Hyperliquid Draws Scrutiny as Coinglass Exposes Inconsistencies in Perp DEX Volumes

- CoinGlass has called into question the authenticity of decentralized perps platforms, with Aster, Lighter and Hyperliquid data showing discrepancies.

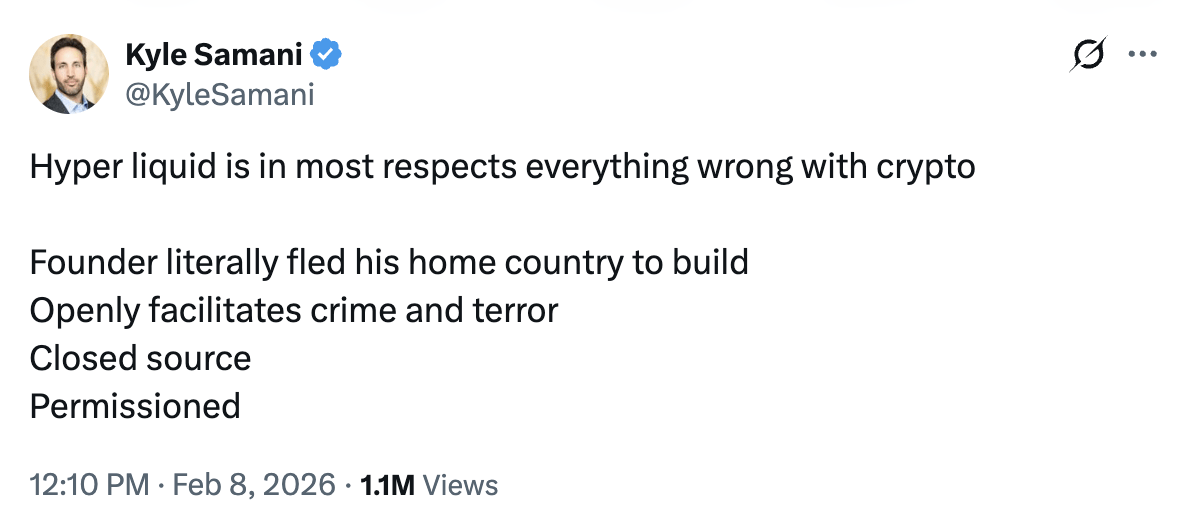

- Some, like Multicoin Capital founder Kyle Samani, used the data to attack Hyperliquid, calling it a facilitator of crime and terror.

Decentralized derivatives exchanges are once again on the spotlight, with data from CoinGlass calling into questions some of the figures reported by Hyperliquid, Aster and Lighter.

CoinGlass compared the three platforms on data recorded on Sunday, Feb 9. Hyperliquid reportedly posted $3.76 billion in trading volume, with a $4.05 billion open interest and $122.96 million in liquidations. Aster’s volume stood at $2.76 billion, but its open interest and liquidations hit $927 million and $7.2 million, respectively.

Lighter came in at third with $1.81 billion in volume, and open interest and liquidations at $731 million and $3.34 million, respectively.

As CoinGlass points out, in a perps trading environment with authentic activity that’s not manipulated, there should be “meaningful open interest dynamics and larger liquidation numbers.” During market moves, there must also be stronger long and short stress.

However, the data from the three shows that while trading volume is relatively close, Aster and Lighter’s liquidations are much lower than Hyperliquid’s at 1:17 and 1:37.

CoinGlass believes that this notable discrepancy stems from these two platforms’ outsized incentive-driven looping. This means that they have been offering incentives to some traders on their platforms, such as through points and airdrop farming.

It could also stem from market makers engaging in self trading and wash trading or the platforms could be inflating the volume by using a different methodology to report on their metrics. CoinGlass concluded:

The Hyperliquid and Aster Manipulation Debates

The CoinGlass data stirred mixed responses. Those who have been critical of the DEXes jumped on to use the data to double down on their criticism, while their communities were quick to defend the metrics and question’s CoinGlass’ motives.

One of the notable critics is Kyle Samani, the founder and former managing partner of Multicoin Capital, an investment fund that was an early backer of projects like Algorand, Dfinity, Kalshi, Lido, Solana and Worldcoin. He stepped down from Multicoin last week.

Samani took to X to describe Hyperliquid as “everything wrong with crypto.” He claims that the platform openly facilitates crime and terror and that a combination of a permissioned and closed-source platform, with a founder who fled the country, presents a level of risk traders should avoid. (It’s worth noting that Hyperliquid founder Jeff Yan grew up in California and is still a resident of the US).

Image courtesy of Kyle Samani on X.

Image courtesy of Kyle Samani on X.

Samani was immediately called out by many, with some describing his post as “Elizabeth Warren-style fearmongering.” Arthur Hayes, the founder and former CEO of BitMEX exchange even bet Samani that HYPE would outperform any token with over $1 billion in market cap; the wager was for $100,000, although Samani hasn’t accepted it at press time.

Aster also had its defenders. One user on X, who identifies as the DEX’s Spanish Discord moderator, dismissed the CoinGlass research as just speculation.

“Wow, I thought Coinglass was a reputable company…Taking these metrics from a single day, a Sunday, just to speculate on a possible explanation is truly malicious,” he posted.

It’s not the first time Hyperliquid has been caught up in such speculation. As we reported, IOTA founder Dominik Schiener had to come to the project’s defense in December after multiple claims of a lack of transparency.

]]>You May Also Like

Hadron Labs Launches Bitcoin Summer on Neutron, Offering 5–10% BTC Yield

South Korea Launches First Won-Backed Stablecoin KRW1 on Avalanche