Capture the PumpFun team wallet address from the 20-second video. Which tokens were traded?

Author: Leshka.eth , Crypto KOL

Compiled by: Felix, PANews

Crypto KOL Leshka.eth tweeted that it had detected the PumpFun team’s wallet and found that it was actively trading low-market-cap tokens and sending new coins to millions of people. The following are the details:

PumpFun shared an update about its trading terminal a month ago through a short 20-second video.

The video may not seem like anything special at first glance, but a closer look reveals their wallet addresses hidden within.

The video is recorded in real time directly on the trading terminal, which means that all the coins shown are real. Based on this, it becomes relatively easy to track their transactions and connect with the entire wallet network.

How do you know the video is recorded in real time? The video was posted on November 14 at 22:25 (UTC time).

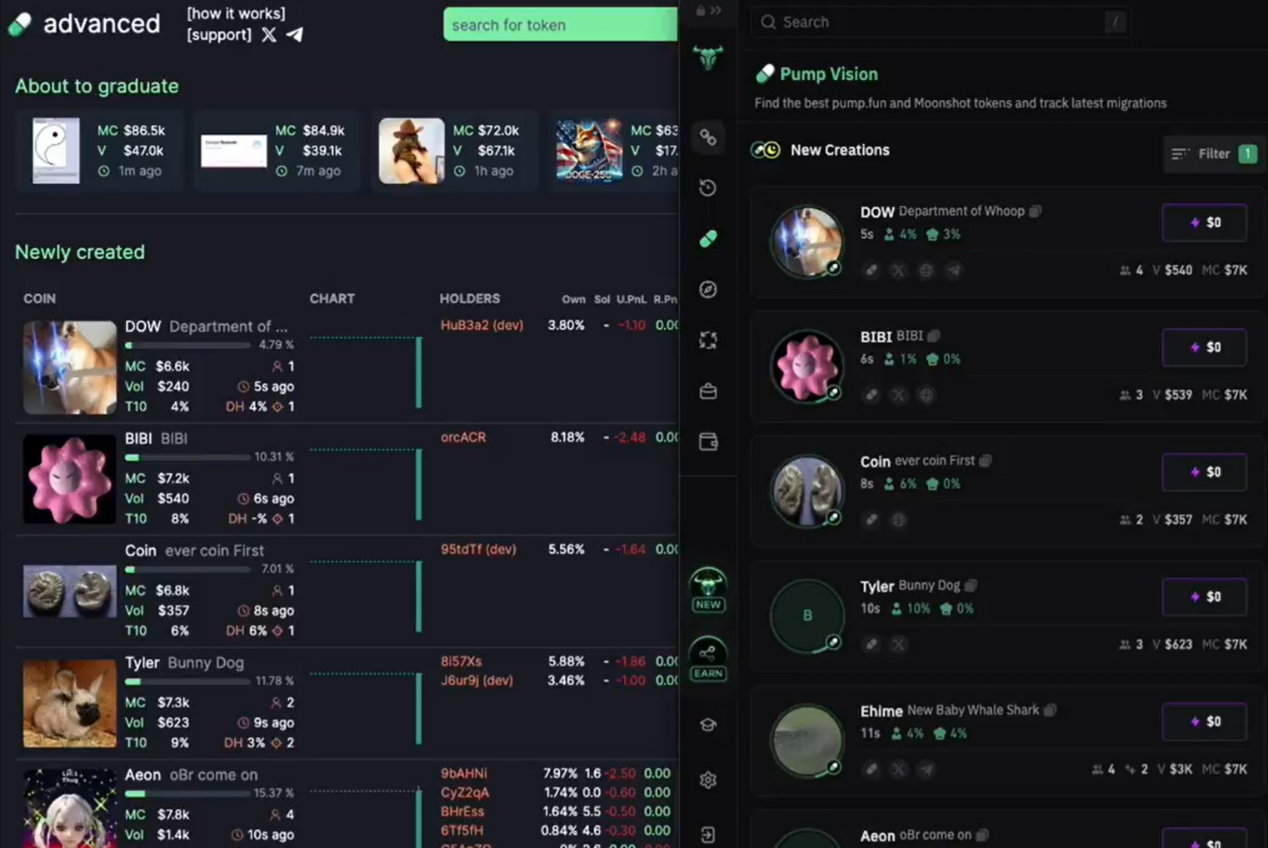

Key observation: At 0:03 in the “Pump Vision” section:

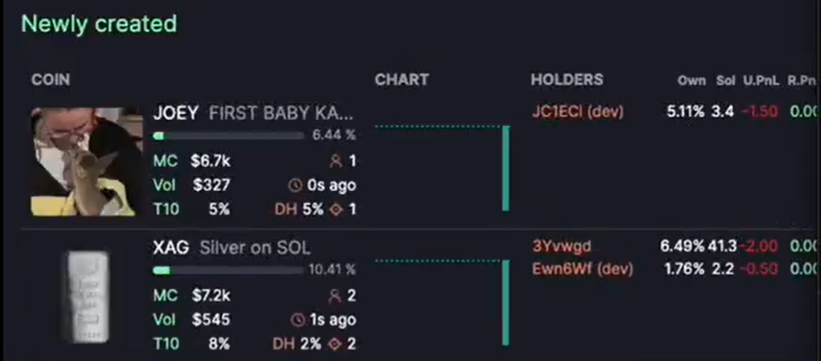

Tokens such as $XAG and $JOEY were deployed on November 13 at 17:41 (UTC) with a market capitalization of approximately $7,000.

The other tokens in the video are also deployed at the same time.

Since all the tokens in the video match data from November 13, it can be confirmed that the video was recorded on that day, which was one day before it was released.

The transaction details in the video are as follows:

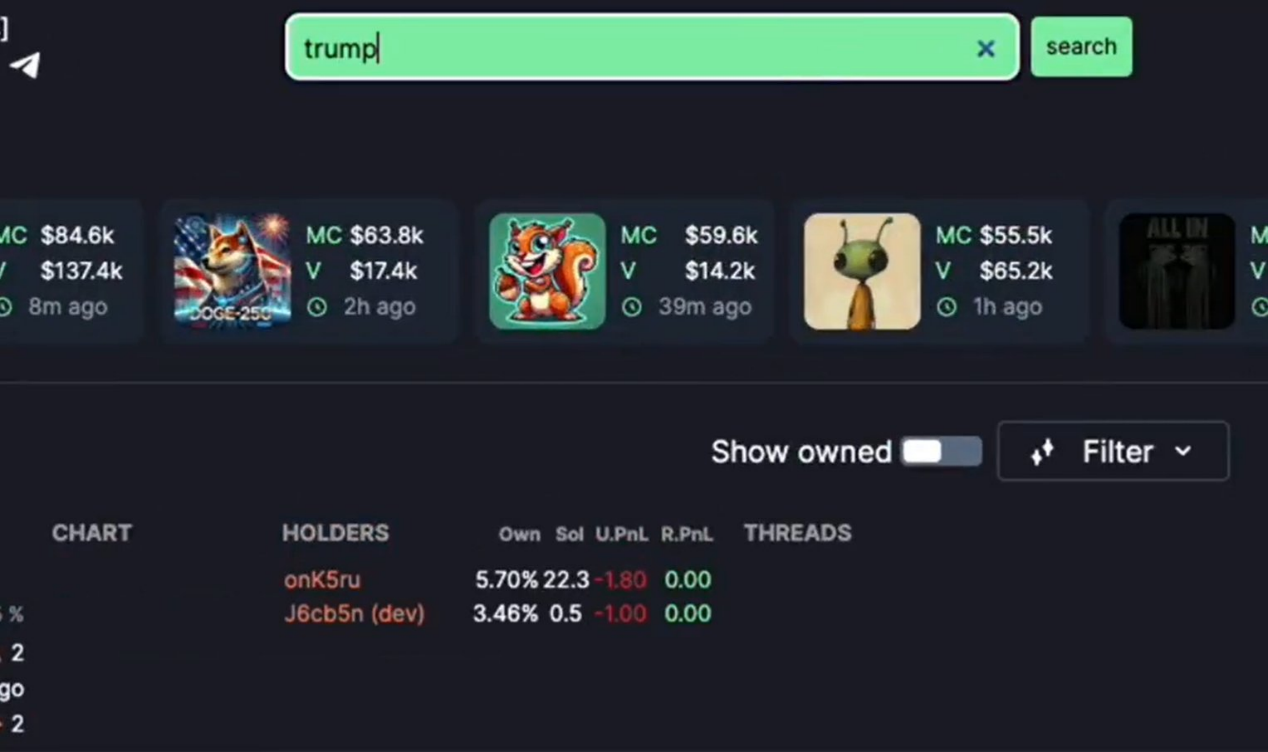

- 0:11 - 0:15: Use 0.01 SOL to buy a token with "Trump" in its name

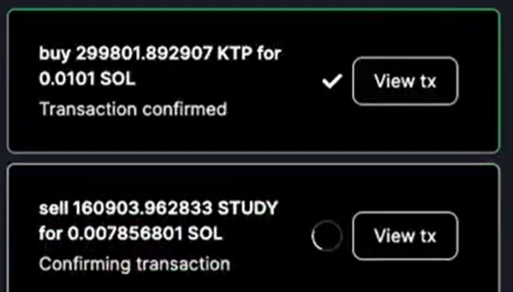

- 0:19 - 0:20: Confirmed transaction of 299,801 $KTP, verified as “Trump” token

- 0:20 - 0:21: Sold 160903 STUDY tokens, valued at 0.00785 SOL

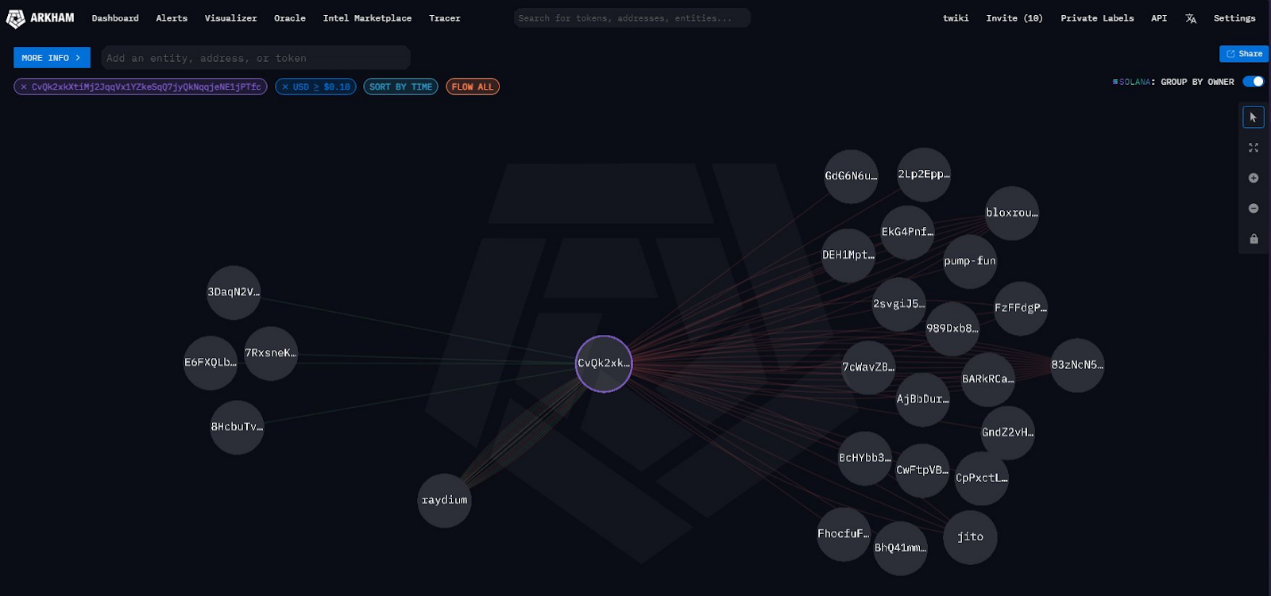

From the transaction on November 13, the wallet used was CvQk2xkXtiMj2JqqVx1YZkeSqQ7jyQkNqqjeNE1jPTfc

Supported transactions:

299,801 $KTP Buy Transaction: http://solscan.io/tx/3ozg1M4GK2GKQTVrcR3JBUM1a2faNarJXcge1ijdjmmPPzV2JiGoLCzn41hx2nn5ipLjvsoEDYHUp3Fm46KddsAQ

160,903 $STUDY Sell Transaction: http://solscan.io/tx/4qSjQ4qXiAS7Ad1HUhP9JgtxhHWdGYXA8Eh3jiqRBDrBWf75Z5a2CNGjJ3Eqx2yVrTGhPHmbMway5ff5pG5ZdRUf

These activities confirm that CvQk2xkXtiMj2JqqVx1YZkeSqQ7jyQkNqqjeNE1jPTfc is the wallet linked to the transaction.

The wallet shown in the video has very little transaction activity, but this is not the main point, the key is to find out the main wallet they are involved in the transaction. It turns out that this wallet is associated with multiple wallets holding more than $1 million in meme coins.

831qmkeGhfL8YpcXuhrug6nHj1YdK3aXMDQUCo85Auh1

- Profit and Loss (PnL): $650,000

- Total tokens traded: 538

- Hot deals: $supercycle, $Motion

J2Q2j6kpSg7tq8JzueCHNTQNcyNnQkvr85RhsFnYZWeG

- Profit and Loss (PnL): $1.3 million

- Total tokens traded: 4

- Hot Trade: $RETARDIO

7RxsneKY83QNMHZAM3QrfMo4knFrDCzmbhwrFMotQkdD

This is the address used to fund the test wallet. Only a few transactions so far, but will keep an eye on it in case they link another wallet and start buying memes from there.

Related reading: Comparative analysis of the differences between MEME launch platforms Clanker and Pump.fun?

You May Also Like

Solana Price Prediction 2026: Mercado Bitcoin Research Says BTC Bottom Is Near as Pepeto Offers What DOGE SHIB and PEPE Never Could

Top 2 Cryptos That Will Create the Most Millionaires in 2025