Argo Blockchain Statistics 2026: BTC Mining on the Edge

Argo Blockchain remains one of the most closely watched public players in Bitcoin mining and crypto infrastructure. In an industry shaped by rapid network difficulty changes, Bitcoin halving cycles, and energy cost pressures, Argo’s performance offers a real-world lens on how mid‑sized miners compete. The company’s operations affect institutional crypto portfolios, and its stock movement offers insights for investors tracking digital asset equities. Explore this article for a deep dive into the latest data and trends shaping Argo today.

Editor’s Choice

- Founded in 2017, Argo Blockchain is a publicly listed, London‑based crypto miner.

- Operates purpose‑built mining operations in North America (US and Canada).

- Dual‑listed on the London Stock Exchange (ARB) and NASDAQ (ARBK).

- The company equitized $40 million of senior notes, reducing debt sharply.

- Argo’s market cap is now ~$1.4 million in early 2026.

- The current ARBK stock price has ranged widely due to volatility.

- Hashrate capacity reported around ~2.4–2.7 EH/s.

Recent Developments

- In late 2025, Argo closed a major UK restructuring plan, reshaping its financial footing.

- The company equitized $40 million of 8.75% senior notes, leaving minimal mortgage debt.

- Court‑sanctioned restructuring marked a significant industry legal event in crypto mining.

- Argo is facing delisting from the London Stock Exchange following restructuring approvals.

- The firm is exploring AI and high‑performance computing diversification beyond mining.

- Share conversion details were supplied ahead of the London exit.

- Q2 2025 revealed substantial declines in top‑line revenue from previous periods.

- Court hearings in December 2025 influenced investor sentiment.

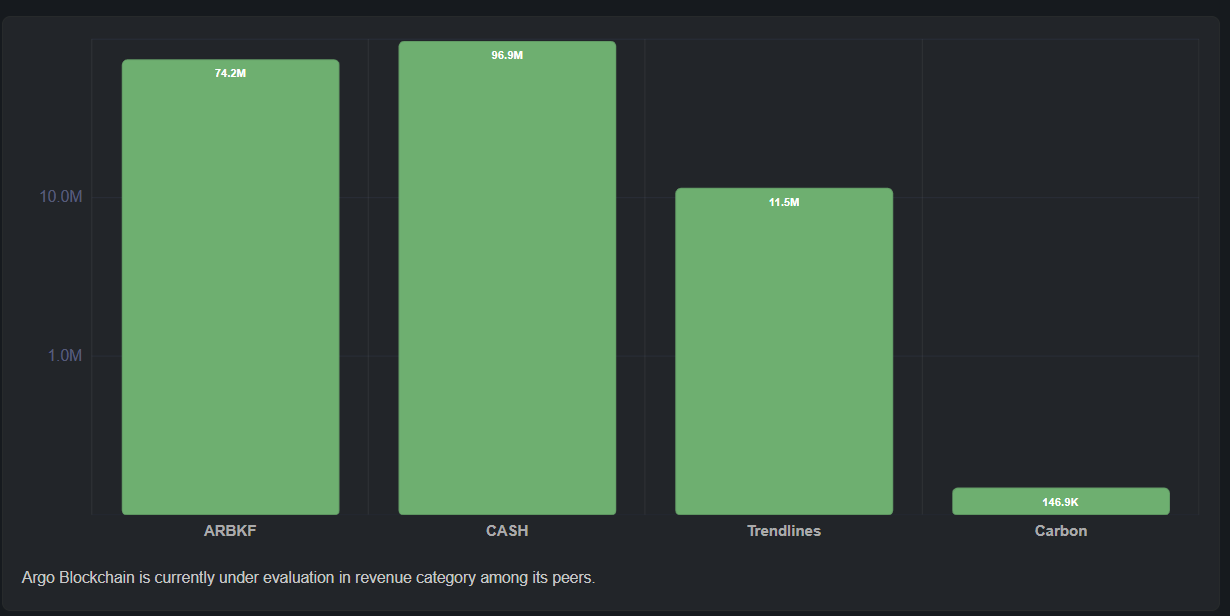

Argo Blockchain Revenue Breakdown Insights

- Cash revenue leads the mix at 96.9 million, making it Argo Blockchain’s largest revenue category among peers.

- ARBKF generates 74.2 million in revenue, highlighting strong core operational performance in public markets.

- Trendlines contribute 11.5 million, indicating a secondary but meaningful revenue stream within Argo’s broader financial structure.

- Carbon-related revenue remains minimal at just 146.9 thousand, showing limited monetization from environmental credits.

- The sharp revenue gap between core cash operations and carbon initiatives underscores Argo Blockchain’s primary reliance on traditional mining and infrastructure revenues.

(Reference: Macroaxis)

(Reference: Macroaxis)

Overview of Argo Blockchain

- Argo reported analysts’ Q1 $18.5 million revenue forecast, up 96% YoY.

- Fiscal year loss per share expected at -$0.202, worsening from prior -$0.060.

- Plans to expand hashrate to 4.2 EH/s through facilities and upgrades.

- Operations predominantly powered by renewable energy across North America.

- Public listing provides transparency for institutional investors.

Company Background and Business Model

- Incorporated in 2017 as GoSun Blockchain Limited, renamed Argo Blockchain plc in December 2017.

- Listed on LSE (ARB) and NASDAQ (ARBK) since IPO on September 23, 2021.

- 2024 revenue $47.1 million, down 7% from $50.6 million in 2023.

- Mined 755 Bitcoin in 2024, or 2.1 BTC/day, versus 1,760 or 4.8 BTC/day in 2023.

- Bitcoin mining margin 33% in 2024, down from 43% in 2023.

- Targets 3.5 EH/s hashrate by end-2026.

- Employs 25 employees with CEO Justin Nolan leading operations.

- Redeems 8.75% senior notes due 2026.

- Diversifying into AI/HPC services targeting 20% revenue growth.

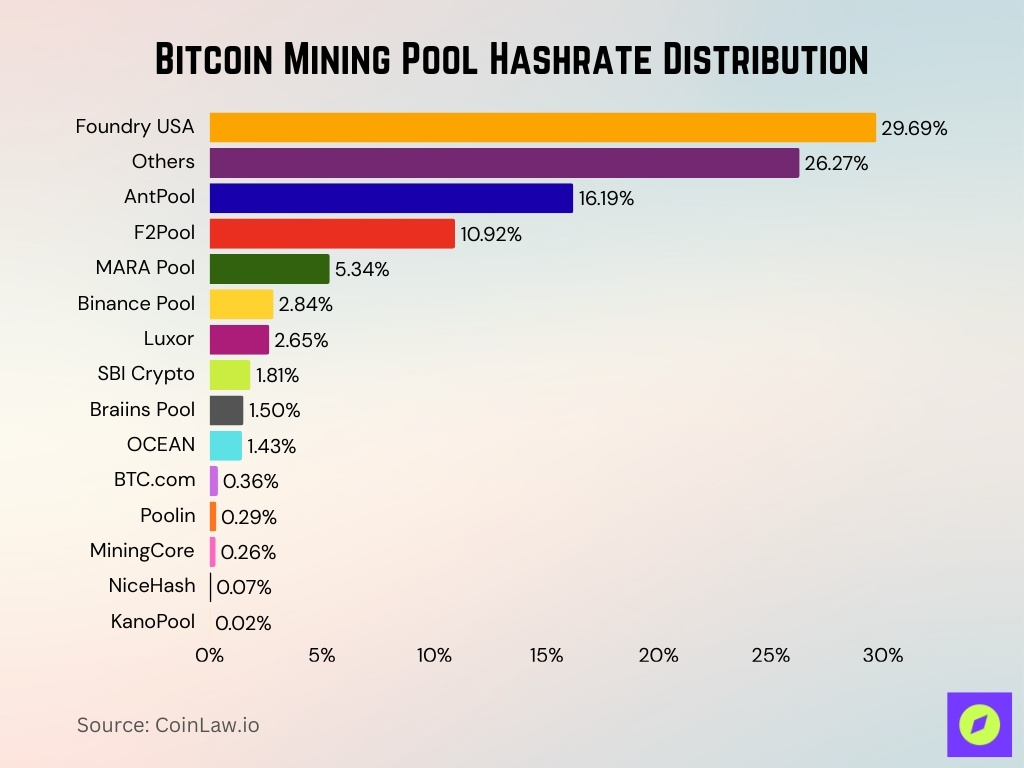

Bitcoin Mining Pool Hashrate Distribution

- Foundry USA dominates with 29.69% of the total Bitcoin network hashrate, maintaining its position as the largest mining pool globally.

- Other pools collectively account for 26.27%, highlighting a fragmented long tail of smaller miners.

- AntPool controls 16.19%, reinforcing its role as a major global mining force.

- F2Pool holds 10.92%, continuing its presence as one of the oldest and most established mining pools.

- MARA Pool contributes 5.34%, reflecting Marathon Digital’s growing influence in self-mining operations.

- Binance Pool represents 2.84%, indicating modest but strategic participation from the world’s largest crypto exchange.

- Luxor captures 2.65%, positioning itself as a notable institutional-focused mining pool.

- SBI Crypto accounts for 1.81%, showing measured participation from Japanese financial institutions.

- Braiins Pool holds 1.50%, maintaining relevance through firmware and pool services.

- OCEAN records 1.43%, signalling early-stage adoption of decentralized mining pool models.

- BTC.com contributes 0.36%, reflecting a sharp decline from its historical dominance.

- Poolin posts 0.29%, indicating reduced activity following operational restructuring.

- MiningCore registers 0.26%, serving primarily smaller independent miners.

- NiceHash represents 0.07%, consistent with its hashrate marketplace model rather than direct pool dominance.

- KanoPool remains marginal at 0.02%, highlighting minimal network influence.

(Reference: CoinMarketCal)

(Reference: CoinMarketCal)

Key Argo Blockchain Highlights

- Nameplate hashrate capacity reached 2.4 EH/s, up from 1.8 EH/s post-restructuring.

- Self-mining operations expanded to 28.5 MW with 13.5 MW of new infrastructure in Alabama.

- Secured electrical assets supporting up to 65 MW incremental deployment capacity.

- Equitized $40 million senior notes due 2026, now debt-free except $472,000 mortgage.

- Quebec facilities are powered by 100% renewable hydro and wind energy.

- Targets 3.5 EH/s hashrate capacity by the end of the year.

- Deployed 1,400 Z11 miners for Zcash, diversifying revenue.

- Operations in Quebec, Texas, and new Alabama sites.

- Exploring AI/HPC data centres for revenue diversification.

Mining Capacity and Hash Rate

- Total nameplate hashrate stands at 2.4 EH/s as of November 30.

- Represents 0.22% of the global Bitcoin network hashrate (421.8 EH/s).

- Increased from 1.8 EH/s post-restructuring to the current 2.4 EH/s.

- Targets expansion up to 4.2 EH/s through upgrades and partnerships.

- Peers like Marathon exceed 29 EH/s, Riot at 22.5 EH/s.

- Plans 20% efficiency increase via ASIC upgrades.

- Self-mining capacity expanded to 28.5 MW with 65 MW potential.

- Deployed 13,315 miners across Tennessee and Quebec.

- 53% growth in Tennessee capacity via Merkle hosting.

Bitcoin Mining Operations

- Self-mining expanded to 28.5 MW with 13.5 MW of new infrastructure in Alabama.

- Secured assets for up to 65 MW additional deployment capacity.

- Helios facility in West Texas features 180 MW of power capacity, now operated by Galaxy.

- Operates ~2.4 EH/s hashrate capacity across North American facilities.

- Quebec facilities are powered by 100% renewable hydropower.

- Deployed 7,800 air-cooled miners split between Tennessee and Quebec sites.

- Mined 124 BTC in January (4.0 BTC/day), generating $5.3 million in revenue.

- 53% increase in Tennessee mining capacity via Merkle Standard hosting.

- 46% of the former Helios fleet will be operational by the end.

- Uses immersion cooling at Helios for efficient operation in hot environments.

Mining Facilities and Locations

- Baie-Comeau, Quebec facility spans 40,000 sq ft with 15 MW capacity.

- 100% renewable hydropower powers the Quebec Baie-Comeau site.

- Hosting 8,113 S19J Pro miners at Merkle Standard in Memphis, Tennessee.

- Deployed 2,500 miners at Baie-Comeau, Quebec facility.

- Helios facility in West Texas provides 180 MW of power capacity.

- 46% of 23,000 former Helios miners operational by end-March.

- 53% increase in Tennessee mining capacity via Merkle hosting.

- Facilities owned/operated since Spring 2021 for Baie-Comeau.

- Operational footprint includes Quebec, Tennessee, and Texas sites.

Energy Usage and Efficiency Metrics

- Quebec facilities are powered by 100% renewable hydro and wind energy.

- 95% of Quebec energy consumption comes from renewable sources.

- Neutralized 46.9 MtCO2e US emissions through REC purchases.

- Targets 20% efficiency boost with next-gen ASICs in Texas.

- Utilizes proprietary immersion cooling at Helios for hot climates.

- 2022 Scope 2 emissions: 168.7 million kg CO2e from electricity.

Valuation Ratios and Multiples

- Price-to-sales 0.52 TTM.

- Enterprise value/EBITDA 12.88.

- Price-to-book -1.40.

- Trailing P/E -0.13x, forward P/E -0.08.

- EV/sales 1.23.

- Price/FCF 3.85, price/OCF 4.13.

- EV/EBITDA -17.26 as of January 29.

- Interest coverage -2.71.

- EV/earnings -1.35.

Bitcoin Production and Mining Output

- Mined 124 BTC in January (4.0 BTC/day), down 20% from the prior month.

- January mining revenue reached $5.3 million, down 19% month-over-month.

- Produced 39 BTC in December 2024, steady from November.

- Q1 2024 output 319 BTC at an average direct cost of $32,727/BTC.

- Held digital assets equivalent to 18 BTC as of January 31.

- Global network difficulty up 116% in 2024, cutting reward rates.

- Hashprice fell 16% due to lower fees and greater difficulty.

Bitcoin Treasury and Holdings

- Holds 3 BTC valued at $211,732 as of November 30.

- Ended June 2025 with 2 BTC equivalent alongside $1.7 million cash.

- Reduced holdings by 8 BTC in November 2024 via partial sale.

- Added 11 BTC in Q1 2024, peaking at 26 BTC briefly.

- Ended Q1 2024 with 11 BTC or Bitcoin equivalent.

- Peers like MicroStrategy hold 444,262 BTC, and Marathon holds 46,255 BTC.

- Treasury strategy balances liquidity against ~124 BTC monthly production.

- 11 BTC reported as of September 12 in some trackers.

Profitability and Margin Metrics

- TTM profit margin -106.85%, operating margin -89.60%.

- TTM revenue $24.04 million, gross profit $5.29 million, EBITDA -$5.77 million.

- Q1 revenue growth forecast 96% YoY to $18.5 million.

- Earnings growth rate -31.42% annually over the past 5 years.

- TTM net income available to common -$25.69 million, diluted EPS -$54.11.

Cash Flow and Liquidity Position

- 2024 operating cash flow -$28.96 million, improved from -$44.8 million prior.

- TTM free cash flow -$28.97 million, operating cash flow -$28.97 million.

- Investing cash flow $23.62 million TTM, financing $17.33 million.

- Q1 2025 operating cash flow -$7.37 million, up 80.9% QoQ.

- 2024 net debt reduced by $24.1 million to $31.0 million.

- H1 2025 cash equivalents $1.7 million alongside 2 BTC.

- Debt-to-equity ratio -107.4% with $40.3M debt, -$37.5M equity.

- Dec 2024 operating cash flow -$38.7 million, up 17.93% YoY.

Balance Sheet and Debt Profile

- Total debt reduced to $472,000, mortgage post $40 million notes equitization.

- Shareholder equity -$37.5 million, debt-to-equity ratio -107%.

- Total assets $9.1 million, liabilities $46.6 million.

- Cash position $1.65 million, current ratio 0.74.

- Post-restructuring is effectively debt-free except for the facility mortgage.

- Quick ratio 0.33, indicating a tight liquidity position.

- $19.3 million total assets per September 2025 reporting.

- $48.7 million total liabilities outstanding.

Share Structure and Market Capitalization

- Market cap $15.64 million at $2.18 share price.

- 717.25 million ordinary shares outstanding post-restructuring.

- Issued 2.89 billion new ordinary shares to noteholders in restructuring.

- ADS ratio changed to 2,160:1 ordinary shares per ADS, effective Dec 2025.

- Institutional ownership 53.57%, insiders 0.01%.

- Float 608.86 million shares.

- Noteholders hold 10% post-exchange, Growler 87.5%.

- Shares increased 22.8% YoY to 720.37 million.

- Micro-cap valuation is $41 million as of October.

Stock Price Performance

- Current price $4.06 to $4.20, day’s range $4.12-$$4.44.

- 52-week range $3.25-$$205.20.

- Market cap $1.45 million, beta 1.94.

- Regained Nasdaq minimum bid compliance on January 5.

- 1-year return underperforms market amid crypto volatility.

- Analyst consensus Sell rating, $4.00 price target.

- Average daily volume: 178,000 shares.

- 5-year beta 2.75, indicating high volatility.

- Shares outstanding: 333.64 thousand ADRs.

Trading Volume and Liquidity Statistics

- Average daily volume is 20.5 million shares over 20 days.

- Latest session volume 49.2 million shares at $3.79.

- Average volume: 36,895 shares.

- 52,182 shares traded vs 350,679 average.

- Float 608.86 million shares.

- Bid/ask spread $0.36/$0.37.

- Short interest 1.83% of shares outstanding.

- Days to cover the short ratio are 0.96.

- Pre-market volume low, range $0.48-$$0.49.

Frequently Asked Questions (FAQs)

Argo announced full redemption and mandatory exchange of its 8.75% senior notes due 2026 into ADRs.

Argo’s market capitalization is around $1.50 million.

Profile data referenced 721 million shares outstanding.

Conclusion

Argo Blockchain today reflects a miner navigating post‑halving production headwinds, ongoing restructuring, and market pressures. Operational margins and financial health remain challenged, with negative profitability and modest liquidity underscoring risks for investors. Stock performance and valuation metrics echo this volatility, with micro‑cap status and speculative trading dynamics dominating the narrative. While strategic shifts, including renewable energy focus and potential diversification, hint at longer‑term opportunity, fundamental data suggest caution as the company aligns mining operations with broader market conditions.

The post Argo Blockchain Statistics 2026: BTC Mining on the Edge appeared first on CoinLaw.

You May Also Like

Fed Decides On Interest Rates Today—Here’s What To Watch For

OpenVPP accused of falsely advertising cooperation with the US government; SEC commissioner clarifies no involvement