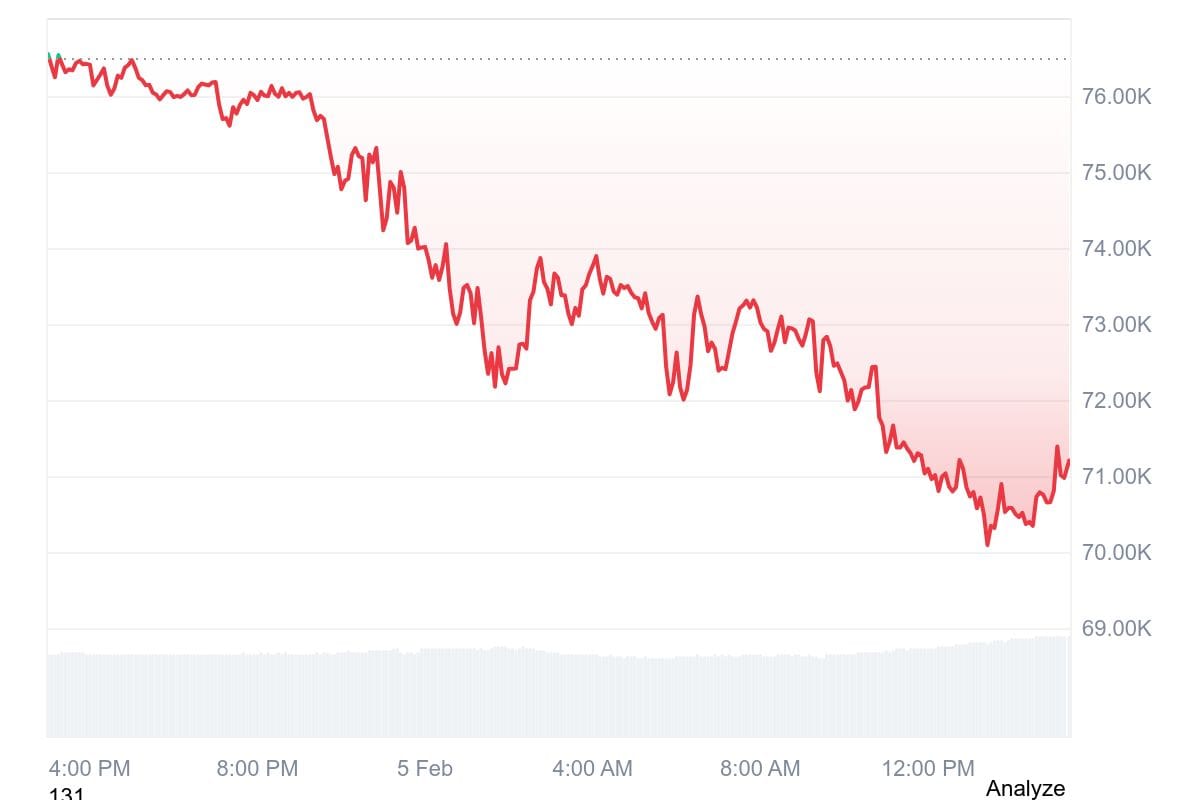

Bitcoin Drops Toward $70,000 as Daily ETF Outflow Hits $545 Million

Bitcoin fell 7.13% over 24 hours to $71,000 on Thursday, extending a slide that has pushed the cryptocurrency down more than 40% from its November peak as U.S. spot Bitcoin exchange-traded funds recorded their largest single-day outflows in weeks.

ETFs tracking Bitcoin saw net withdrawals of $544.9 million on Wednesday, led by BlackRock's IBIT which posted $373.4 million in outflows. Fidelity's FBTC recorded $86.4 million in withdrawals, while Grayscale's GBTC saw $41.8 million leave the fund, according to data compiled by Farside Investors.

The decline followed a broader sell-off in U.S. technology stocks that pushed investors away from growth-oriented assets. Bitcoin and other cryptocurrencies came under pressure as risk appetite weakened across markets, reflecting macro concerns rather than crypto-specific developments.

The downturn has amplified losses for institutional investors who purchased shares in Strategy, the Bitcoin treasury company led by Michael Saylor. Eleven U.S. state pension schemes that bought Strategy shares now face combined paper losses of $337 million as the stock continues to slide, DL News reported.

The pension funds collectively hold nearly 1.8 million Strategy shares currently worth about $240 million, down from $577 million when they first reported their positions, according to research platform Fintel. Ten of the 11 funds are down roughly 60% on their purchases.

Strategy shares closed Wednesday at $129.09, down 3.13%. The stock has fallen 65.62% over the past six months as Bitcoin's price decline eroded the value of the company's cryptocurrency holdings.

The company pioneered a strategy of issuing debt and equity to purchase Bitcoin, creating leveraged exposure that amplifies returns in rising markets. Hundreds of companies adopted similar approaches in 2024 and 2025, with institutional investors including pension funds buying shares to gain Bitcoin exposure.

However, the strategy amplifies losses when prices fall. Strategy currently trades at a steep discount to the value of its Bitcoin holdings, reflecting investor concerns about the sustainability of its debt-funded acquisition model.

Other Bitcoin treasury companies are facing similar pressure. Tom Lee's BitMine, which holds 4.29 million Ethereum tokens valued at $8.42 billion, is facing more than $7 billion in unrealized losses as Ethereum slid towards $2,100, down about 7% over 24 hours.

Bitcoin has now erased all gains made following the November 2024 U.S. presidential election, when optimism about crypto-friendly policies under the incoming administration drove prices higher. The cryptocurrency briefly fell below $75,000 earlier this week before staging a modest recovery.

Total cryptocurrency market capitalization stood at $2.43 trillion as of publication time, down 6.14% over 24 hours.

You May Also Like

Vitalik Buterin Pushes Ethereum Builders to Move Beyond Clone Chains

Circle unveils CCTP V2 for seamless USDC crosschain transfers with Stellar