VCI Global Launches $2.1B Bitcoin-Backed Sovereign Infrastructure Venture

VCI Global has unveiled a joint venture on August 19 valued at over $2.16 billion, backed by 18,000 Bitcoin BTC $113 075 24h volatility: 3.0% Market cap: $2.25 T Vol. 24h: $43.28 B , to create sovereign-grade infrastructure for digital assets.

The company will manage commercialization with a 70% stake, while its partner maintains custody of the Bitcoin reserves. Focus areas include tokenizing real-world assets, offering vault services, and linking encrypted systems with AI computing.

According to VCI Global’s announcement, the Bitcoin will be stored in QuantVault, a platform with hardware encryption and quantum-resilient features, addressing some growing concerns about quantum computing and cryptocurrency security. This setup aims to support governments and institutions with secure digital frameworks.

The initiative builds on VCI Global’s work in cybersecurity and AI, including recent launches like Qsecore and its V Gallant division for GPU hardware. Dato’ Victor Hoo, group executive chairman and CEO, indicated the partnership helps build secure, scalable digital asset systems aligned with regulations.

With Bitcoin’s market cap exceeding $2.25 trillion at the time of this writing, according to CoinMarketCap data, this positions VCI Global among Nasdaq-listed firms combining large Bitcoin holdings with advanced infrastructure.

VCI Global (NASDAQ:VCIG) Price Analysis

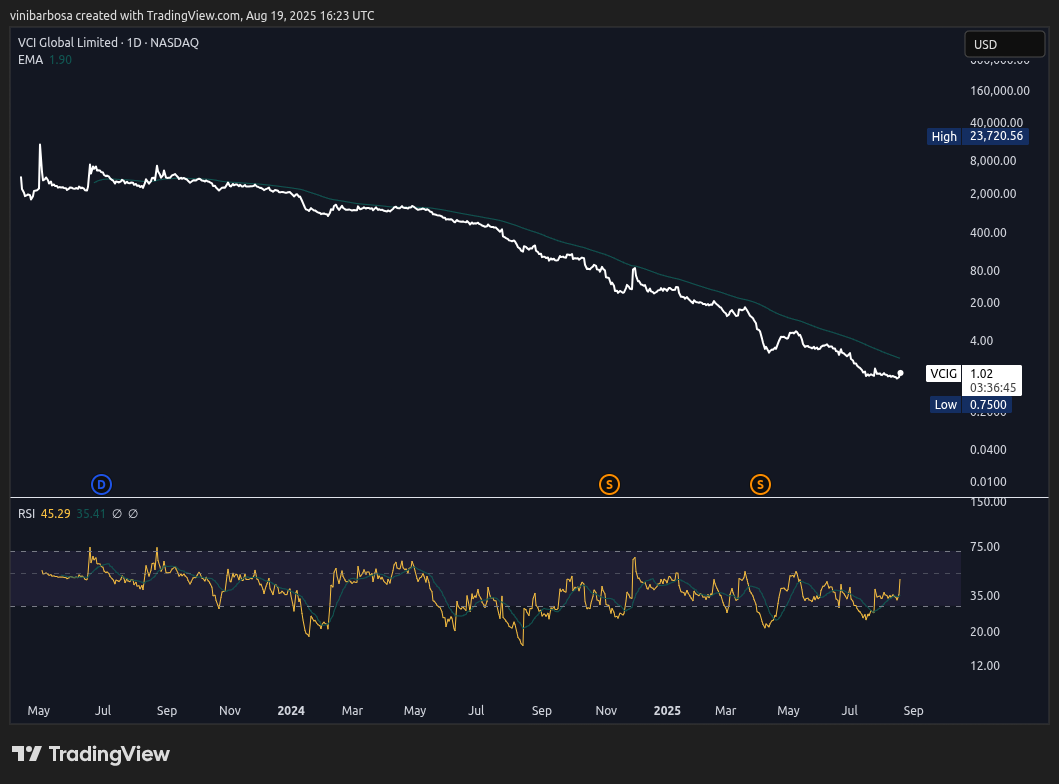

VCI Global (NASDAQ:VCIG) shares were trading at $1.02 by press time, up 17.6% intraday, following the announcement. However, VCIG has been struggling in price performance since its NASDAQ listing, accumulating 99.98% in losses from April 13, 2023, to its current valuation.

From a technical analysis perspective, the stock has been trading in a neutral-to-bearish momentum, according to the daily relative strength index (RSI), and its trend is consistently far below the 50-day exponential moving average (1D50EMA).

VCI Global (NASDAQ:VCIG) 1D historical price chart | Source: TradingView

Historically, companies like former MicroStrategy, now Strategy (NASDAQ:MSTR), have used a Bitcoin reserve strategy as a way to regain market interest and positive price action, betting on Bitcoin’s success against the dollar and other traditional assets.

On a similar note, BitMine went a step further, announcing an Ethereum-based treasury reserve, also seeing positive price action post-announcement. Brevan Howard, one of the world’s largest hedge funds, recently disclosed a significant allocation in BlackRock’s Bitcoin ETF (IBIT), accounting for 21% of the fund’s portfolio. This is another testimony to growing institutional interest in the leading cryptocurrency.

nextThe post VCI Global Launches $2.1B Bitcoin-Backed Sovereign Infrastructure Venture appeared first on Coinspeaker.

You May Also Like

CME Group to Launch Solana and XRP Futures Options

XCN Rallies 116% — Can Price Hold as New Holders Gain?