Bitcoin Fear and Greed Index Plummets to 6-Year Low: Is The Worst Over?

The past few weeks have been brutal for BTC and the rest of the market. The largest digital asset plummeted by roughly $30,000 in less than ten days, and bottomed out (at least for now) on Friday morning with a drop to $60,000.

Given this calamity, it’s almost expected that the overall investor sentiment has plunged just as badly. In fact, it has reached multi-year lows.

Fear Continues to Dominate

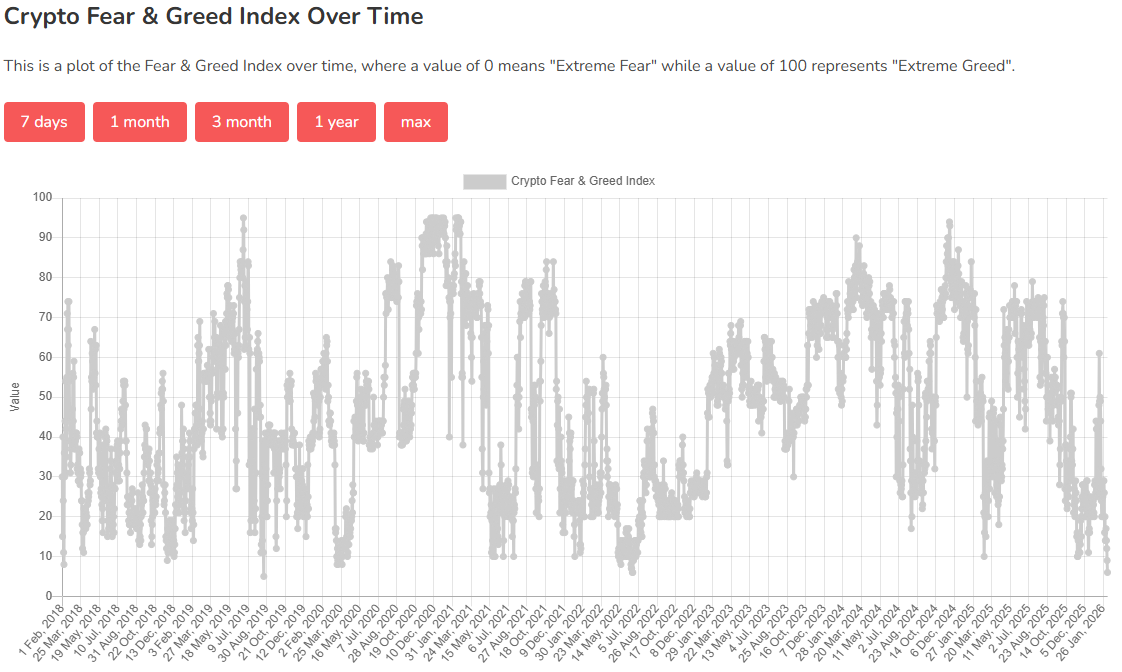

Since the cryptocurrency markets (as well as most other financial fields) can be highly emotional, the Fear and Greed Index was created to demonstrate the rapid changes. Market momentum and overall volatility are responsible for half of the index’s final result, which ranges from extreme fear (0) to extreme greed (100).

As such, it’s no wonder that it has been mostly downhill lately. Bitcoin’s price peaked at over $95,000 in mid-January, and stood above $90,000 just over ten days ago – on January 28. However, what happened next was difficult (if not impossible) to predict, as the asset plunged by $30,000 in days to its lowest price levels in well over a year.

Although it rebounded to $69,000 as of press time, this hasn’t been sufficient to move the needle on the Index. The metric has consistently declined lately and tanked to 6, its lowest level since August 2019.

Bitcoin Fear and Greed Index. Source: Alternative.me

Bitcoin Fear and Greed Index. Source: Alternative.me

Is a Rebound Next?

As Warren Buffett has said in the past, investors should be fearful when others are greedy and vice versa. As such, they should be greedy now, right? Previous instances of sharp increases or declines in the metric have led to immediate trend reversals, which could finally bring some hope for the bulls.

However, if we go back to the developments back in 2019, history does not exactly support this narrative. At the time, BTC had actually begun to recover from its late 2018/early 2019 bear market and traded 2-3x higher than the $3,500 bottom. Nevertheless, it couldn’t penetrate the $10,000 barrier and failed to do so for months.

Then came 2020 and a major black swan event (the COVID-19 crash), and BTC dumped further before it finally went on the offensive. It took the cryptocurrency over a year to break beyond $10,000. But the good news is that it never looked back and has never traded within a four-digit price territory since then.

The moral of the story now is that yes, extreme fear dominates the markets, which is typically followed by a sharp trend reversal. However, the current market environment is quite uncertain given the rising geopolitical tension, internal issues, market instability, different asset classes exploding, and so on.

The post Bitcoin Fear and Greed Index Plummets to 6-Year Low: Is The Worst Over? appeared first on CryptoPotato.

You May Also Like

UK and US Seal $42 Billion Tech Pact Driving AI and Energy Future

SEC approves new listing standards paving way for crypto ETFs on Nasdaq, Cboe, and NYSE