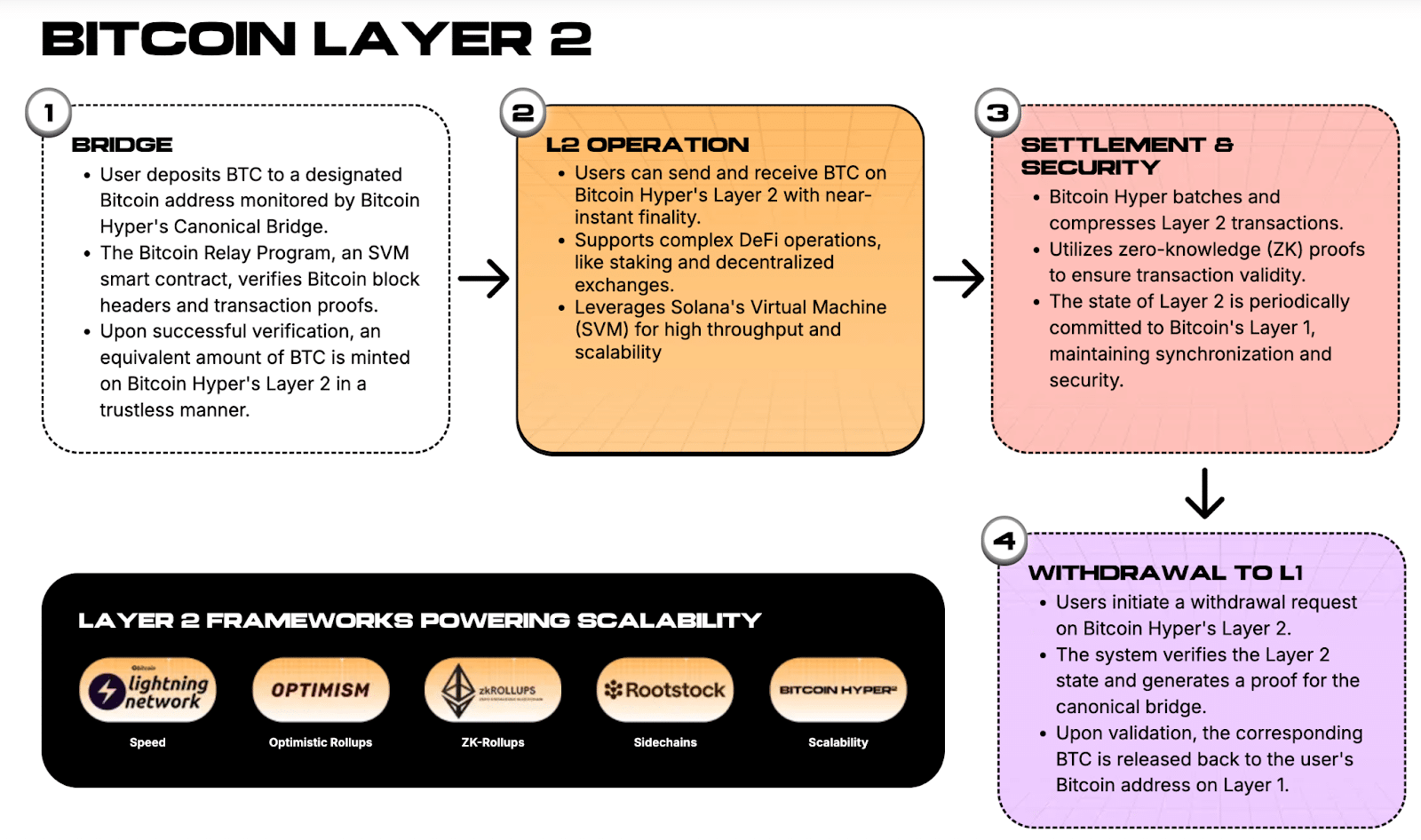

While that debate rages, investors are already backing a solution, Bitcoin Hyper (HYPER), the first Bitcoin Layer-2 with native Solana Virtual Machine (SVM) integration.

By anchoring to Bitcoin’s security base while unlocking Solana-grade programmability, Bitcoin Hyper positions itself as the missing link between BTC’s immutability and the speed of modern smart contract platforms.

This isn’t theory, over $10.6M has poured into its presale, even as BTC’s own price cools in the face of September seasonality.

The mechanics are simple but transformative: BTC locked in the bridge mints wrapped BTC on Hyper, enabling DeFi, gaming, NFTs, and payments at lightning-fast execution speeds, all without diluting Bitcoin’s hard monetary cap.

The HYPER token fuels this ecosystem as the gas currency for fees, dApp interactions, and governance, ensuring demand scales with adoption.

With Uptober and Moonvember looming, historically Bitcoin’s strongest stretch, the timing could not be sharper.

If traders view Bitcoin Hyper as the protocol that solves BTC’s looming security budget challenge, the upside extends far beyond seasonal rallies.

To secure allocation, visit the Bitcoin Hyper website, connect a wallet (SOL, ETH, USDT, USDC, BNB, or card), and lock in your stake in Bitcoin’s future.

VISIT HYPER HERE

The post Experts Panic Over Long-term Bitcoin Security: Smart Money Bid Future of Secure BTC appeared first on 99Bitcoins.

You May Also Like

Trump MAGA statue has strange crypto backstory

ABC Also Pulled Jimmy Kimmel’s Predecessor After Controversial Comments