Bhutan moves $22M in Bitcoin as Arkham flags patterned BTC sales

Bhutan-linked wallets controlled by Druk Holding & Investments (DHI) moved more than 284 bitcoin worth roughly $22 million over the past week, according to on-chain data from Arkham Intelligence.

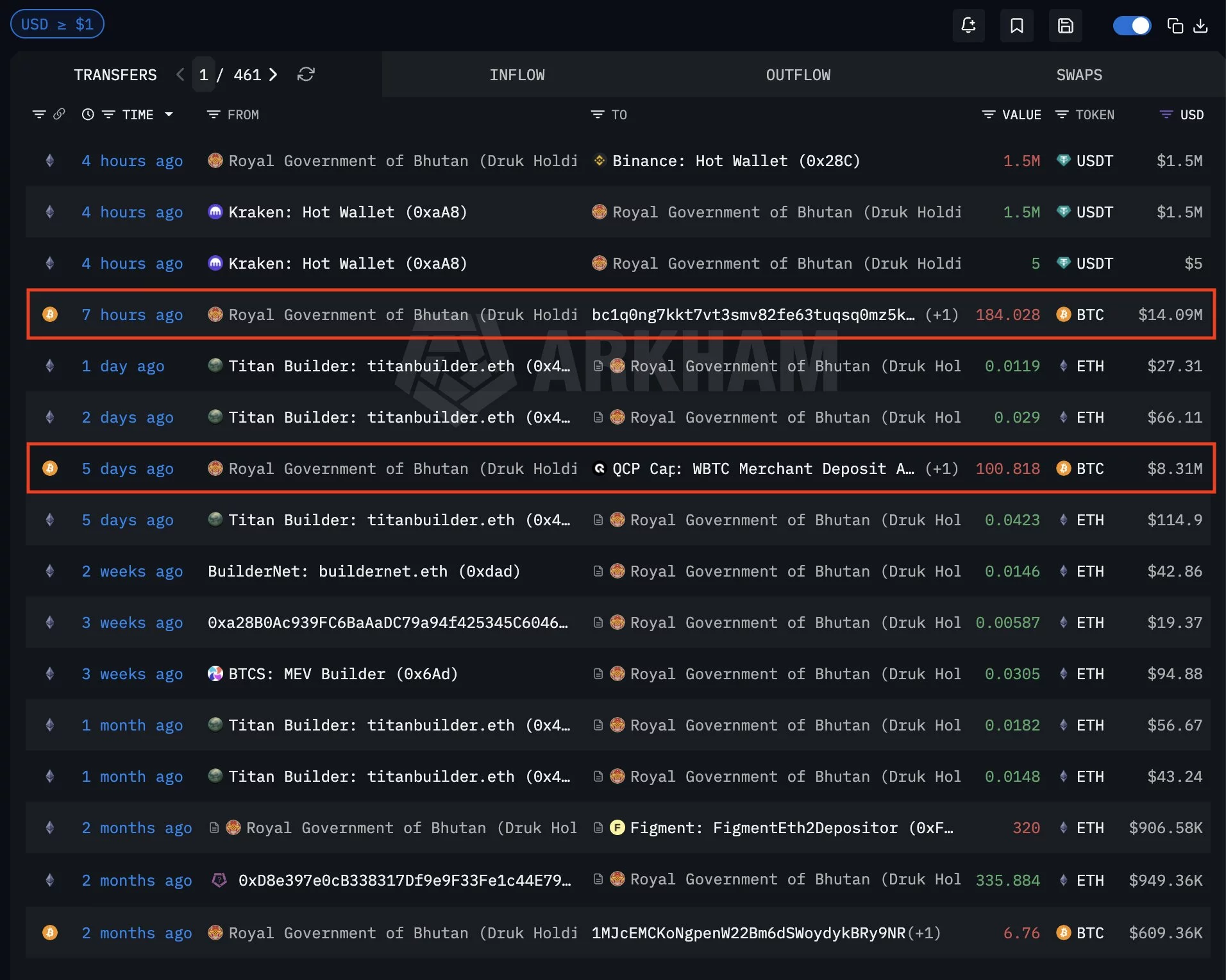

- Bhutan-linked wallets moved over $22 million in Bitcoin this week, including a $14 million transfer and an earlier $8.3 million transaction tied to an institutional merchant deposit, according to Arkham data.

- Arkham says Bhutan has a history of selling Bitcoin in structured clips of around $50 million, with heavy selling observed in mid-to-late September 2025, though no sale has been confirmed from the latest transfers.

- Additional Ethereum and USDT movements suggest active treasury management, reinforcing Bhutan’s role as one of the few governments with Bitcoin sourced from state-backed mining operations.

The activity places fresh focus on the Himalayan nation’s growing role as a sovereign Bitcoin holder.

Bhutan’s Largest Transfer Tops $14 Million

The most significant transaction occurred seven hours ago, when a wallet linked to Bhutan moved 184.028 Bitcoin (BTC), valued at about $14.09 million.

Last Friday, another 100.818 BTC, worth approximately $8.31 million, was transferred from a Bhutan-controlled wallet to an address labelled as a QCP Capital WBTC merchant deposit. Such destinations are commonly associated with institutional crypto infrastructure.

The transfers do not confirm that Bhutan has sold any Bitcoin. However, deposits to merchant or intermediary-linked addresses are often viewed as preparatory steps for liquidity management or asset repositioning.

The activity comes amid heightened market volatility, with Bitcoin recently under pressure. Sovereign-linked movements tend to attract attention due to their potential impact on market sentiment.

Interestingly, Bhutan’s Bitcoin holdings have now fallen from a peak of 13,295 BTC in October 2024 to 5,700 BTC at press time.

According to Arkham, Bhutan’s Bitcoin movements tend to follow a consistent pattern.

“From our observations, Bhutan periodically sells BTC in clips of around $50 million,” Arkham noted. The firm added that a particularly heavy period of selling occurred around mid to late September 2025.

Additional Ethereum and Stablecoin Activity

Beyond Bitcoin, Bhutan-linked wallets also recorded several small Ethereum (ETH) transactions during the same period.

Separately, $1.5 million in USDT moved between exchange-linked wallets and Bhutan-associated addresses within the last several hours. The flows suggest active treasury operations rather than passive holding.

Bhutan’s Unique Position as a Sovereign Bitcoin Holder

Bhutan’s Bitcoin reserves are widely believed to come from state-backed mining operations powered by hydroelectric energy. This sets the country apart from other governments whose holdings typically stem from seizures or enforcement actions.

The latest transfers highlight Bhutan’s continued engagement with crypto markets. They also underscore how sovereign involvement in digital assets is becoming harder for markets to ignore.

You May Also Like

Galaxy Digital Authorizes $200M Share Buyback as Stock Rebounds

Kalshi debuts ecosystem hub with Solana and Base