Strategy Just Flipped Its Bitcoin Playbook—Here’s Why It Matters Now

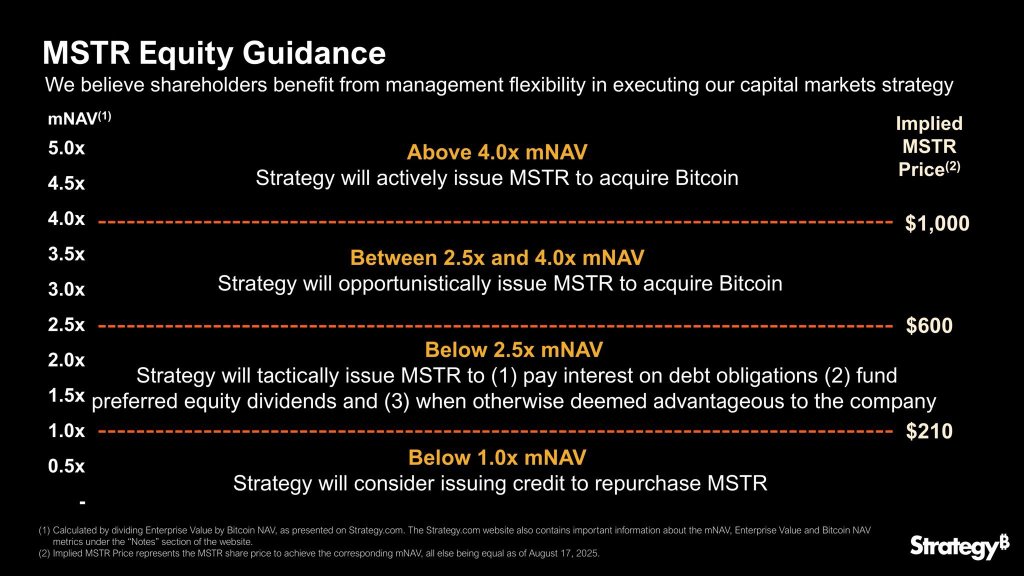

Strategy has redrawn the lines for when it will issue new MSTR shares, repurchase stock, or buy more Bitcoin—explicitly tying those decisions to its self-defined “mNAV” multiple and publishing price guardrails that anchor investor expectations. “Strategy today announced an update to its MSTR Equity ATM Guidance to provide greater flexibility in executing our capital markets strategy,” Michael Saylor wrote on X as he released a slide titled “MSTR Equity Guidance.”

The New Bitcoin Playbook By Saylor

The new framework segments actions by where the stock trades versus “mNAV,” which Strategy footnotes as the company’s enterprise value divided by its Bitcoin NAV. It also provides “implied MSTR price” signposts, stated as the share prices that would correspond to each mNAV band “all else being equal” as of August 17, 2025.

In the top band—“Above 4.0x mNAV”—Strategy says it “will actively issue MSTR to acquire Bitcoin,” with an implied MSTR level of roughly $1,000 for that threshold. In the middle band—“Between 2.5x and 4.0x mNAV”—it “will opportunistically issue MSTR to acquire Bitcoin,” pegging 2.5x mNAV to about $600 per share.

Below that—“Below 2.5x mNAV”—issuance turns “tactical,” directed first to “pay interest on debt obligations,” second to “fund preferred equity dividends,” and third “when otherwise deemed advantageous to the company.” At the bottom end—“Below 1.0x mNAV”—with an implied level near $210—Strategy says it “will consider issuing credit to repurchase MSTR.”

The language shift is subtle but consequential. Until now, Crypto Twitter widely believed Strategy would not sell new shares to buy more Bitcoin unless the stock traded at or above 2.5x mNAV. “CT is having a hard time figuring out what changed so I’ll make it easy for you,” wrote Udi Wertheimer.

“Up until yesterday: Strategy wasn’t going to sell more MSTR to buy more bitcoin until mNAV hit 2.5x. Starting today: Strategy can sell MSTR to buy more bitcoin.” That interpretation hinges on the added clause in the sub-2.5x bucket—“when otherwise deemed advantageous”—which gives management explicit discretion to issue equity even when the multiple is lower, after covering debt service and preferred dividends.

Reactions From X

Skeptics seized on the update to argue it lowers the bar for dilution. Founder of Kynikos Associates and MSTR short-seller James Chanos framed the change alongside a jab at recent purchasing cadence: “So not only did MSTR buy just $51M of Bitcoin, due to lack of demand for the preferred ATM’s, but it also looks like Saylor is lowering the 2.5x mNAV floor ‘when otherwise deemed advantageous’ to the Company.”

Supporters countered that the willingness to pivot is a hallmark of capable capital allocation. “One of the best signs of a confident and strong leadership team is seeing them pivot and update shareholders instantly when they see a better path for the business,” wrote Matt Cole, CEO of Strive.

The slide also clarifies how Strategy thinks about buybacks, stating that if MSTR trades below 1.0x mNAV it will “consider issuing credit to repurchase MSTR.” Read plainly, the policy draws a line between equity-funded Bitcoin accumulation when the stock commands a premium multiple, and leverage-funded buybacks when the market prices MSTR near or below its Bitcoin-derived baseline.

Speculation around the timing and purpose of the change rippled through trading circles, with one pseudonymous account, “Teddy Bitcoins,” asserting that Strategy intends to “hammer the ATM during the S&P inclusion,” claiming a goal to raise “$10–20 billion” to buy “100,000–200,000 bitcoin.”

When challenged—“During the inclusion?”—the account replied, “Correct,” and argued that waiting for inclusion to lift mNAV above 2.5x would have limited buying power once dilution pulled it back down. Others pushed back that an inclusion-driven rally might have put MSTR above the old 2.5x trigger in any case. None of those inclusion assertions are confirmed by the company yet.

The immediate takeaway is less about a single near-term trade and more about elasticity: Strategy has codified a wider decision bandwidth to raise equity for Bitcoin when it believes the terms are attractive, not just when a mechanical multiple threshold is met, while also sketching conditions under which it could swing to credit-funded repurchases.

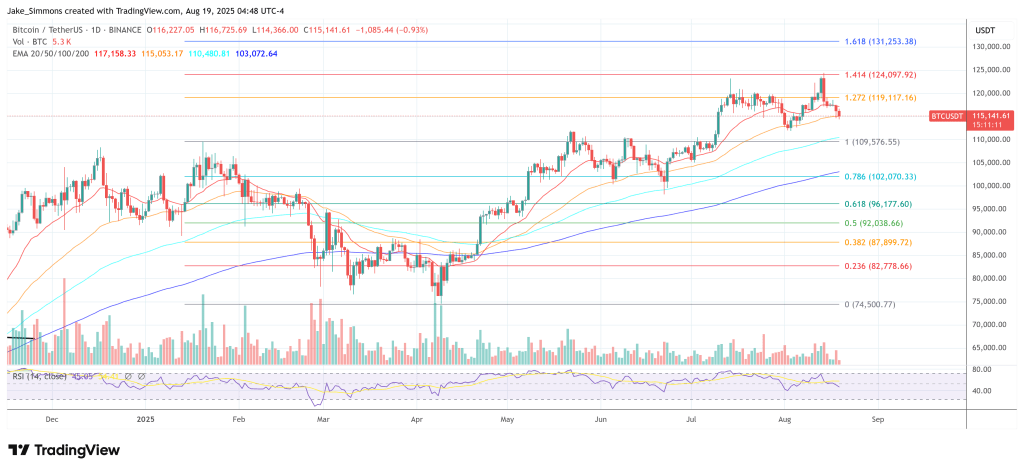

At press time, Bitcoin traded at $115,141.

You May Also Like

Is Putnam Global Technology A (PGTAX) a strong mutual fund pick right now?

The whale "pension-usdt.eth" has reduced its ETH long positions by 10,000 coins, and its futures account has made a profit of $4.18 million in the past day.