Dogecoin Price Eyes Reversal as RSI, Patterns Signal Momentum Shift

TLDR

- DOGE RSI hits deep oversold, signaling seller exhaustion.

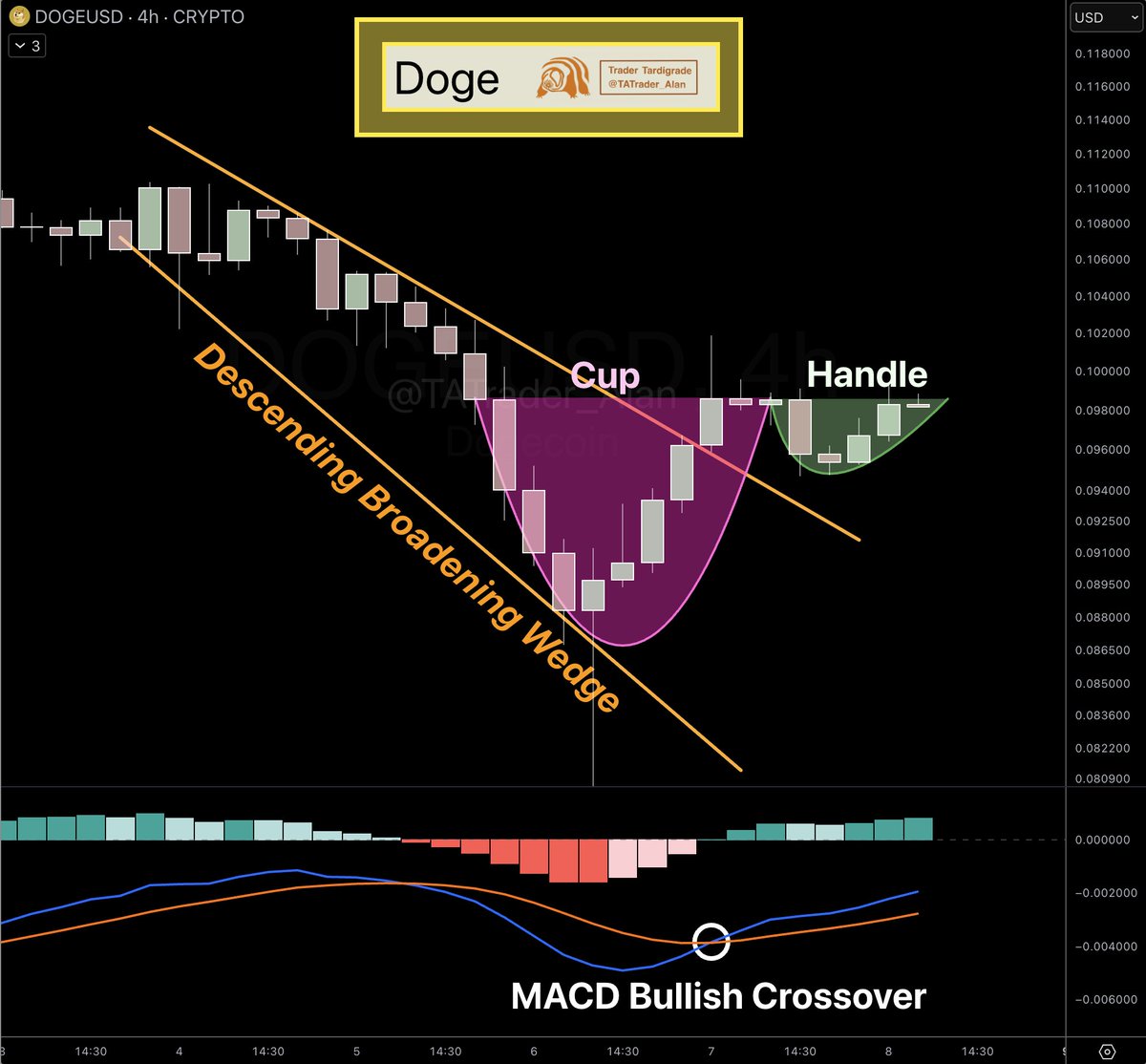

- 4H wedge breakout forms bullish cup-and-handle.

- MACD crossover supports short-term momentum shift

- Weekly 0.786 Fib near $0.08 anchors key demand zone.

Dogecoin(DOGE) price is approaching a technically sensitive area as multiple indicators suggest downside momentum may be fading. Analysts tracking RSI behavior, intraday reversal formations, and weekly Fibonacci support noted convergence around the $0.08–$0.10 range. This cluster of signals is shaping expectations for stabilization after an extended correction.

Dogecoin Price Hits RSI Extreme on Daily Chart

According to analyst Trader Tardigrade, the daily structure shows momentum cycles aligning closely with RSI peaks and troughs. Previous tops formed as RSI entered overbought territory, warning that buyers were exhausted. The subsequent decline validated the oscillator as an early signal of distribution.

Moreover, the move lower unfolded without bullish divergence. RSI continued printing lower highs while price trended downward in an orderly fashion. This behavior pointed to a full sentiment reset rather than a temporary pullback. Sellers maintained control throughout the descent.

Now the indicator sits in deeply oversold territory. Historically, similar readings have marked late-stage sell pressure for Dogecoin price. While not a guarantee of reversal, such extremes often precede consolidation or relief bounces. Momentum, therefore, appears stretched after months of decline.

Cup-and-Handle Pattern Emerges After Wedge Breakout

Meanwhile, the 4-hour chart presents a more constructive technical picture. Tardigrade highlighted that DOGE recently broke out from a descending broadening wedge. This pattern often resolves upward as volatility compresses and supply weakens.

Following the breakout, Dogecoin price carved a rounded base that evolved into a recognizable cup formation. The subsequent handle developed through tight consolidation with limited retracement. Such structures typically represent continuation pauses rather than renewed selling.

In addition, momentum indicators are beginning to confirm the shift. The MACD has delivered a bullish crossover, and histogram bars have turned positive. When improving momentum aligns with a cup-and-handle, traders often anticipate expansion. A move through handle resistance could attract increased participation.

Weekly Fibonacci Zone Anchors Market Structure

Furthermore, higher-timeframe analysis from analyst Surf emphasizes the importance of the 0.786 retracement near $0.08. This level derives from the prior macro advance and frequently acts as a final defense in corrections. Long-term participants often monitor such areas for evidence of absorption.

Price currently trades inside a broader demand band between $0.08 and $0.10. Historical interaction and volume clustering strengthen the region’s credibility. Repeated reactions here highlight its role across previous cycles. The market’s behavior within this band remains decisive.

According to Surf, consolidation inside the range suggests accumulation dynamics may be developing. Downside momentum has moderated as price compresses near support. If weekly closes continue to defend the retracement, the broader structure would remain intact. This context aligns with improving signals seen on lower timeframes.

The post Dogecoin Price Eyes Reversal as RSI, Patterns Signal Momentum Shift appeared first on CoinCentral.

You May Also Like

Shocking OpenVPP Partnership Claim Draws Urgent Scrutiny

Wintermute CEO Reveals Crucial Structural Shifts