Bitcoin Miner Activity Hits Highest Level Since 2024. Could a Price Rebound Come Next?

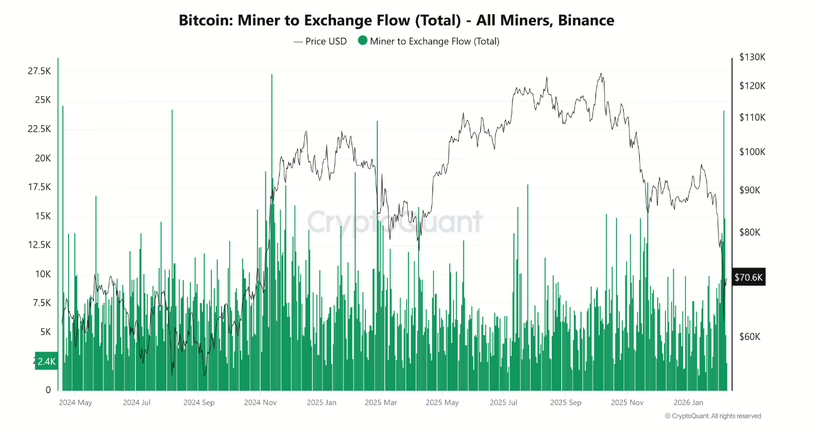

Bitcoin miners have sharply increased their on-chain activity since early February, raising questions about how the market may respond next. Exchange flow data shows large volumes of BTC moving from miner wallets, a trend that often appears during key transition phases.

The shift is reflected in exchange inflows. According to the on-chain analytics platform CryptoQuant, more than 90,000 BTC has been sent to Binance from miner-linked addresses within weeks. The surge includes a single day with over 24,000 BTC deposited, marking the highest level of such activity since 2024.

Source: CryptoQuant

Source: CryptoQuant

Miner Exchange Inflows Pick Up

When miners move bitcoin to exchanges, it usually signals a preparation to sell or balance sheet adjustments. These transfers are commonly linked to operational costs or decisions to lock in value after volatile price action.

In the current cycle, the timing of these inflows suggests miners may be reacting to recent price conditions rather than exiting the market entirely. Such behavior often reflects short-term liquidity needs rather than a long-term loss of confidence.

At the same time, this increase in miner transfers comes as broader market sentiment remains cautious and price swings persist. In this environment, additional supply can temporarily weigh on prices, especially if demand remains muted.

Still, historical patterns offer some perspective. Past market cycles show that heavy miner activity does not always lead to prolonged weakness. Similar phases have previously occurred during sideways movement or corrective periods that later stabilized.

Could a Price Rebound Come Next?

At writing, the apex cryptocurrency is bleeding, trading around $69,000, down about 3% in the past 24 hours. It’s over 45% below its all-time high of $126,000 recorded in October.

Once the current miner-driven supply is absorbed, BTC has historically shown signs of recovery as selling pressure fades. These periods can reset market positioning and create conditions for renewed momentum.

Meanwhile, sustained miner output indicates that the network continues to function efficiently. Consistent production suggests mining remains economically viable despite short-term uncertainty.

Looking ahead, attention is likely to remain on miner flows and exchange balances. Whether this phase leads to further consolidation or a rebound will depend on how quickly the market adjusts to the increased supply.

The post Bitcoin Miner Activity Hits Highest Level Since 2024. Could a Price Rebound Come Next? appeared first on CoinTab News.

You May Also Like

Grayscale’s Digital Large Cap Fund Now Open for Trading

Polymarket sues Massachusetts in growing state-federal fight over prediction markets