Token Unlocks This Week aren’t as Scary as $278M Suggests

Key Insights:

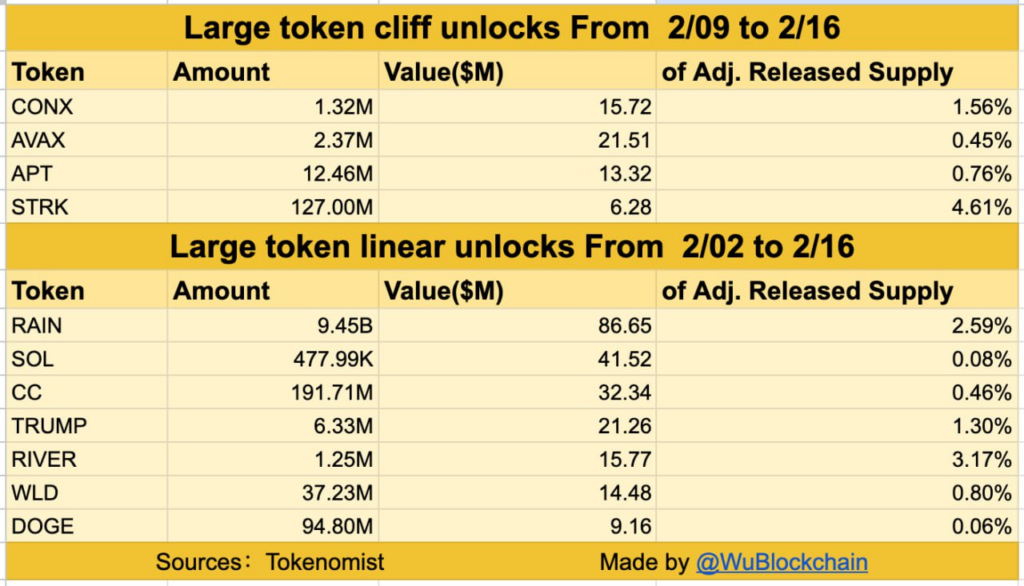

- Token unlocks totaling $278 million arrive this week, with $56.83 million in cliff unlocks and $221.18 million in linear releases spread over two weeks through Feb. 16.

- STRK faces the highest percentage impact at 4.61% but only $6.28 million absolute value, while Solana’s $41.52 million unlock represents just 0.08% dilution.

- Crypto community reaction remained measured with minimal social engagement. That shows traders view scheduled unlocks as routine events already priced into markets.

Token unlocks worth $278 million hit crypto markets this week. Wu Blockchain posted the data on Feb. 9. The chart showed cliff unlocks and linear unlocks scheduled through Feb. 16. Social media reactions stayed calm.

Traders see these events all the time now. The big dollar number doesn’t scare anyone anymore. Here is what the numbers actually mean

Cliff and Linear Token Unlocks to Surface

Token projects lock up coins when they launch. Teams, investors, and advisors can’t sell immediately. Lock periods last months or years. When the lock ends, tokens get released.

Two types exist. Cliff unlocks drop all tokens at once. Linear unlocks release small amounts every day or week.

Cliff unlocks create a sudden supply. If a project releases 10 million tokens on one day, sellers could flood the market. The price might drop fast if nobody wants to buy that much at once.

Linear unlocks spread the pain. Same 10 million tokens, but released over 30 days means 333,333 tokens per day. Markets absorb this more easily. Buyers and sellers match up gradually. Less shock to the system.

Token Unlocks | Source: X

Token Unlocks | Source: X

This week’s data shows $56.83 million in cliff unlocks and $221.18 million in linear releases. The linear number looks huge, but remember it spreads over two weeks. That’s roughly $15.8 million per day. Compare that to Bitcoin’s daily trading volume of several billion dollars. The supply addition barely registers.

Projects use long unlock schedules to prevent crashes. Nobody benefits if early investors dump everything and tank the price. Vesting periods force patience. Most tokens vest over 2 to 4 years, with small amounts releasing continuously.

These Unlocks Face Different Risks Based on Size

Starknet (STRK) shows the highest percentage impact this week at 4.61%. That sounds scary. But the actual dollar value only hits $6.28 million. Compare that to major tokens. Solana’s unlock reaches $41.52 million but only represents 0.08% of the supply.

Small percentage, big dollars. Or a big percentage, small dollars. Which matters more? Both matter, but in different ways. STRK’s 4.61% could move the price if the token has low liquidity. Buyers and sellers trade smaller volumes. A few million dollars of selling pressure makes a difference.

Solana’s $41.52 million unlock looks massive. But 0.08% of the supply is nothing. Solana trades hundreds of millions daily. The unlock gets absorbed without anyone noticing. Price might not move at all.

Rain (RAIN) shows the biggest absolute number at $86.65 million. But it’s a linear unlock over two weeks. That’s about $6.19 million per day. And it represents 2.59% of the supply. Moderate on both metrics. Markets handle this kind of release easily unless something else goes wrong with the project.

Traders watch these numbers to find opportunities. Big percentage unlocks on small projects create volatility. Some people short the token expecting dumps. Others buy the dip if they believe the project has strong fundamentals. The unlock itself just provides a known event to trade around.

This Week’s Token Unlocks Might Not Move Markets Much

Wu Blockchain’s post got 11,000 views but minimal engagement. That tells you something. If traders expected market volatility backed by these unlocks, they’d be talking about it more. Forums would fill with panic posts. Short interest would spike.

None of that happened. The crypto community sees unlock schedules as routine now. Tokenomist and other sites publish this data constantly. Everyone knows when big releases arrive. Prices often adjust weeks in advance.

Look at the tokens on the list. Solana, Avalanche, Dogecoin. These networks have been around for years. Their unlock schedules were public from day one. Nobody gets surprised anymore.

The exception might be newer projects with less history. STRK and RIVER show higher percentages. If their communities include weak holders who want to sell immediately, prices could dip short term. But even then, the dollar amounts stay small enough that one or two buyers could absorb everything.

Token unlocks used to create panic in 2021 and 2022. Markets were less mature. Information spread more slowly. Now every unlock gets tracked, analyzed, and priced in before it happens. This week’s $278 million looks big on paper. In practice, it’s just another scheduled event that traders already knew about months ago.

The post Token Unlocks This Week aren’t as Scary as $278M Suggests appeared first on The Coin Republic.

You May Also Like

Trading time: Tonight, the US GDP and the upcoming non-farm data will become the market focus. Institutions are bullish on BTC to $120,000 in the second quarter.