$6.6B in ETH? BitMine Quietly Becomes Ethereum’s Top Whale & Wall Street’s Crypto Titan

Key Takeaways:

- BitMine now holds 1.52 million ETH worth $6.6 billion, up $1.7B in just one week.

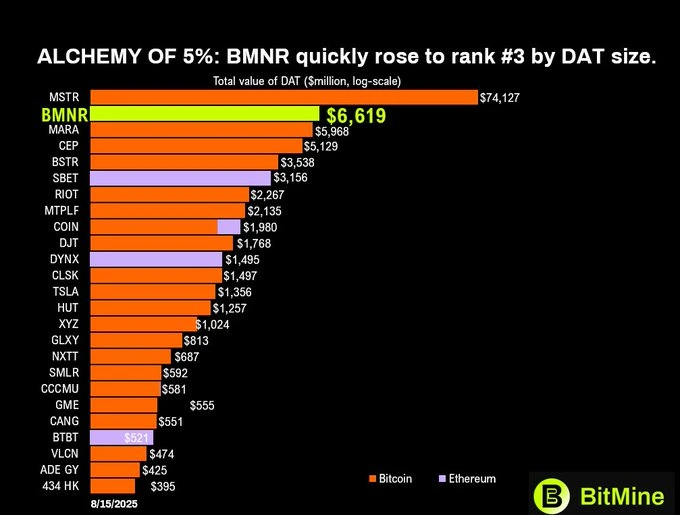

- Ranked as the world’s largest Ethereum treasury, BitMine trails only MicroStrategy in overall crypto holdings.

- Its stock ($BMNR) trades $6.4B daily, surpassing Alphabet and JPMorgan in liquidity.

BitMine Immersion Technologies ($BMNR) is making waves in both the crypto and equity markets. With its aggressive Ethereum accumulation strategy and Wall Street-caliber trading volume, BitMine is positioning itself as one of the most influential players in the digital asset ecosystem.

BitMine’s ETH Holdings Surge Past 1.5M Tokens

Second-Largest Crypto Treasury Globally

As of August 17, BitMine’s Ethereum holdings have reached 1,523,373 ETH, valued at $6.6 billion based on Bloomberg’s ETH spot price of $4,326. That’s a $1.7 billion increase from just a week ago, when the company reported 1.15 million ETH, worth $4.9 billion.

This surge positions BitMine as the largest Ethereum treasury in the world, and second only to MicroStrategy (MSTR) in total crypto assets held. MicroStrategy currently holds 628,946 BTC, worth approximately $74 billion.

The aggressive ETH buildup began on June 30, with BitMine closing its first wave of purchases by July 8. In just six weeks, the company has scaled up faster than most in the industry.

“As we continue to say, we are leading crypto treasury peers by both the velocity of raising crypto NAV per share and the high trading liquidity of our stock,” said Tom Lee, Chairman of BitMine and Managing Partner at Fundstrat.

Read More: BlackRock’s Bold $85M Ethereum Buy Hints at Crypto Confidence Surge Post-ETF Turnaround

BitMine Stock Outpaces JPMorgan and Google in Trading Volume

$BMNR Now a Top 10 Most Liquid U.S. Stock

BitMine isn’t just making moves on-chain. On Wall Street, $BMNR has become the 10th most actively traded stock in the U.S., with an average daily volume of $6.4 billion (as of August 8).

To put that in perspective:

- BitMine ranks above JPMorgan ($JPM), which holds the #27 spot.

- Surpasses Alphabet (Google) $GOOG in trading volume.

- Trails only behind blue-chip giants like UnitedHealth.

This level of liquidity makes $BMNR one of the most accessible crypto proxy investments on traditional equity markets. For institutions unable or unwilling to hold ETH directly, BitMine represents a compliant, high-volume Ethereum exposure play.

A Regulatory Backdrop with Historic Parallels

Tom Lee compared the current U.S. regulatory environment marked by the GENIUS Act and SEC’s Project Crypto to the 1971 collapse of the gold standard. That event catalyzed Wall Street’s rise, ushering in the modern era of global finance.

“This (GENIUS Act and SEC Project Crypto) is as transformational to financial services in 2025 as US action on August 15, 1971, ending Bretton Woods and the USD on the gold standard,” Lee stated.

According to him, Ethereum is now in a similar position to what gold-backed instruments were before the financial liberalization of the 1970s. But this time, the shift isn’t about paper replacing gold, it’s about code replacing institutions.

Read More: Ethereum Price Inches Toward $5K, Pi Gains 10% While Cold Wallet Presale Hits $6M in Record Time

Ethereum as the Core of the Future Financial System

BitMine is betting that Ethereum will be the foundation of tokenized money, AI-powered finance, and on-chain capital markets over the next 10–15 years.

Tom Lee emphasized that Ethereum’s programmable features are critical to the next stage of financial system modernization, particularly with the shift toward smart contracts, real-world asset tokenization, and AI-enabled trading platforms.

“Wall Street and AI moving onto the blockchain should lead to a greater transformation of today’s financial system. And the majority of this is taking place on Ethereum.”

The post $6.6B in ETH? BitMine Quietly Becomes Ethereum’s Top Whale & Wall Street’s Crypto Titan appeared first on CryptoNinjas.

You May Also Like

BlackRock Increases U.S. Stock Exposure Amid AI Surge

Why The Green Bay Packers Must Take The Cleveland Browns Seriously — As Hard As That Might Be