Tom Lee’s BitMine Becomes World’s Second-Largest Crypto Treasury Firm, Trailing Only Michael Saylor’s Strategy

Tom Lee’s BitMine has become the second-biggest crypto treasury company globally after Michael Saylor’s Strategy after it added 373,110 Ethereum tokens to its reserves over the past week.

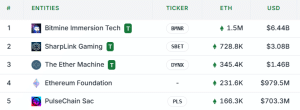

That series of buys has pushed the company’s total ETH holdings to 1,523,373 tokens valued at $6.44 billion at current prices, according to data from StrategicETHReserve.

BitMine now holds 1.26% of the total ETH supply, and has more than double the amount of ETH on its balance sheets compared to its nearest rival, SharpLink Gaming.

Top 5 biggest ETH treasury companies (Source: StrategicETHReserve)

SharpLink Gaming holds 728.8K ETH valued at $3.08 billion, while the third-biggest ETH treasury company is The Ether Machine with as stockpile of 345.4K ETH valued at $1.46 billion.

BitMine Now Only Behind Strategy In Crypto Holdings

BitMine shared an update on its ETH holdings via an Aug. 18 X thread to say its ETH holdings gained $1.7 billion in value in just over the past week.

At the time of the update, ETH’s price had pegged the overall value of BitMine’s ETH reserves at $6.6 billion. However, the largest altcoin by market cap retraced over 2% in the last 24 hours to trade at $4,225.03 as of 1:15 a.m. EST.

Nevertheless, BitMine still has more crypto on its books than the Bitcoin mining firm MARA Holdings in terms of dollar value.

Data from BiTBO shows MARA currently has 50,639 BTC on its balance sheets, valued at $5.84 billion at current prices.

Now, the only company that is ahead of BitMine in terms of crypto holdings is Strategy, the firm led by Bitcoin bull Saylor that pioneered the large-scale corporate crypto treasury strategy.

Strategy currently holds 629,376 BTC valued at $72.53 billion at current prices. That’s after Strategy announced it bought another 430 BTC for $51.4 million yesterday.

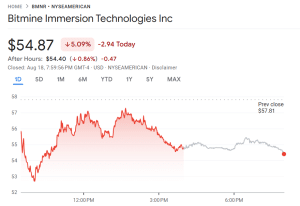

BitMine Stock Plummets 5%, Continues To Slide In After-Hours Trading

Despite the milestone, BitMine’s stock plunged over 5% in the past 24 hours, and continued to slide during the after-hours trading session, data from Google Finance shows.

BMNR share price (Source: Google Finance)

That was part of a longer-term negative trend that saw BMNR plunge 15% in the last week. The stock is still up more than 38% in the past month.

According to BitMine’s X thread, the stock price does not tell the full story.

BitMine currently ranks 10th among the 5,700 US-listed stocks, BitMine said. It also has around $6.4 billion in daily trading volume, which ranks it ahead of JPMorgan (JMP) and just above Alphabet (Google), it added.

Ethereum ETFs Suffer Second-Biggest Outflows Since Launch

BitMine’s continued accumulation of ETH has not been able to positively impact the altcoin leader’s price in recent days. This is likely due to the outflows from US spot Ethereum ETFs (exchange-traded funds) this week.

On Aug. 18, investors pulled $59.3 million out of the products, marking the end of a multi-day inflows streak, Farside investors data shows. It was also their second-biggest net daily outflows since launch last year.

On the day, $196.6 million was withdrawn from the funds. The only day the funds recorded more outflows was Aug. 4, when $465.1 million was pulled from the products.

BlackRock’s ETHA posted the largest outflows yesterday with $87.2 million exiting the fund’s reserves.

The next biggest outflows were posted by Fidelity’s FETH, which saw $78.4 million in outflows. Bitwise’s ETHW, VanEck’s ETHV, Franklin’s EZET and Grayscale’s ETHE saw net daily outflows of $0.9 million, $4.8 million, $6.6 million and $18.7 million, respectively.

You May Also Like

Botanix launches stBTC to deliver Bitcoin-native yield

PBOC sets USD/CNY reference rate at 6.9590 vs. 6.9570 previous