Bitcoin Cycle Still Alive: Why “This Time Is Different” May Be Wrong Says Top Analyst

TLDR

- Bitcoin’s four-year cycle pattern continues to follow historical trends

- Current market conditions mirror past post-halving consolidation periods

- Long sideways price movements are normal before major rallies begin

- Institutional involvement hasn’t changed underlying cycle psychology

- Higher lows continue forming despite flat short-term price action

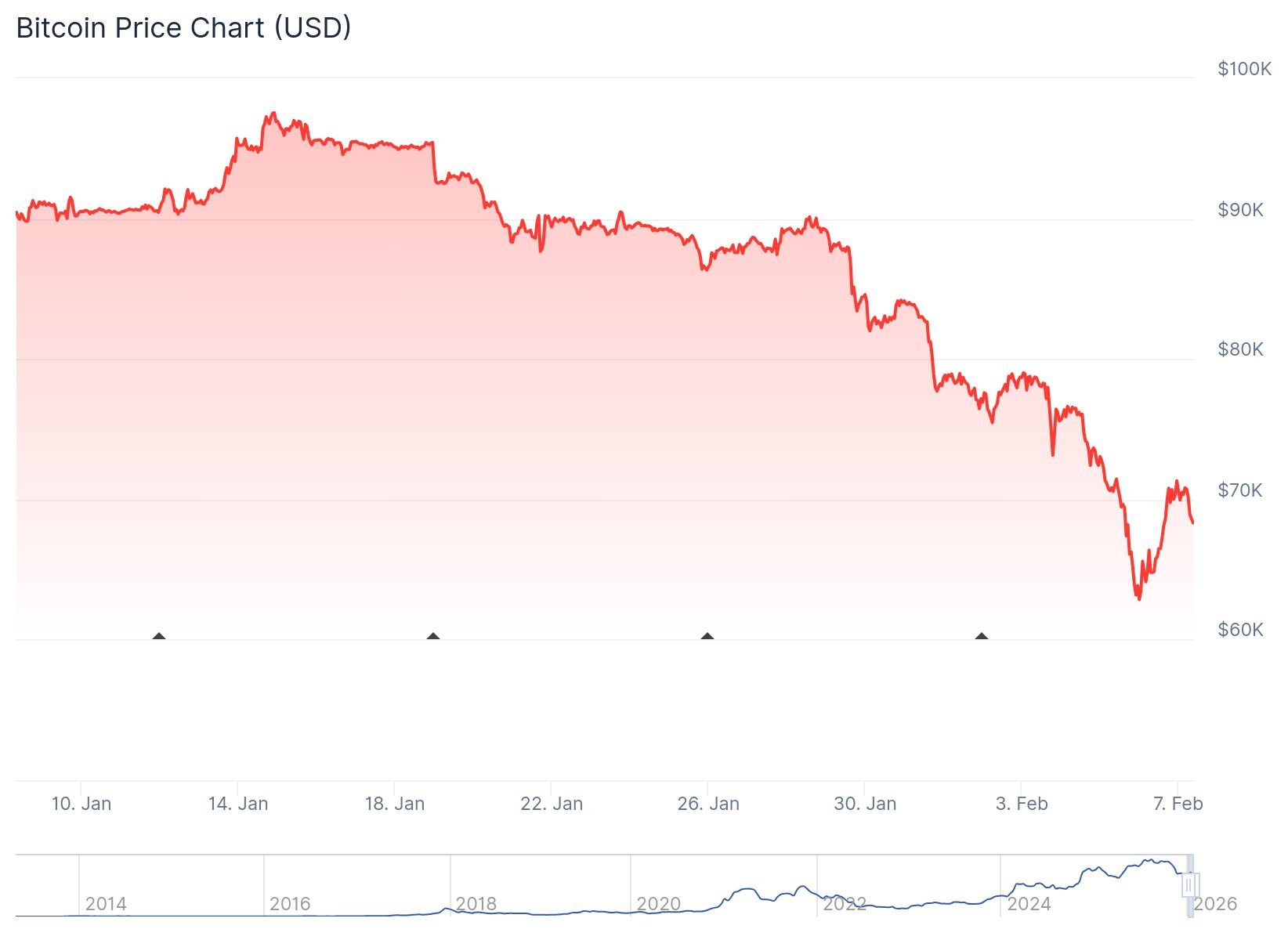

Bitcoin continues to move through its established four-year cycle pattern. Despite growing voices claiming the cryptocurrency has outgrown its historical behavior, market data shows otherwise.

The current market phase mirrors previous post-halving periods. Each cycle has included extended periods of sideways price movement before major rallies began. This pattern has repeated multiple times over Bitcoin’s history.

Market participants often struggle during consolidation phases. When prices stall and momentum fades, many investors lose confidence in the cycle framework. However, past data shows these quiet periods typically preceded explosive price moves.

The “this time is different” narrative appears in every cycle. Doubters point to new market conditions or changed circumstances as reasons why historical patterns won’t repeat. Yet the same forces that drove earlier cycles remain in play.

Timing and Market Structure

Bitcoin’s strongest rallies have occurred well after halving events. The lag time between halvings and price surges creates impatience among traders. This waiting period shakes out investors who expected immediate results.

Bitcoin (BTC) Price

Bitcoin (BTC) Price

Long-term trend indicators continue showing higher lows forming over time. While daily or weekly price action may disappoint, the broader structure remains intact. This divergence between sentiment and structure has appeared in previous cycles.

Institutional participation has changed some market mechanics. Bitcoin ETFs and larger players have entered the space in recent years. However, these changes haven’t eliminated human psychology from trading decisions.

Fear and greed still dominate market behavior. Impatience during consolidation phases remains common regardless of who holds the assets. These emotional forces continue shaping cycle patterns as they did in earlier years.

Consolidation and Volatility

Price ranges have tightened during the current phase. As volatility compresses, attention naturally drifts away from Bitcoin. Past cycles show these quiet periods often ended abruptly.

Both bullish and bearish traders have been caught off guard by sudden moves. Compressed ranges historically preceded breakouts in either direction. The current consolidation fits this historical template.

Market expectations often anchor to recent price action. When Bitcoin fails to move higher quickly, bearish narratives gain traction. This sentiment shift has occurred during every major cycle’s consolidation phase.

The video presentation focused on probability rather than specific predictions. Cycles don’t repeat exactly but tend to rhyme. Understanding historical context provides more value than reacting to short-term uncertainty.

Bitcoin’s current behavior doesn’t require new explanations. The same cycle dynamics from previous years continue playing out today.

The post Bitcoin Cycle Still Alive: Why “This Time Is Different” May Be Wrong Says Top Analyst appeared first on CoinCentral.

You May Also Like

CME Group to Launch Solana and XRP Futures Options

Microsoft Corp. $MSFT blue box area offers a buying opportunity