Why Would Cardano Holders Be Moving So Many Funds Into Rollblock And What Is It?

In 2025, investors are weighing up which top cryptocurrencies can deliver the best returns as the crypto bull run 2025 gathers pace. Cardano and Rollblock are both attracting attention, but Rollblock (RBLK) is the one building the kind of excitement that has early investors dreaming of 50x.

As big funds flow in, the big question is why so many Cardano holders are shifting their bets toward this new crypto coin.

Rollblock: The Window To Be Early Is Closing

Rollblock (RBLK) is a Web3 GambleFi platform where over 12,000 AI-powered games, from live poker and blackjack to sports prediction leagues, are hosted on blockchain rails for total transparency.

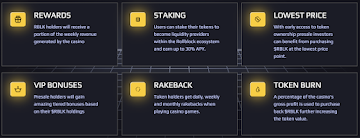

Analysts point out that the real draw for early investors is how Rollblock ties token ownership directly to platform revenue, offering a stake in one of the world’s largest industries.

Each bid and payout is secured on Ethereum, eliminating manipulation, while fiat payment options like Apple Pay and Mastercard make adoption seamless.

The platform has already paid out millions in rewards and is shaping up as one of the top crypto projects of 2025. A recent social post captured the spirit perfectly, presenting Rollblock not just as another game site but as a blockchain-powered luxury entertainment lounge.

With presale progress already over 82%, the window to be early is closing.

- Over $15 million in wagers placed across 12,000+ games

- RBLK holders earn weekly rewards through buyback and burn revenue sharing

- 30% of revenue used to repurchase tokens, 60% of those burned, the rest funding up to 30% APY staking

- Security backed by a SolidProof audit and fully licensed operations

Tokenomics And Presale Momentum

Rollblock’s tokenomics have struck a chord with serious investors. The project has a hard cap of just one billion tokens, making inflation impossible.

Every week, 30% of the platform’s revenue is used to buy back RBLK, with 60% of that permanently burned to reduce the supply and 40% distributed to stakers.

At $0.068 in stage 10 of its presale, over 82% of tokens are already sold, with more than $11.4 million raised.

With just 42 days until the presale closing date is announced, many are calling this the best crypto presale on the market. Freddie Finance even broke down the project’s mechanics in detail on YouTube, making it clear why some view it as the next 100x crypto: https://youtu.be/qztj3p8uy_c?si=U1TVQ94C6Anvi6Vp.

Cardano: A Blue-Chip Facing Fresh Competition

Cardano is priced at $0.9113 today. The coin is down 5.63% over the past 24 hours, reflecting strong selling pressure after yesterday’s highs, though a small recovery attempt remains visible at key support levels.

Analyst @anastamaverick noted: “ADA is currently trading at $0.9219, down 3.11% in the last 24 hours after hitting a high of $0.9878 and a low of $0.9134.”

This commentary mirrors today’s crypto chart, where volatility has created opportunities for patient traders. Cardano continues to attract crypto news with major headlines including increased institutional interest, new enterprise partnerships, and ongoing technical upgrades.

At the same time, EMURGO has paused its Genesis ADA delegation initiative to strengthen governance.

These updates show why Cardano remains one of the top altcoins, but with its market cap already over $32 billion, the upside is more limited compared to new altcoins to watch like Rollblock.

Side-By-Side Comparison

| Metric | Rollblock (RBLK) | Cardano (ADA) |

| Current Price | $0.068 | $0.9113 |

| Market Cap | Presale $11.4M | $32.53B |

| Max Supply | 1B | 45B |

| Revenue Share | 30% of revenue | None |

| Buyback And Burn | Yes, weekly | No |

| Upside Potential | 50x | Limited |

Final Takeaway: Where Big Gains Could Come From

The numbers show why funds are flowing. Cardano is one of the best long-term crypto bets, but its size makes it less explosive. Rollblock offers a rare mix of Web3 adoption, DeFi mechanics, and a live platform already scaling fast.

For investors hunting the next big crypto, Rollblock looks set to deliver the kind of gains that Cardano holders are now chasing.

Discover the Exciting Opportunities of the Rollblock (RBLK) Presale Today!

Website: https://presale.rollblock.io/

Socials: https://linktr.ee/rollblockcasino

Disclaimer: This is a paid post and should not be treated as news/advice. LiveBitcoinNews is not responsible for any loss or damage resulting from the content, products, or services referenced in this press release.

The post Why Would Cardano Holders Be Moving So Many Funds Into Rollblock And What Is It? appeared first on Live Bitcoin News.

You May Also Like

Is Putnam Global Technology A (PGTAX) a strong mutual fund pick right now?

The whale "pension-usdt.eth" has reduced its ETH long positions by 10,000 coins, and its futures account has made a profit of $4.18 million in the past day.