WLFI Token Holds Steady Amid Regulatory Scrutiny and Market Volatility

- WLFI trading remains range-bound near $0.13 amid ongoing U.S. regulatory review.

- Broader crypto market trends and governance concerns continue to affect WLFI price movement.

World Liberty Financial’s native token WLFI is trading at approximately $0.107 as of the most recent market close, with modest intraday volatility between roughly $0.09812 and $0.1145. Data from CoinMarketCap shows WLFI’s market capitalization around $2.86 billion with 24‑hour trading volume exceeding $226 million, reflecting active trading despite broader market weakness.

The WLFI token has retraced substantially from its 2025 all‑time high near $0.46, down over 76% from peak levels, even as short‑term price action shows occasional upticks. Technical indicators signal mixed momentum, with short‑term resistance near $0.16 with the oversold conditions could prompt a near‑term rebound.

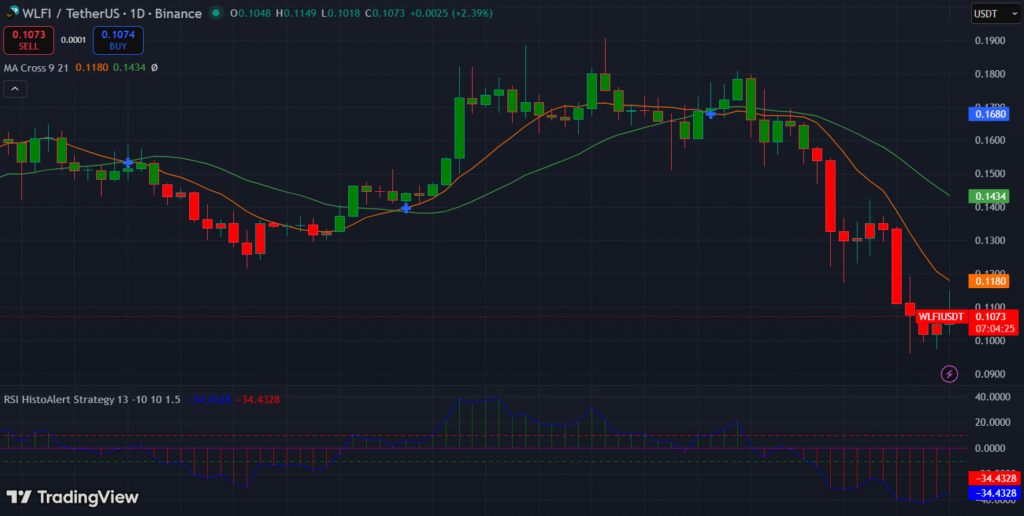

Technical indicators suggest WLFI remains in a consolidation phase. On the daily chart, the token continues to trade within a defined range, with support located near 0.098 and resistance forming around 0.115. Price action has tested both levels multiple times in recent sessions without producing a sustained breakout.

The 9-day moving average is positioned near 0.1180 and remains below the 21-day moving average around 0.1434, indicating a bearish short-term crossover. This configuration suggests that recent price momentum remains weaker than the broader short-term trend.

(Source: TradingView)

(Source: TradingView)

Meanwhile Momentum indicators remain neutral. The RSI is hovering around 34-40, staying close to the midpoint, indicates neither overbought nor oversold conditions.

A move above 0.114 with rising volume could signal short-term bullish momentum, while a sustained drop below 0.098 may open the door for further downside. Until either scenario materializes, technical signals suggest WLFI is likely to continue trading within its current range.

Regulatory and Market Factors Affect WLFI Trading Activity

U.S. House investigators have opened a formal probe into World Liberty Financial after reports that UAE investor acquired a substantial stake in the Trump‑linked crypto firm without timely public disclosure. Lawmakers cited concerns about foreign influence and governance transparency in the emerging digital asset sector.

The regulatory scrutiny coincides with wider market hesitation toward WLFI. The probe has weighed on WLFI price, contributing to recent losses in Trump‑linked crypto assets.

In broader market context, declines in major cryptocurrencies such as Bitcoin have also pressured altcoin markets. Bitcoin has fallen from record highs late in 2025 to below $70K, which has reduced risk appetite across the sector.

However, the World Liberty ecosystem continues to expand, having launched its USD1 stablecoin into crypto lending markets last year. After reaching $2.1 billion within a month of launch, the market cap of USD1 surged to approximately $5.2 billion by February 2026, making it a top-five stablecoin.

You May Also Like

Trading time: Tonight, the US GDP and the upcoming non-farm data will become the market focus. Institutions are bullish on BTC to $120,000 in the second quarter.