Will Bitcoin Break a 15 Year Pattern for the First Time Ever?

The post Will Bitcoin Break a 15 Year Pattern for the First Time Ever? appeared first on Coinpedia Fintech News

The global market crash has hit the crypto market hard, wiping out $184 billion in value and pushing the total market cap down to $2.43 trillion. Bitcoin is now trading around $71,470, just $2,000 above its key 2021 all-time high of $69,000.

Meanwhile, traders fear that if Bitcoin breaks its 15-year pattern, the market could face further downside.

Bhutan Selling BTC Led The Drop

One of the reasons behind this bitcoin price drop is selling from wallets linked to Bhutan’s Royal Government. During this market dip, Bhutan sold more than $22 million worth of Bitcoin, transferring over 284 BTC to institutional market maker QCP Capital.

Data shows that Bhutan has been selling Bitcoin in batches of nearly $50 million over the past few months.

Meanwhile, experts believe this selling is mainly due to rising mining costs after the latest Bitcoin halving, which has reduced profits for sovereign and state-linked miners.

Coinbase Premium Turns Deeply Negative

Another key signal comes from the Coinbase Premium Gap. This metric compares Bitcoin prices on Coinbase versus Binance. It has now turned deeply negative, the lowest level this year, indicating strong selling from institutional traders

This institutional selling has been clearly visible in Bitcoin ETFs for the past three weeks.

On February 4, 2026, alone, U.S. spot Bitcoin ETFs saw about $545 million in net outflows, with BlackRock’s IBIT losing roughly $373 million.

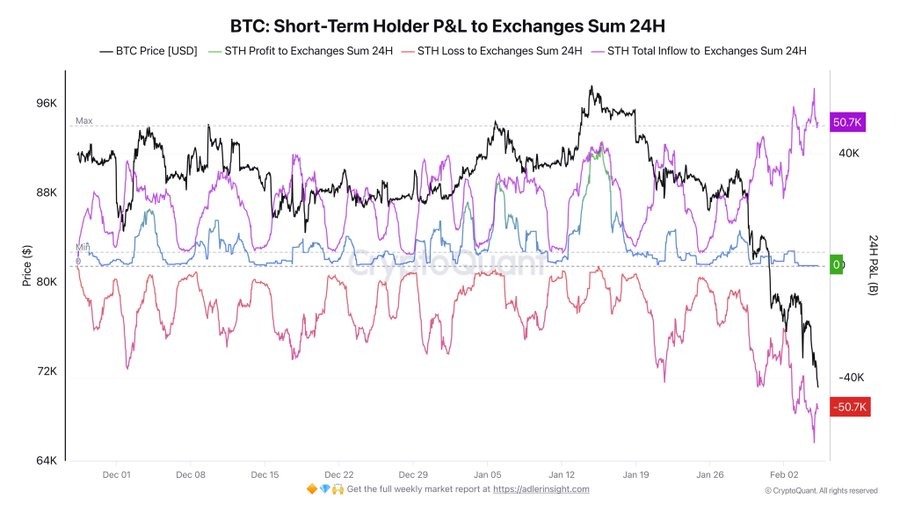

CryptoQuant Data Show STH Selling BTC In Losses

CryptoQuant data shows that short-term holders (STH) are panicking as Bitcoin continues to fall. In the last 24 hours, these holders have sent nearly 60,000 BTC to exchanges, marking the highest single-day inflow seen this year.

Most of these coins were moved at a loss, meaning recent buyers are exiting under pressure.

At the same time, long-term holders are mostly inactive, with very little profit-taking from older wallets. This pattern usually appears during strong and heavy market corrections.

Will Bitcoin Break Its 15 Year Pattern?

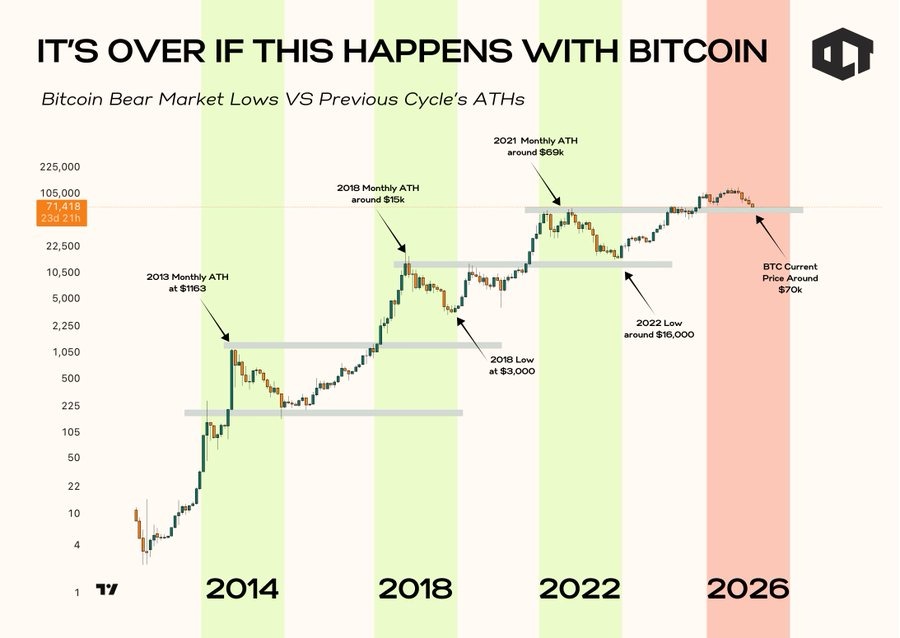

As of now, Bitcoin is testing a very important historical price level. It is now just $2K away from hitting the previous ATH of $69,000 from the last cycle in 2021.

For 15 years, Bitcoin has followed one strong pattern, it has never stayed below the previous cycle’s all-time high. In every cycle, old highs turned into long-term support. This rule held in 2014, 2018, and even during the 2022 crash.

Now the market is testing that rule again. If Bitcoin drops and stays below $69,000, it would be the first time this historic pattern breaks. That could signal a major change in market structure and open the door for a deeper fall toward the $62,442 level.

But if Bitcoin holds above $70,000, the long-term bullish trend remains intact. This level is now the key line between strength and fear.

You May Also Like

‘Big Short’ Michael Burry flags key levels on the Bitcoin chart

Solana Price Prediction: SOL Tipped for 3x Boom While Little Pepe (LILPEPE) Gains 100x Speculation