Daily Market Update: Stock Futures Steady as Bitcoin Rally Stalls Near $70,000

TLDR

- Bitcoin’s rebound from the low-$60,000s has stalled near $70,000, with traders viewing it as a bear-market relief rally rather than a new uptrend

- The Crypto Fear and Greed Index hit 6 over the weekend, matching levels from the 2022 FTX downturn, before recovering to 14

- Trading volumes on major crypto exchanges have dropped roughly 30% since late 2025, with monthly spot volumes falling from $1 trillion to $700 billion

- Stock futures remained flat on Tuesday after the Dow hit another record above 50,000, while the S&P 500 nears its own all-time high

- Investors await key economic data this week including retail sales on Tuesday, the January jobs report on Wednesday, and the Consumer Price Index on Friday

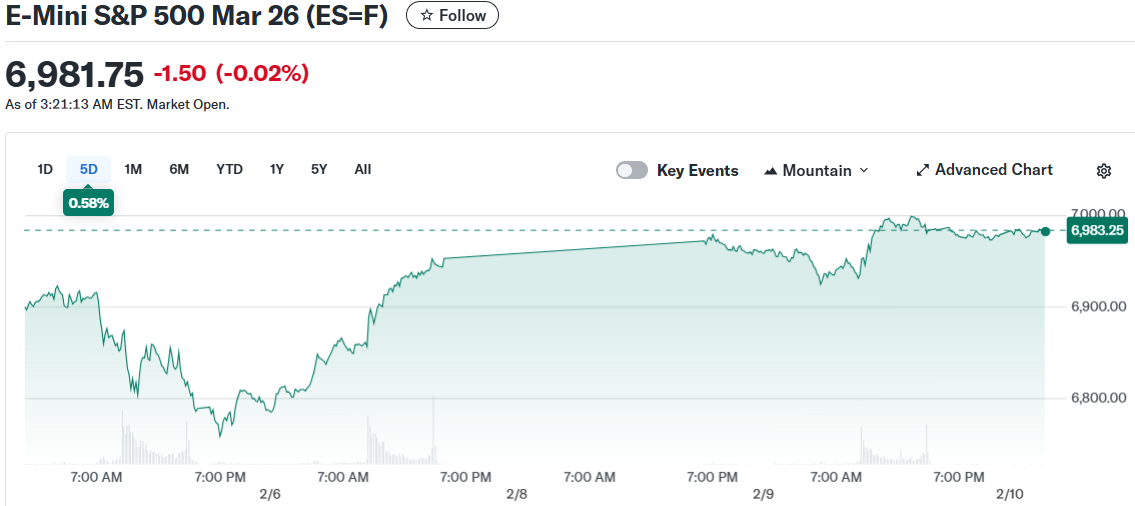

Stock futures held steady on Tuesday morning as Wall Street paused after the Dow Jones Industrial Average set another record above 50,000. Contracts on the Dow, S&P 500, and Nasdaq 100 traded near the baseline following Monday’s positive session.

E-Mini S&P 500 Mar 26 (ES=F)

E-Mini S&P 500 Mar 26 (ES=F)

The S&P 500 advanced roughly 0.5% on Monday and sits within striking distance of its own record high. The Nasdaq Composite outperformed with a 0.9% jump as technology shares led the rally.

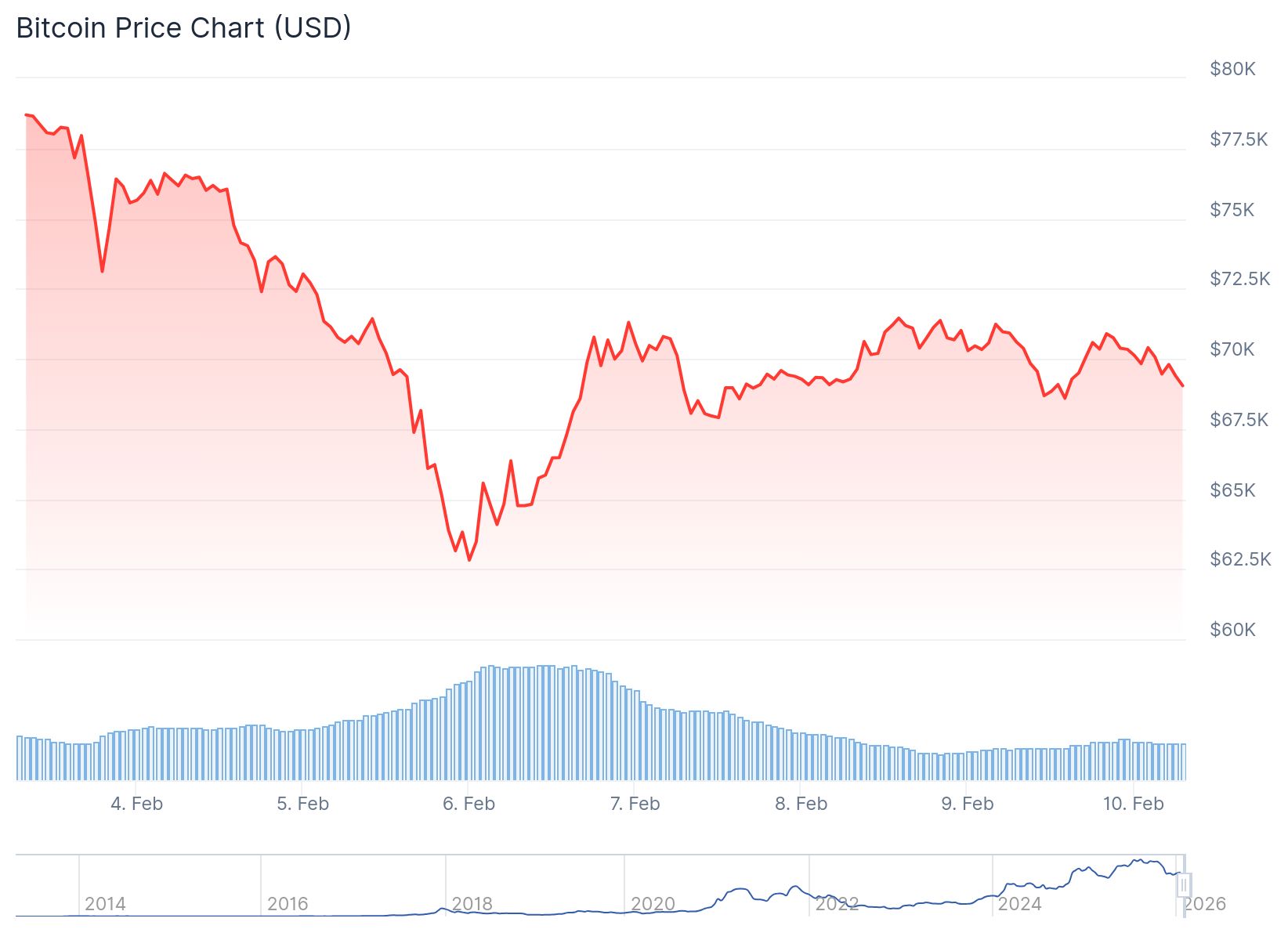

Bitcoin’s recent bounce has hit resistance around $70,000 after the cryptocurrency dropped into the low-$60,000s last week. Traders now view the rebound as a classic bear-market relief rally rather than the start of a sustainable uptrend.

Bitcoin (BTC) Price

Bitcoin (BTC) Price

The cryptocurrency briefly slid below $60,000 in a sharp selloff last week before snapping back toward $70,000 over the weekend. However, momentum has since faded as buyers met resistance from investors looking to exit at better prices.

FxPro chief market analyst Alex Kuptsikevich warned that heavy overhead supply could trigger another test of key support around the 200-week moving average and the $60,000 area. He noted the recovery momentum lost steam over the weekend after encountering selling pressure near the $2.4 trillion market cap level.

Sentiment Hits Multi-Year Lows

The Crypto Fear and Greed Index dropped to 6 over the weekend, reaching the same levels seen during the FTX-led downturn in 2022. The index has since recovered to 14 by late Monday but remains at levels Kuptsikevich called “too low for confident purchases.”

Trading data reveals a broad pullback in market participation. Aggregate trading volumes across major centralized exchanges have declined by roughly 30% since October and November, according to analytics firm Kaiko.

Monthly spot volumes have dropped from around $1 trillion to the $700 billion range. The firm said retail participation has been fading, with traders gradually leaving the market rather than being forced out all at once.

Thinner liquidity conditions mean modest sell pressure can produce outsized price moves. This dynamic triggers additional stop-outs and liquidations, creating a feedback loop that makes price action feel disorderly.

Bitcoin’s Halving Cycle Pattern

Kaiko framed the current pullback within the familiar four-year halving cycle pattern. Bitcoin peaked around $126,000 in late 2025 and early 2026 before retracing sharply.

Source; Kaiko

Source; Kaiko

The pullback into the $60,000 to $70,000 zone represents a roughly 50% drawdown from those highs. The firm noted that historically, these bottoms can take months to develop and often feature multiple failed rallies.

Bitcoin’s ability to hold the $60,000 area remains the key indicator for market direction. If buyers continue to defend this level, the market may settle into a choppy consolidation pattern.

If support fails, the same thin-liquidity dynamics that fueled the recent washout could return quickly. This risk increases if broader macro conditions remain unfavorable for risk assets.

Technology shares extended momentum from last week’s rebound on Monday. Investors appear to have regained some confidence after recent concerns around software and megacap tech stocks.

Earnings season continues with Coca-Cola reporting before Tuesday’s market open and Ford after the close. Investors are also waiting for fresh retail sales data due Tuesday morning.

The January jobs report arrives Wednesday and will be closely watched following last week’s reports showing softening in the labor market. The Consumer Price Index reading is due Friday to provide updated inflation data.

Gold and bitcoin both remain on investors’ radar as they attempt to stabilize after last week’s sharp pullback. One analyst described bitcoin’s recent volatility as a “crisis of confidence” for the cryptocurrency market.

The post Daily Market Update: Stock Futures Steady as Bitcoin Rally Stalls Near $70,000 appeared first on CoinCentral.

You May Also Like

USD Weakness Reveals Surprising Relief: Dollar’s Decline Lowers Global Risk Scores, Says DBS Analysis

White House bitcoin regulation debate intensifies with new crypto market structure meeting