Google Searches for “Alt Season” Collapses, Implication for Ethereum Price

Earlier this month, excitement around “alt season” spread across the crypto space. However, Google Trends data now shows a sharp decline in U.S. searches, signaling fading hype and waning retail investor interest.

Is Alt Season Hype Fading?

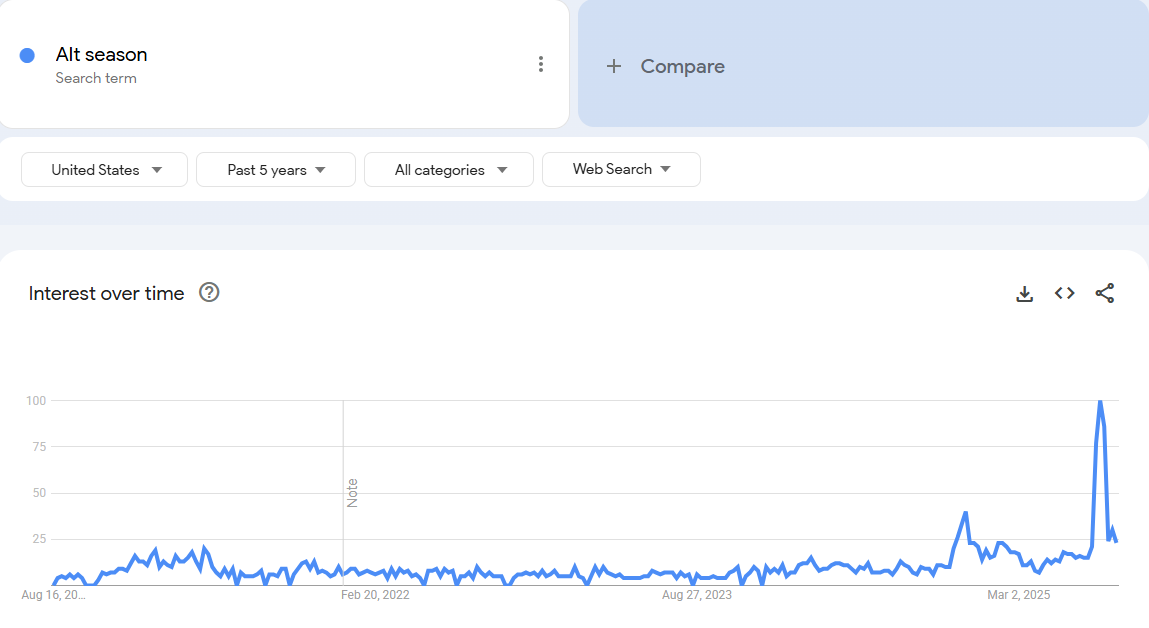

There has been a dramatic collapse in search interest for the term “alt season” in the United States as seen on Google Trends. This drop is striking, given that the term reached a peak score of 100 during July 20–26, 2025.

“Alt season” search trends in the United States. | Source: Google Trends

Alt season describes a period when altcoins, including ETH ETH $4 188 24h volatility: 3.1% Market cap: $506.35 B Vol. 24h: $35.25 B , outperform Bitcoin BTC $113 665 24h volatility: 1.6% Market cap: $2.26 T Vol. 24h: $40.08 B amid a broader shift in dominance.

In August, Ethereum reached a multi-year high of $4,788.55, just below its all-time high of $4,891. XRP XRP $2.95 24h volatility: 1.7% Market cap: $175.01 B Vol. 24h: $6.12 B also rose to $3.642 as the Ripple-SEC lawsuit concluded.

Altcoins like BNB BNB $831.0 24h volatility: 0.9% Market cap: $115.75 B Vol. 24h: $1.45 B bagged a new all-time high of $868.67 and have successfully managed to maintain their growth trend to date.

The positive momentum in the altcoin market proved unsustainable, as macroeconomic factors, such as uncertainty over interest rate cuts, weighed on investor confidence.

The rest of the month saw a sharp selloff in the altcoin market, with different coins giving up their earlier accrued gains.

What remains to be seen is whether or not the search trend will shift as Bitcoin’s dominance remains under a negative threat.

The Corporate Adoption Trigger

Market experts believe that a steady inflow of capital into the altcoin market could help coins break through key resistance levels.

As the closest alternative to Bitcoin, Ethereum has drawn the interest of institutional investors like Tom Lee’s BitMine and Joseph Lubin’s SharpLink Gaming.

With the ultimate plans to buy up to 5% of the total Ethereum stash in circulation, BitMine has retained the crown of the largest Ethereum treasury firm. It boasts of more than $6.6 billion in assets.

Other altcoins, including XRP, Litecoin LTC $113.8 24h volatility: 3.4% Market cap: $8.68 B Vol. 24h: $685.96 M , BNB, and Dogecoin DOGE $0.22 24h volatility: 3.4% Market cap: $32.39 B Vol. 24h: $2.69 B , are also seeing a promising flow of institutional capital.

With the BNC investment into BNB credited as a catalyst for the all-time high push, the projection is that ETH, XRP, and ADA ADA $0.90 24h volatility: 1.0% Market cap: $32.72 B Vol. 24h: $2.64 B will also hit similar milestones in the future.

Besides this treasury factor, the proposed approval of spot ETFs tied to these altcoins is also considered a major trigger for the incoming alt season.

nextThe post Google Searches for “Alt Season” Collapses, Implication for Ethereum Price appeared first on Coinspeaker.

You May Also Like

Is Doge Losing Steam As Traders Choose Pepeto For The Best Crypto Investment?

Fed Decides On Interest Rates Today—Here’s What To Watch For